Celestica (TSE:CLS) sheds 8.1% this week, as yearly returns fall more in line with earnings growth

We think all investors should try to buy and hold high quality multi-year winners. While the best companies are hard to find, but they can generate massive returns over long periods. For example, the Celestica Inc. (TSE:CLS) share price is up a whopping 757% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. It's also up 17% in about a month. It really delights us to see such great share price performance for investors.

Since the long term performance has been good but there's been a recent pullback of 8.1%, let's check if the fundamentals match the share price.

See our latest analysis for Celestica

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

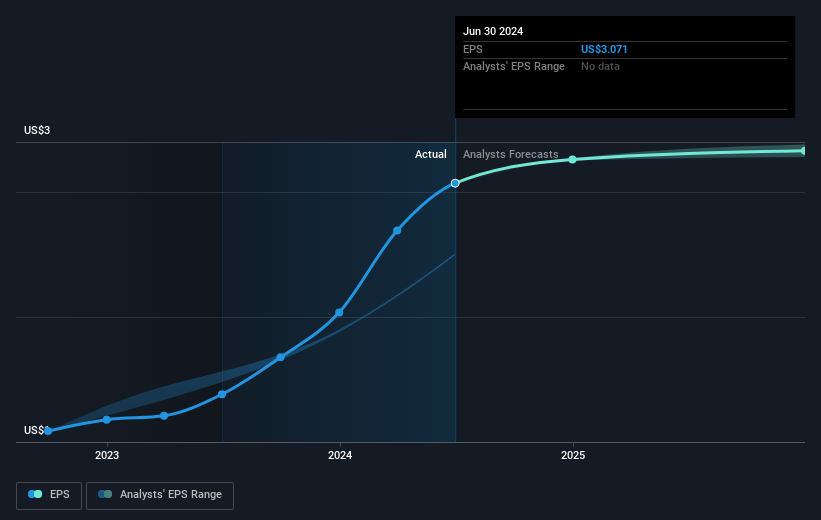

During five years of share price growth, Celestica achieved compound earnings per share (EPS) growth of 23% per year. This EPS growth is slower than the share price growth of 54% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Celestica has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Celestica shareholders have received a total shareholder return of 117% over one year. That's better than the annualised return of 54% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before spending more time on Celestica it might be wise to click here to see if insiders have been buying or selling shares.

Of course Celestica may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives