As we move through 2025, Canadian markets are navigating a complex landscape marked by persistent inflation and shifting leadership in key sectors. For investors looking beyond the well-trodden paths of large-cap stocks, penny stocks offer intriguing possibilities. Despite being an older term, these smaller or newer companies can present unique opportunities for growth and value when supported by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.19 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Arrow Exploration (TSXV:AXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arrow Exploration Corp. is a junior oil and gas company involved in acquiring, exploring, developing, and producing oil and gas properties in Colombia and Western Canada, with a market cap of CA$110.06 million.

Operations: The company's revenue is derived entirely from its oil and gas exploration and production activities, totaling $64.26 million.

Market Cap: CA$110.06M

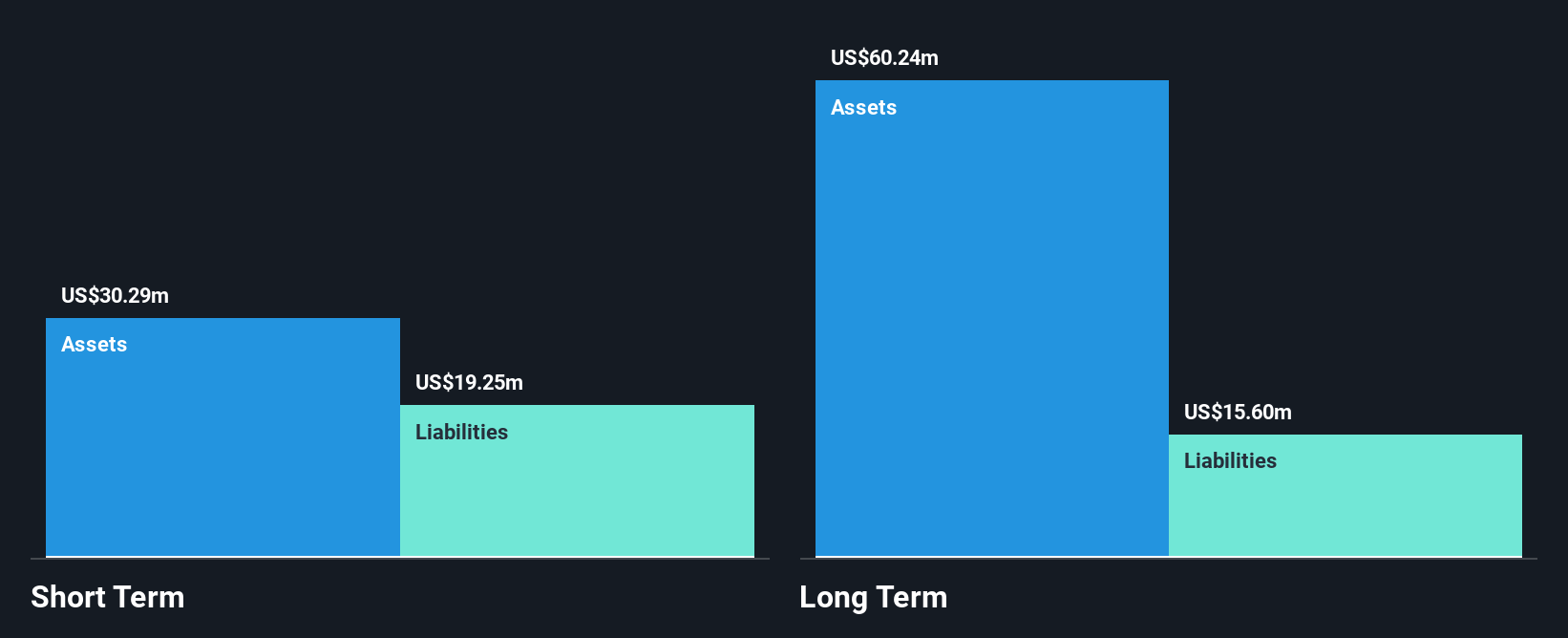

Arrow Exploration, with a market cap of CA$110.06 million, has demonstrated financial stability by maintaining short-term assets that exceed both its short and long-term liabilities. Despite recent negative earnings growth, the company remains debt-free and has not diluted shareholders over the past year. Recent developments in Colombia's Alberta Llanos field indicate promising production potential, with AB-1 well results confirming multiple hydrocarbon-bearing intervals. The company's December peak production reached 5,175 boe/d, aligning with expectations. Arrow's revenue for nine months ended September 2024 was US$50.85 million, reflecting growth from US$31.26 million a year earlier.

