Celestica (TSX:CLS) Shareholders Approve Advance Notice By-Law at Annual Meeting

Reviewed by Simply Wall St

Celestica (TSX:CLS), following its shareholders' approval of the new By-Law 2 (Advance Notice), experienced a 37% increase over the last quarter. This rise could be supported by strong market conditions characterized by the Dow Jones and S&P 500 maintaining a positive stance amidst interest rate decisions and Middle East tensions. Additionally, Celestica's Q1 earnings report showed increased sales and an upward revision in revenue guidance, which may have contributed positively to the stock's performance. Notably, during this period, geopolitical uncertainties and Federal Reserve decisions kept broader market movements in check, aligning with Celestica's significant advance.

Buy, Hold or Sell Celestica? View our complete analysis and fair value estimate and you decide.

The recent 37% quarterly rise in Celestica's share price amid geopolitical tensions and market strength suggests confidence among investors. The approval of By-Law 2 could provide clearer governance and potentially boost shareholder trust, thus reinforcing market interest. Over a longer-term perspective, the company has achieved a total return, including dividends, of 1911.25% over five years, which is an exceptional performance. This far surpasses the Canadian market's one-year return of 18.9% and the Canadian Electronic industry's 118.4% in the same period, highlighting Celestica's robust growth trajectory over the half-decade period.

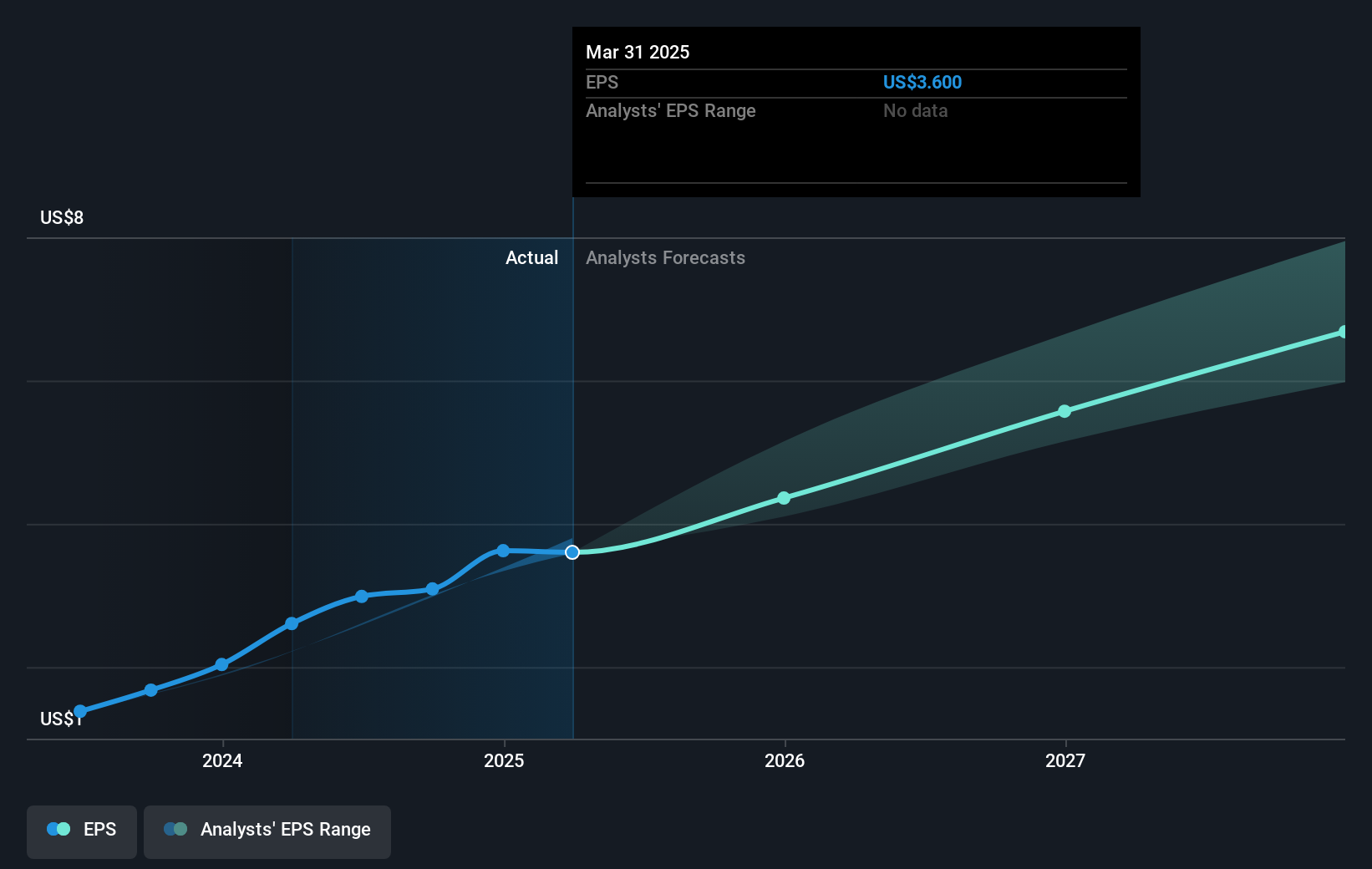

Celestica's focus on high-performance switch demand and AI programs indicates promising expansion, likely influencing revenue and earnings forecasts positively. Analysts anticipate annual revenue growth of 13.4% and EPS growth, with a particular emphasis on improving profit margins in the coming years. The price target set at CA$202.38, significantly higher than the current share price of CA$120.48, suggests substantial upside potential according to consensus expectations. However, trade policy shifts and reliance on hyperscaler customers remain potential obstacles to meeting these forecasts.

Dive into the specifics of Celestica here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives