- Canada

- /

- Oil and Gas

- /

- TSX:PEY

3 TSX Stocks Possibly Trading At Discounts Of Up To 28.2%

Reviewed by Simply Wall St

As the Canadian market navigates through trade uncertainty and inflation concerns, investors are closely watching the impact of newly announced tariffs on economic growth. Amidst this volatility, identifying stocks that may be trading at a discount can offer potential opportunities for value-focused investors seeking to balance risk and reward in their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Savaria (TSX:SIS) | CA$16.26 | CA$30.40 | 46.5% |

| K92 Mining (TSX:KNT) | CA$11.99 | CA$19.99 | 40% |

| Tantalus Systems Holding (TSX:GRID) | CA$2.00 | CA$3.90 | 48.7% |

| Lithium Royalty (TSX:LIRC) | CA$5.07 | CA$9.27 | 45.3% |

| Wishpond Technologies (TSXV:WISH) | CA$0.285 | CA$0.55 | 48% |

| Electrovaya (TSX:ELVA) | CA$3.41 | CA$5.92 | 42.4% |

| illumin Holdings (TSX:ILLM) | CA$2.25 | CA$3.75 | 40% |

| BRP (TSX:DOO) | CA$48.65 | CA$80.12 | 39.3% |

| AtkinsRéalis Group (TSX:ATRL) | CA$68.05 | CA$104.40 | 34.8% |

| Metalla Royalty & Streaming (TSXV:MTA) | CA$4.25 | CA$7.73 | 45% |

Below we spotlight a couple of our favorites from our exclusive screener.

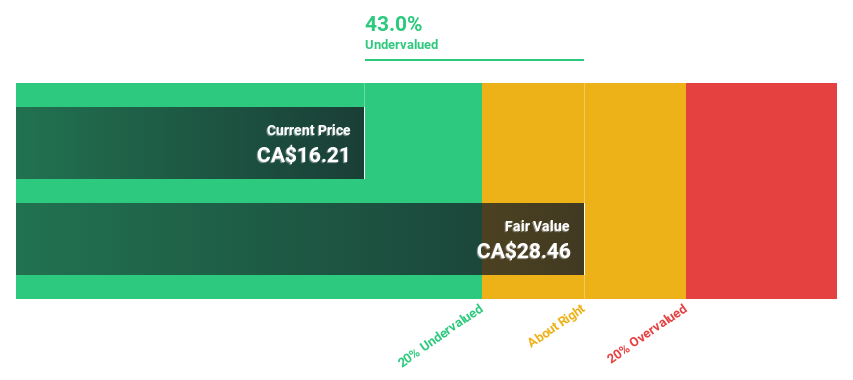

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.36 billion.

Operations: The company's revenue segment is primarily derived from Software & Programming, totaling $483.11 million.

Estimated Discount To Fair Value: 28.2%

Kinaxis is trading at CA$155.24, significantly below its estimated fair value of CA$216.36, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow substantially faster than the Canadian market, with annual profit growth expected at 60.6%. Recent strategic partnerships and AI advancements in its Maestro platform enhance supply chain capabilities for clients like Fujirebio Inc., potentially driving future revenue increases despite recent profit margin declines and impairment losses.

- In light of our recent growth report, it seems possible that Kinaxis' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Kinaxis' balance sheet health report.

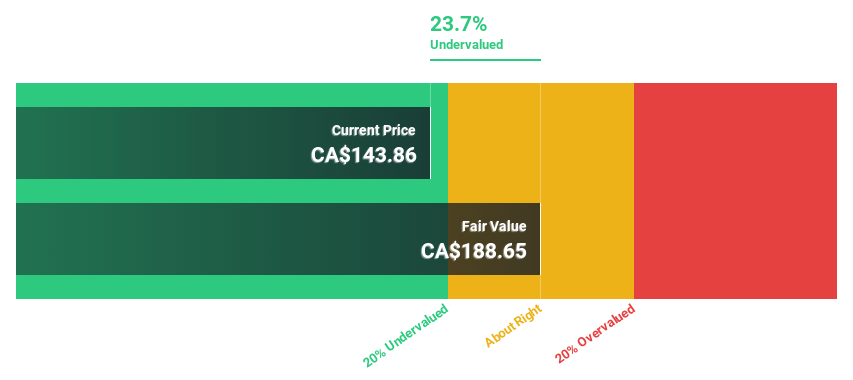

Peyto Exploration & Development (TSX:PEY)

Overview: Peyto Exploration & Development Corp. operates in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's deep basin with a market cap of CA$3.60 billion.

Operations: The company's revenue primarily comes from its oil and gas exploration and production segment, which generated CA$857.09 million.