- Jump into the full analysis health report here for a deeper understanding of Arrow Exploration.

- Gain insights into Arrow Exploration's future direction by reviewing our growth report.

BluMetric Environmental (TSXV:BLM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BluMetric Environmental Inc. offers sustainable solutions for environmental issues both in Canada and internationally, with a market cap of CA$31.31 million.

Operations: The company's revenue segment includes Waste Management, generating CA$34.84 million.

Market Cap: CA$31.31M

BluMetric Environmental, with a market cap of CA$31.31 million, has shown resilience in the penny stock space despite facing challenges such as declining earnings and low profit margins. The company’s recent contracts for advanced water treatment systems in the Caribbean highlight its capability to deliver comprehensive solutions amid growing regional demand. While BluMetric's debt is not well covered by operating cash flow, its strategic expansion into a larger U.S. manufacturing facility suggests potential growth opportunities. The experienced management team and board provide stability, though interest coverage remains an area of concern for investors monitoring financial health closely.

- Dive into the specifics of BluMetric Environmental here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into BluMetric Environmental's track record.

NamSys (TSXV:CTZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NamSys Inc. offers software solutions for currency management and processing in the banking and merchant sectors, with a market cap of CA$31.16 million.

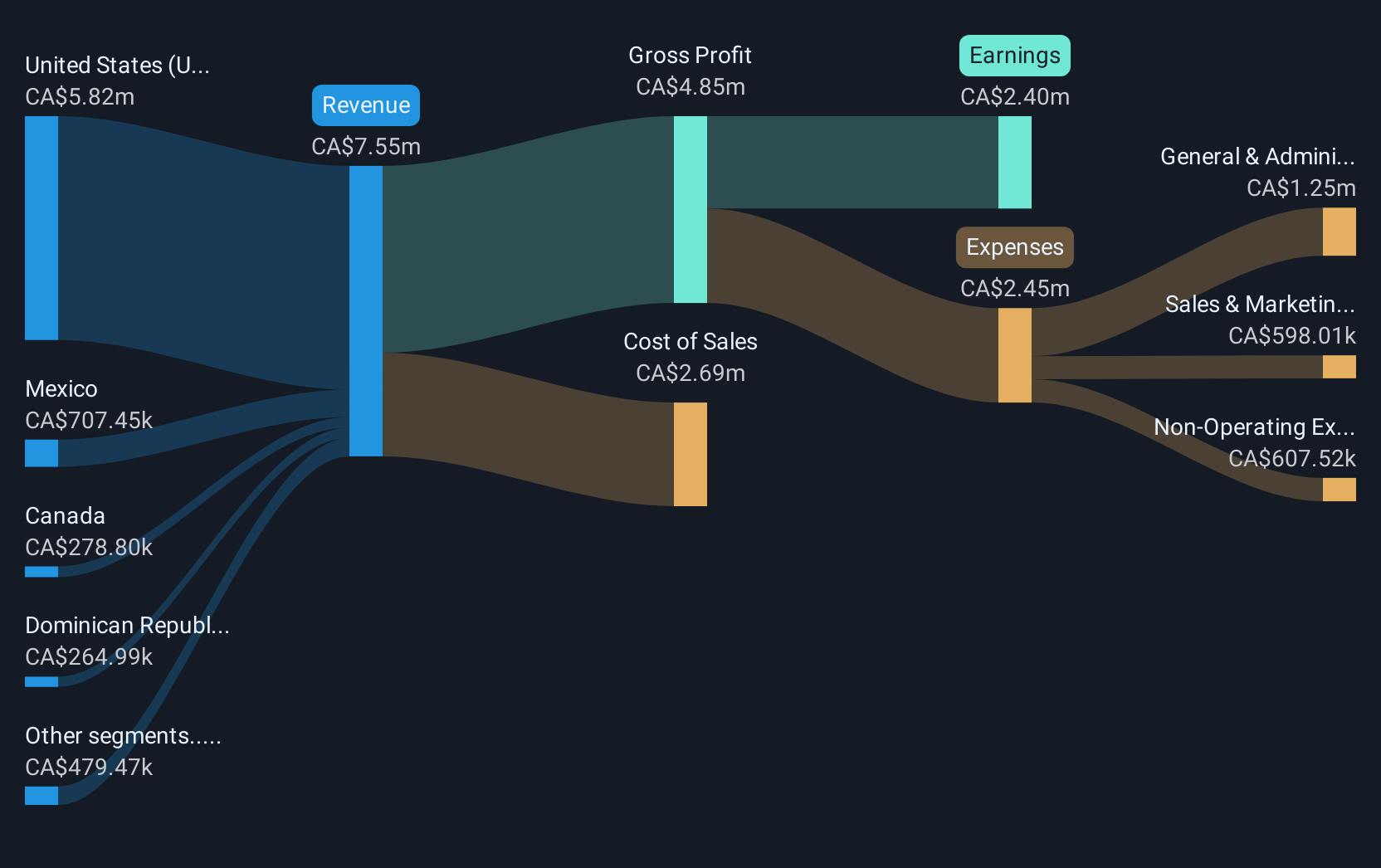

Operations: The company's revenue segment consists of Software Related Sales and Services, generating CA$6.54 million.

Market Cap: CA$31.16M

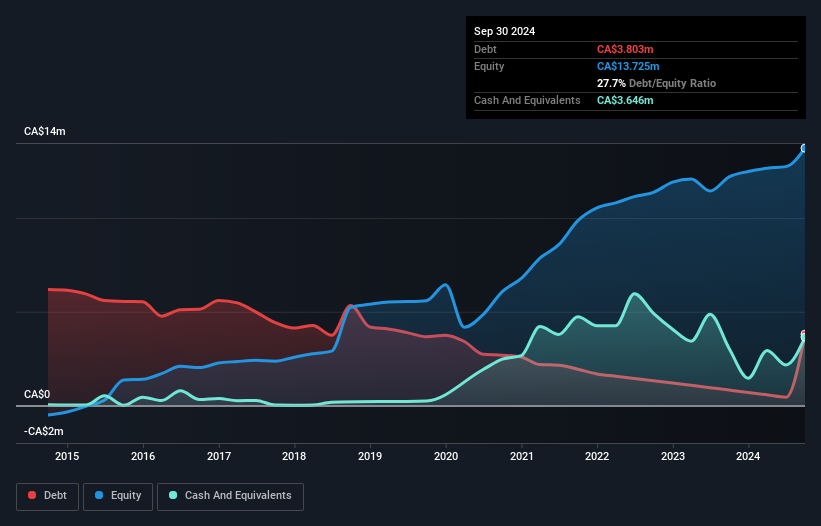

NamSys Inc., with a market cap of CA$31.16 million, demonstrates strong financial health in the penny stock sector. The company is debt-free and has seen earnings grow by 26.7% over the past year, outpacing the software industry average. Its high-quality earnings are supported by a robust net profit margin of 30.5%, an improvement from last year's 26.3%. NamSys's short-term assets significantly exceed liabilities, ensuring liquidity stability. Trading at a substantial discount to its estimated fair value, NamSys offers potential upside for investors seeking undervalued opportunities in the software sector without significant debt concerns or shareholder dilution risks.

- Click to explore a detailed breakdown of our findings in NamSys' financial health report.

- Understand NamSys' track record by examining our performance history report.

Next Steps

- Click this link to deep-dive into the 940 companies within our TSX Penny Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NamSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CTZ

NamSys

Provides software solutions for currency management and processing for the banking and merchant industries in North America.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>