Here's Why Shareholders Should Examine Route1 Inc.'s (CVE:ROI) CEO Compensation Package More Closely

Shareholders will probably not be too impressed with the underwhelming results at Route1 Inc. (CVE:ROI) recently. At the upcoming AGM on 07 December 2021, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Route1

How Does Total Compensation For Tony Busseri Compare With Other Companies In The Industry?

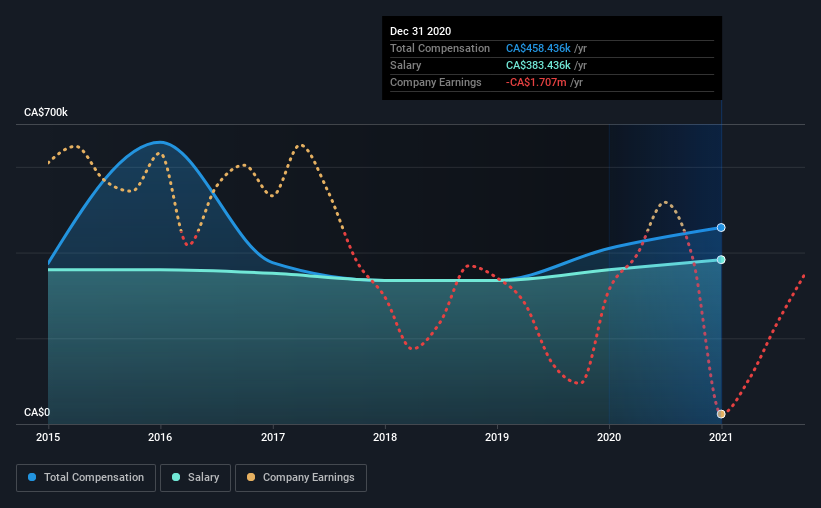

Our data indicates that Route1 Inc. has a market capitalization of CA$14m, and total annual CEO compensation was reported as CA$458k for the year to December 2020. We note that's an increase of 12% above last year. Notably, the salary which is CA$383.4k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under CA$256m, the reported median total CEO compensation was CA$202k. Accordingly, our analysis reveals that Route1 Inc. pays Tony Busseri north of the industry median. What's more, Tony Busseri holds CA$223k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$383k | CA$360k | 84% |

| Other | CA$75k | CA$50k | 16% |

| Total Compensation | CA$458k | CA$410k | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Route1 is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Route1 Inc.'s Growth

Over the last three years, Route1 Inc. has shrunk its earnings per share by 11% per year. Its revenue is down 11% over the previous year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Route1 Inc. Been A Good Investment?

The return of -34% over three years would not have pleased Route1 Inc. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 5 warning signs (and 2 which are concerning) in Route1 we think you should know about.

Important note: Route1 is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ROI

Route1

Provides engineering and professional services using data capture technologies in the United States, Canada, and internationally.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026