Celestica (TSX:CLS): Assessing Valuation Following Recent 26% Share Price Surge

Reviewed by Kshitija Bhandaru

Celestica (TSX:CLS) has drawn renewed attention from investors after its shares rose over 26% in the past month. This surge follows heightened trading activity and growing interest in the company’s performance across the technology sector.

See our latest analysis for Celestica.

Celestica’s share price jump over the past month caps off a strong stretch for the stock, with momentum building in both the short and long term. While this month’s returns caught the spotlight, the company’s 1-year total shareholder return sits at just over 4%. For investors who stayed the course for three to five years, total returns of 27% and almost 34% respectively have rewarded patience as the company continues to benefit from improving sector sentiment.

If you’re watching the tech sector’s recent moves and want to expand your investing radar, now’s a good moment to check out See the full list for free.

With shares trading near analyst targets after significant recent gains, investors are left to wonder if Celestica is still undervalued or if the market is already pricing in all of the company’s future growth prospects.

Most Popular Narrative: 3.3% Undervalued

Celestica's current fair value, based on the most widely followed narrative, comes in just above the last close price, suggesting only modest upside remains. This small degree of undervaluation positions the share price right at the edge of what analysts believe is justified for future growth potential.

“Surging demand for advanced networking and AI among hyperscalers is fueling rapid segment growth, deeper customer ties, and increased revenue visibility. Regional manufacturing diversification and a shift toward high-margin markets and services are enhancing resilience, margin expansion, and long-term growth prospects.”

Wonder what growth levers are behind such a tight gap to fair value? The driving force may surprise you. Analysts are projecting aggressive expansion of both revenue and margins, underpinned by bold shifts in Celestica’s market strategy. Find out which financial forecasts and business moves could power the next chapter. The full story reveals the surprising targets and assumptions guiding this narrative.

Result: Fair Value of $362.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on hyperscaler customers and concentrated revenue streams could amplify volatility if technology trends shift or key clients scale back orders.

Find out about the key risks to this Celestica narrative.

Another View: Is the Valuation Too High?

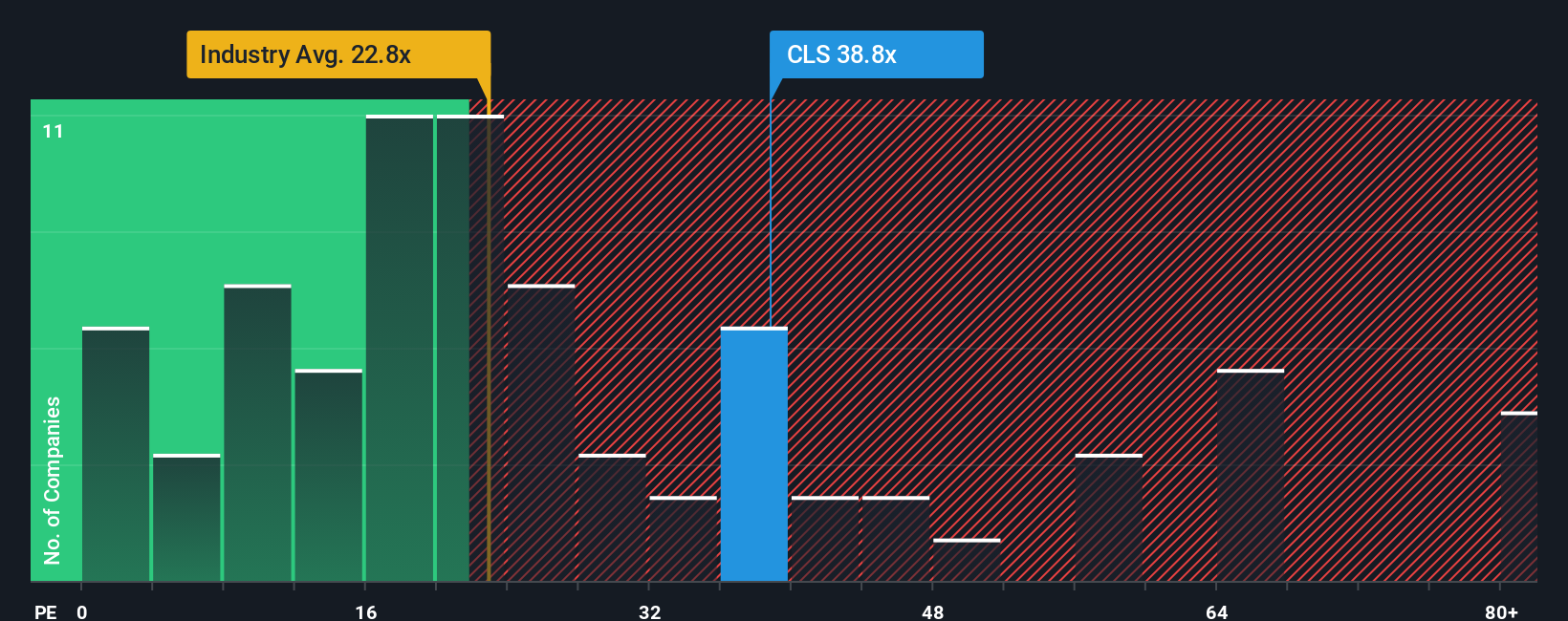

Looking at one key market ratio, Celestica’s shares appear quite expensive compared to both its industry and peers. The current earnings multiple stands at 53.6x, which is significantly higher than the North American electronic industry average of 24.4x and its peer group’s 30.4x. In addition, it is well above the fair ratio of 49.4x that the market could ultimately revert to. This hefty premium hints at higher valuation risk if expectations cool off. Does the excitement justify this steep price, or is caution warranted now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celestica Narrative

If you have a different outlook, or would rather carve your own path through the numbers, digging into the data and building a personalized perspective is quick and easy. In less than three minutes, you can Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Celestica.

Looking for More Investment Ideas?

Your next winning opportunity could be right at your fingertips. Don’t let tomorrow’s standout stocks slip past you. Expand your investing universe with these handpicked ideas today:

- Capitalize on undervalued growth by reviewing these 900 undervalued stocks based on cash flows, which are poised for strong cash flow and potential market re-rating.

- Spot the income advantage with these 19 dividend stocks with yields > 3%, offering yields above 3% and unlocking steady returns often missed by the crowd.

- Position yourself at the forefront of tomorrow’s tech shifts by analyzing these 24 AI penny stocks, which are shaping industry innovation and scalable disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives