- Canada

- /

- Metals and Mining

- /

- TSXV:QPM

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Canadian market has been experiencing a period of optimism following the decisive U.S. election outcome, which has removed a layer of uncertainty and contributed to record highs for the TSX this year. Amidst these broader market dynamics, penny stocks—often associated with smaller or newer companies—continue to present unique growth opportunities at lower price points. While the term may seem outdated, these stocks can still offer potential upside when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.63 | CA$611.45M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$276.89M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.825 | CA$179.38M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$117.05M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.18M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.30 | CA$311.11M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.20 | CA$4.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.21 | CA$219.69M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AirIQ (TSXV:IQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AirIQ Inc. operates in the telematics industry in North America with a market cap of CA$12.69 million.

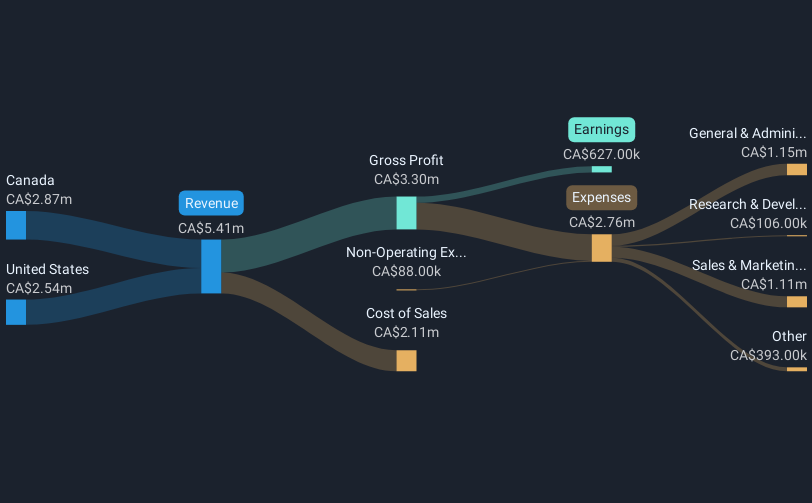

Operations: The company generates revenue of CA$5.41 million from developing and operating a telematics asset management system.

Market Cap: CA$12.69M

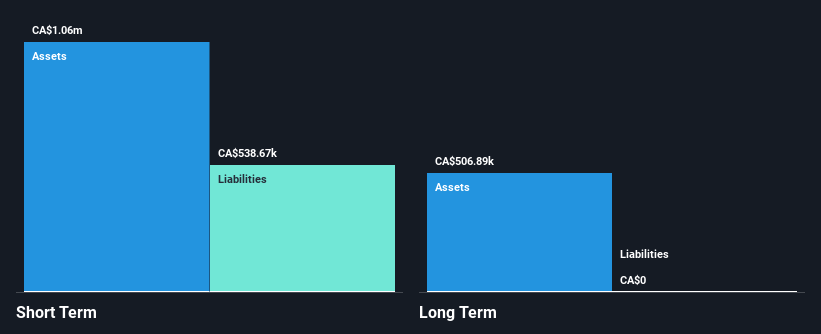

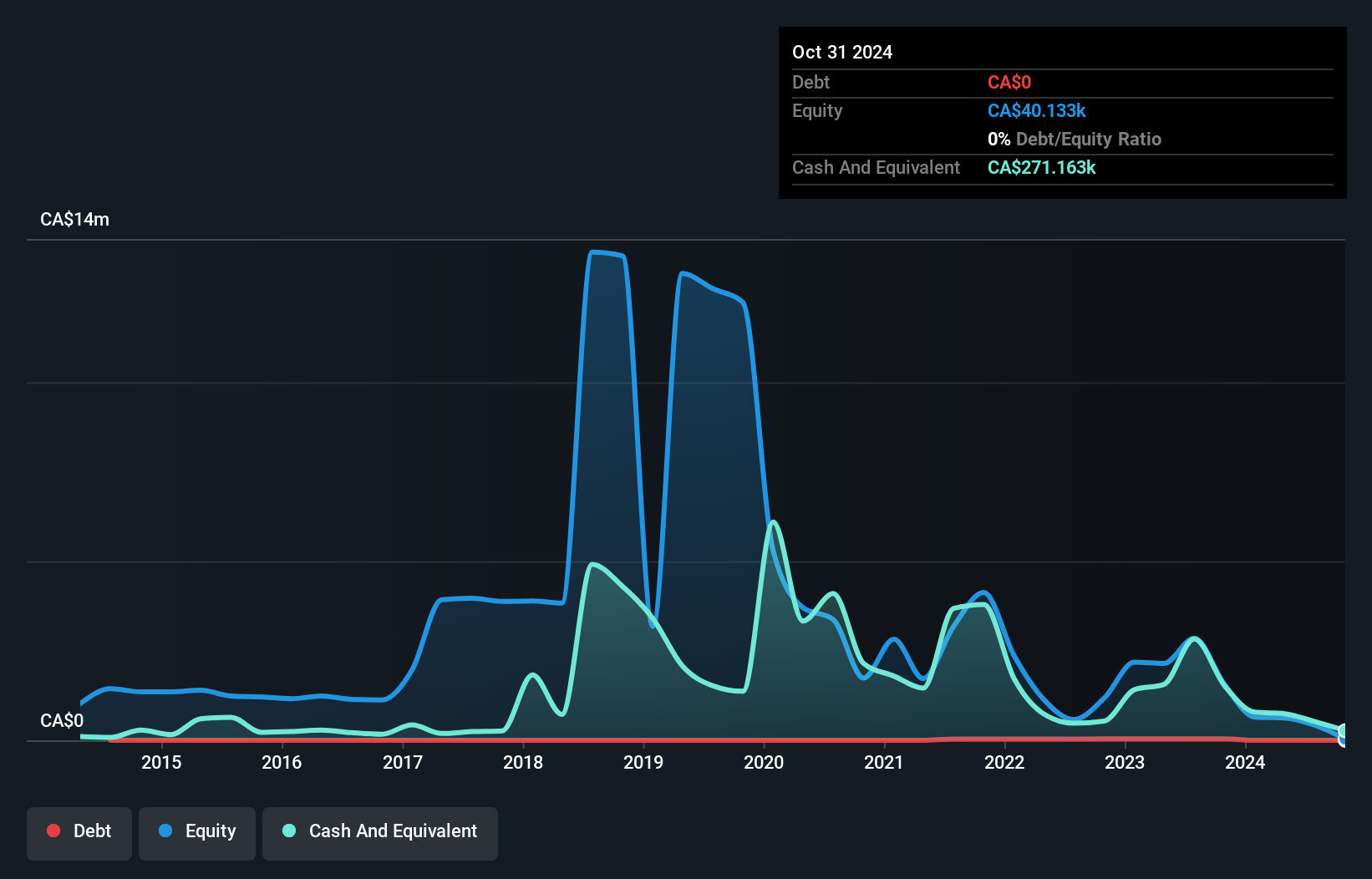

AirIQ Inc., with a market cap of CA$12.69 million, operates debt-free and has strong asset coverage over liabilities. Despite negative earnings growth of -83.4% last year, its five-year earnings have grown significantly by 38.5% annually, indicating potential for recovery. The company recently announced a strategic partnership with TD SYNNEX to enhance distribution across North America, potentially increasing sales through expanded market reach. Although recent financial results showed a decline in net income from CA$0.349 million to CA$0.107 million year-over-year for the first quarter ending June 2024, AirIQ remains focused on leveraging partnerships for growth in the IoT sector.

- Take a closer look at AirIQ's potential here in our financial health report.

- Assess AirIQ's previous results with our detailed historical performance reports.

Nio Strategic Metals (TSXV:NIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nio Strategic Metals Inc. is a development stage company focused on the exploration and development of mineral properties in Quebec, with a market cap of CA$3.83 million.

Operations: The company's revenue segment is derived entirely from mining exploration, amounting to CA$0.0093 million.

Market Cap: CA$3.83M

Nio Strategic Metals Inc., with a market cap of CA$3.83 million, is a pre-revenue company focused on mineral exploration in Quebec. Despite having more cash than debt and no long-term liabilities, it remains unprofitable with increasing losses over the past five years. The company's cash runway suggests it can sustain operations for over a year if current free cash flow trends continue. However, shareholder dilution has occurred recently, and its share price has been highly volatile. Recent earnings reports show minimal revenue and widening net losses compared to the previous year, highlighting ongoing financial challenges.

- Click to explore a detailed breakdown of our findings in Nio Strategic Metals' financial health report.

- Learn about Nio Strategic Metals' historical performance here.

Quebec Precious Metals (TSXV:QPM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quebec Precious Metals Corporation focuses on the acquisition, exploration, and development of mining projects in Canada, with a market cap of CA$4.65 million.

Operations: There are no revenue segments reported for Quebec Precious Metals Corporation.

Market Cap: CA$4.65M

Quebec Precious Metals Corporation, with a market cap of CA$4.65 million, is a pre-revenue mining exploration company in Canada. The firm has no debt and its short-term assets surpass liabilities, but it remains unprofitable despite reducing losses by 33.2% annually over five years. Recent shareholder dilution and high share price volatility are concerns for investors. However, promising lithium exploration results at the Ninaaskumuwin project could enhance future prospects, as indicated by spodumene-bearing pegmatite findings. A recent private placement aims to raise CA$562,500 to support ongoing operations and exploration activities amid these developments.

- Jump into the full analysis health report here for a deeper understanding of Quebec Precious Metals.

- Evaluate Quebec Precious Metals' historical performance by accessing our past performance report.

Make It Happen

- Navigate through the entire inventory of 962 TSX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quebec Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:QPM

Quebec Precious Metals

Engages in the acquisition, exploration, and development of mining projects in Canada.

Adequate balance sheet slight.

Market Insights

Community Narratives