Tony Busseri has been the CEO of Route1 Inc. (CVE:ROI) since 2010, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Route1.

View our latest analysis for Route1

Comparing Route1 Inc.'s CEO Compensation With the industry

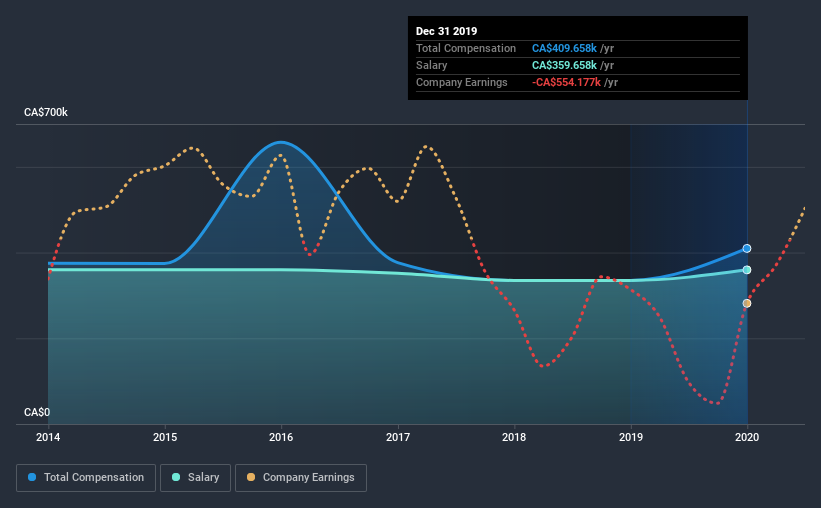

Our data indicates that Route1 Inc. has a market capitalization of CA$31m, and total annual CEO compensation was reported as CA$410k for the year to December 2019. Notably, that's an increase of 22% over the year before. In particular, the salary of CA$359.7k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$262m, we found that the median total CEO compensation was CA$218k. Accordingly, our analysis reveals that Route1 Inc. pays Tony Busseri north of the industry median. Furthermore, Tony Busseri directly owns CA$607k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$360k | CA$335k | 88% |

| Other | CA$50k | - | 12% |

| Total Compensation | CA$410k | CA$335k | 100% |

Talking in terms of the industry, salary represented approximately 79% of total compensation out of all the companies we analyzed, while other remuneration made up 21% of the pie. It's interesting to note that Route1 pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Route1 Inc.'s Growth Numbers

Over the last three years, Route1 Inc. has shrunk its earnings per share by 11% per year. Its revenue is up 18% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Route1 Inc. Been A Good Investment?

We think that the total shareholder return of 350%, over three years, would leave most Route1 Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we noted earlier, Route1 pays its CEO higher than the norm for similar-sized companies belonging to the same industry. Still, shareholder returns over the last three years,and recent revenue growth have been trending northwards. Importantly though, EPS has not been growing over the same stretch. Although we would have liked to see EPS growth, positive shareholder returns, and growing revenues make us believe CEO compensation is reasonable.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 4 warning signs for Route1 that you should be aware of before investing.

Important note: Route1 is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Route1, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:ROI

Route1

Provides engineering and professional services using data capture technologies in the United States, Canada, and internationally.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026