Estimated Discount To Fair Value: 10.1%

Peyto Exploration & Development trades at CA$18.1, slightly below its estimated fair value of CA$20.13, reflecting potential undervaluation based on cash flows. Despite high debt levels and a dividend yield of 7.29% not fully covered by earnings, the company's revenue and earnings are forecast to grow faster than the Canadian market at 17% and 28.5% per year respectively. Recent results show revenue growth but a slight decline in net income compared to last year.

- Upon reviewing our latest growth report, Peyto Exploration & Development's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Peyto Exploration & Development with our comprehensive financial health report here.

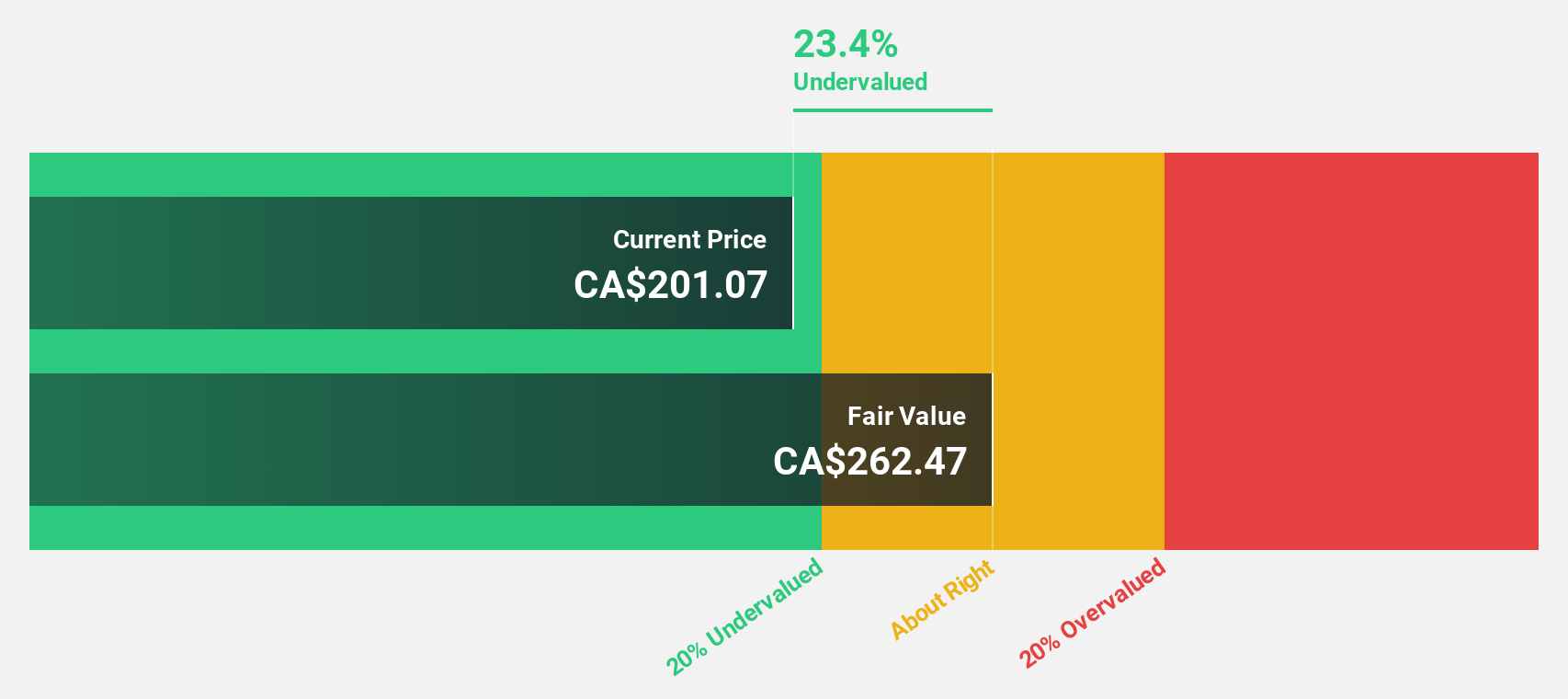

Topicus.com (TSXV:TOI)

Overview: Topicus.com Inc. offers vertical market software and platforms in the Netherlands and internationally, with a market cap of CA$12.03 billion.

Operations: The company generates revenue of €1.29 billion from its software and programming segment.

Estimated Discount To Fair Value: 26.6%

Topicus.com, trading at CA$144.85, is considered undervalued with a fair value estimate of CA$197.25, suggesting a discount of over 20%. The company's earnings are projected to grow significantly at 21.8% annually, outpacing the Canadian market's growth rate of 15.2%. Recent financial results show revenue increased to EUR 1.29 billion and net income rose to EUR 91.99 million for the year ended December 2024, reflecting robust performance and potential for future growth based on cash flows.

- Insights from our recent growth report point to a promising forecast for Topicus.com's business outlook.

- Take a closer look at Topicus.com's balance sheet health here in our report.

Taking Advantage

- Click here to access our complete index of 24 Undervalued TSX Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion