Zoomd Technologies (TSXV:ZOMD) Valuation After Strong Q3 2025 Earnings and New Growth Strategy Update

Reviewed by Simply Wall St

Zoomd Technologies (TSXV:ZOMD) just paired higher Q3 2025 earnings with a clear three pillar roadmap of organic growth, strategic partnerships, and M&A, giving investors fresh context for its recent volatile share performance.

See our latest analysis for Zoomd Technologies.

Despite the sharp 7 day and 30 day share price returns, the stock still sits at CA$1.38 and its multi year total shareholder returns signal that long term momentum is very much intact. Recent volatility appears to reflect shifting expectations around the faster growth and M&A narrative rather than a broken story.

If Zoomd’s latest move has you rethinking where growth could come from next, it might be worth exploring high growth tech and AI stocks as potential fresh ideas for your watchlist.

With profits rising, a multiyear total return above 700% and the share price still trading at a steep discount to analyst targets, the key question is whether this represents a buying opportunity or whether the market is already pricing in future growth.

Price-to-Earnings of 5.6x: Is it justified?

At a last close of CA$1.38, Zoomd Technologies trades on a price-to-earnings ratio of 5.6x, a level that looks materially undervalued versus peers.

The price-to-earnings multiple compares the share price to the company’s earnings per share, making it a useful yardstick for profitable software platforms like Zoomd. A low multiple here can indicate that the market is not fully crediting the pace or durability of recent profit growth, especially when earnings have expanded rapidly.

For Zoomd, that 5.6x multiple sits far below both the Canadian Software industry average of 51.1x and a peer average of 42.9x, suggesting a deep discount. It is also well under an estimated fair price-to-earnings ratio of 16.4x, a level the market could potentially migrate toward if strong profitability and revenue growth continue to hold.

Explore the SWS fair ratio for Zoomd Technologies

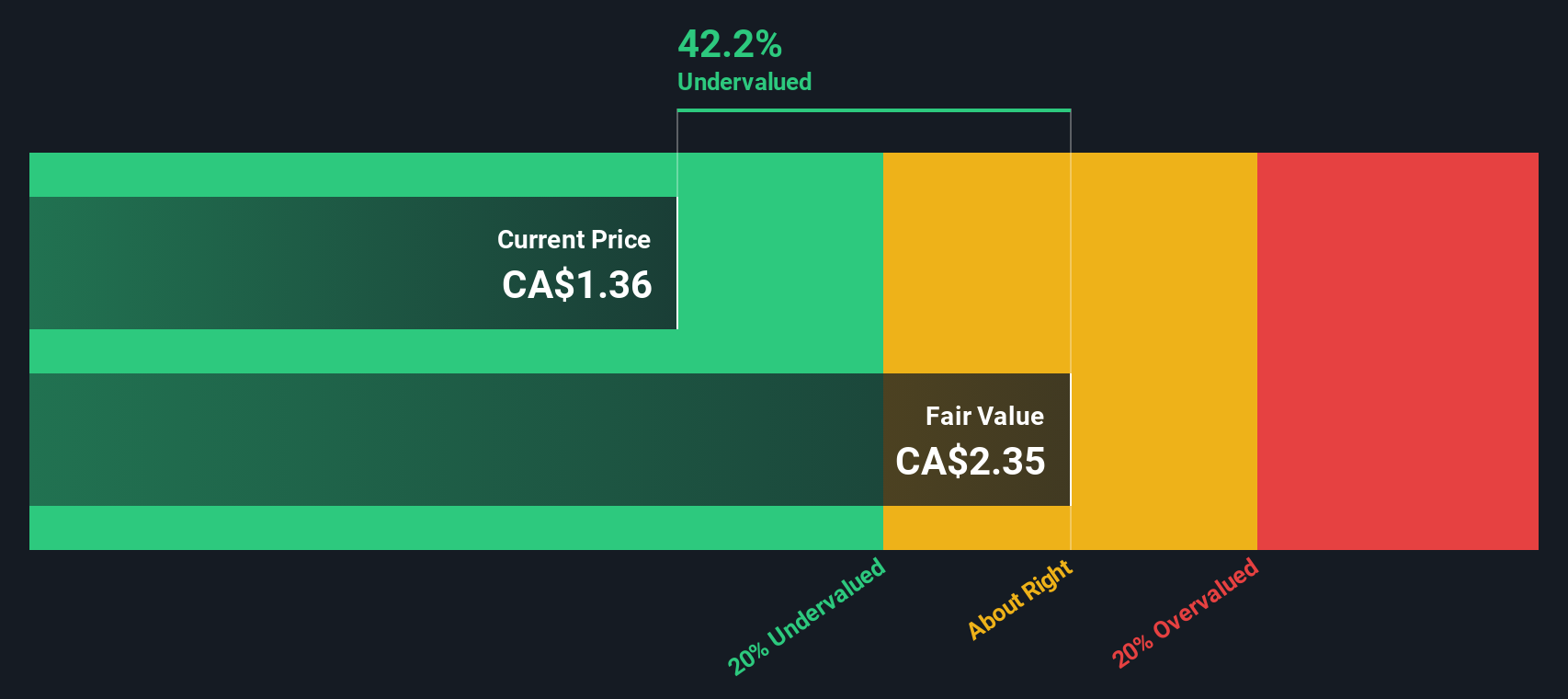

Beyond multiples, the SWS DCF model estimates Zoomd’s fair value at roughly CA$2.39 per share, implying the stock trades at about a 42.2% discount. Our DCF approach projects the company’s future cash flows and then discounts them back to today using an appropriate rate to capture risk and the time value of money. In the context of a high growth, high margin software platform that has recently accelerated earnings and maintains outstanding return on equity, this gap between market price and modeled value highlights how skeptical current sentiment appears relative to the company’s fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Result: Price-to-Earnings of 5.6x (UNDERVALUED)

However, softer net income trends and execution risks around Zoomd’s ambitious M&A and partnership plans could quickly challenge today’s undervaluation thesis.

Find out about the key risks to this Zoomd Technologies narrative.

Another View on Value

Our SWS DCF model also points to meaningful upside, estimating Zoomd’s fair value at about CA$2.39 per share versus the current CA$1.38. This suggests the stock is materially undervalued. If both earnings multiples and cash flows appear inexpensive, is the market overlooking something or underestimating durability?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zoomd Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zoomd Technologies Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a customized view of Zoomd in under three minutes: Do it your way.

A great starting point for your Zoomd Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Zoomd might be compelling, but you may miss other high potential opportunities that match your style and risk appetite if you focus on it alone.

- Capture potential mispricing early by scanning these 920 undervalued stocks based on cash flows that pair strong fundamentals with attractive valuation signals before the crowd catches on.

- Explore innovation trends by reviewing these 25 AI penny stocks positioned in areas such as automation, data intelligence, and next generation software solutions.

- Strengthen your income strategy with these 14 dividend stocks with yields > 3% that combine regular payouts with business models designed to withstand market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoomd Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZOMD

Zoomd Technologies

Operates as a marketing technology user-acquisition and engagement platform worldwide.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026