The Canadian market has been experiencing a period of growth, with the TSX reaching record highs alongside the S&P 500, driven by favorable economic fundamentals and a decisive U.S. election outcome that has cleared some uncertainties. In this context, investors might consider exploring penny stocks—smaller or newer companies that can offer surprising value despite their somewhat outdated label. By focusing on those with solid financial foundations and potential for growth, investors may find opportunities in these stocks that combine stability with the possibility of future upside.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$611.45M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.65 | CA$276.89M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.83 | CA$179.38M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$117.05M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.18M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.28 | CA$311.11M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.17 | CA$4.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$219.69M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Avricore Health (TSXV:AVCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avricore Health Inc. operates in the health data and point-of-care technologies sector in Canada with a market cap of CA$14.13 million.

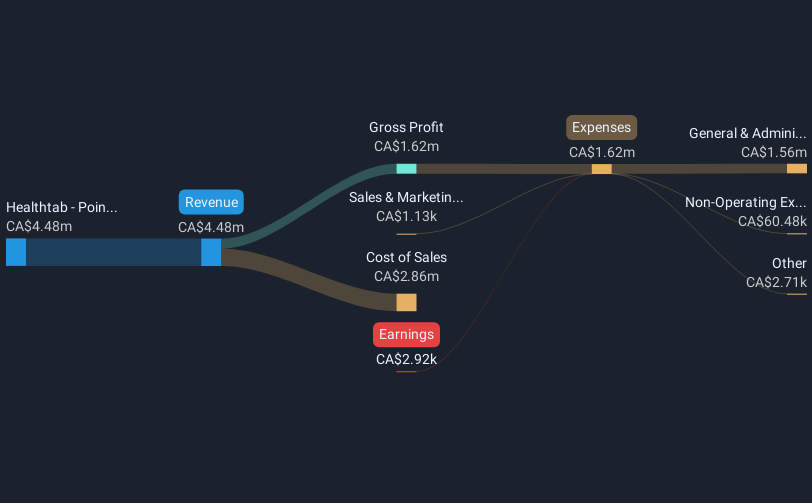

Operations: The company generates revenue primarily from its Healthtab - Point of Care segment, which amounted to CA$4.48 million.

Market Cap: CA$14.13M

Avricore Health Inc., with a market cap of CA$14.13 million, operates in the health data and point-of-care technologies sector. Despite being unprofitable, the company has shown significant improvement by reducing losses at a rate of 30.2% annually over five years and achieving positive net income recently. Its short-term assets exceed liabilities, and it remains debt-free with no long-term liabilities. Avricore has a stable cash runway for more than three years due to positive free cash flow growth. Recent earnings reports highlight increased sales to CA$2.17 million for six months ending June 2024, indicating revenue growth potential despite current challenges.

- Click here to discover the nuances of Avricore Health with our detailed analytical financial health report.

- Evaluate Avricore Health's historical performance by accessing our past performance report.

Blockmint Technologies (TSXV:BKMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Blockmint Technologies Inc. develops distributed systems and networks for decentralized blockchain applications, with a market cap of CA$2.41 million.

Operations: Blockmint Technologies Inc. has not reported any revenue segments.

Market Cap: CA$2.41M

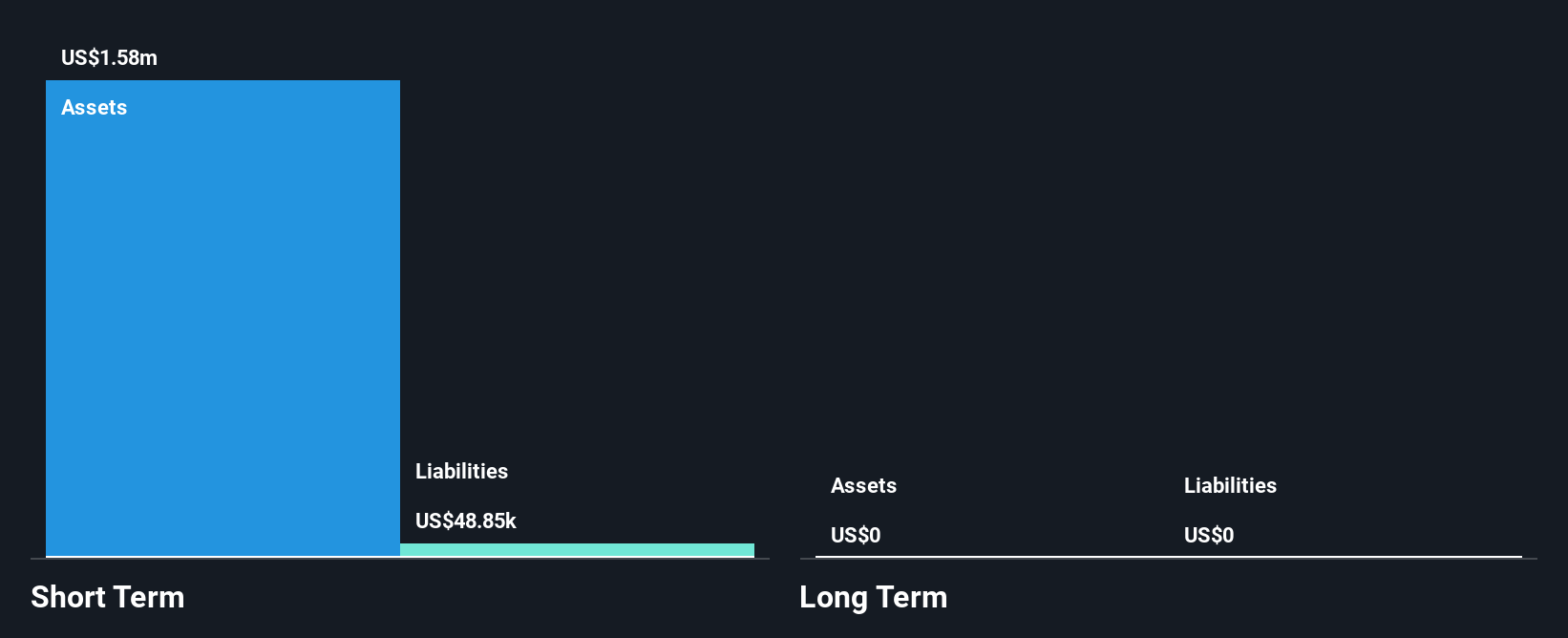

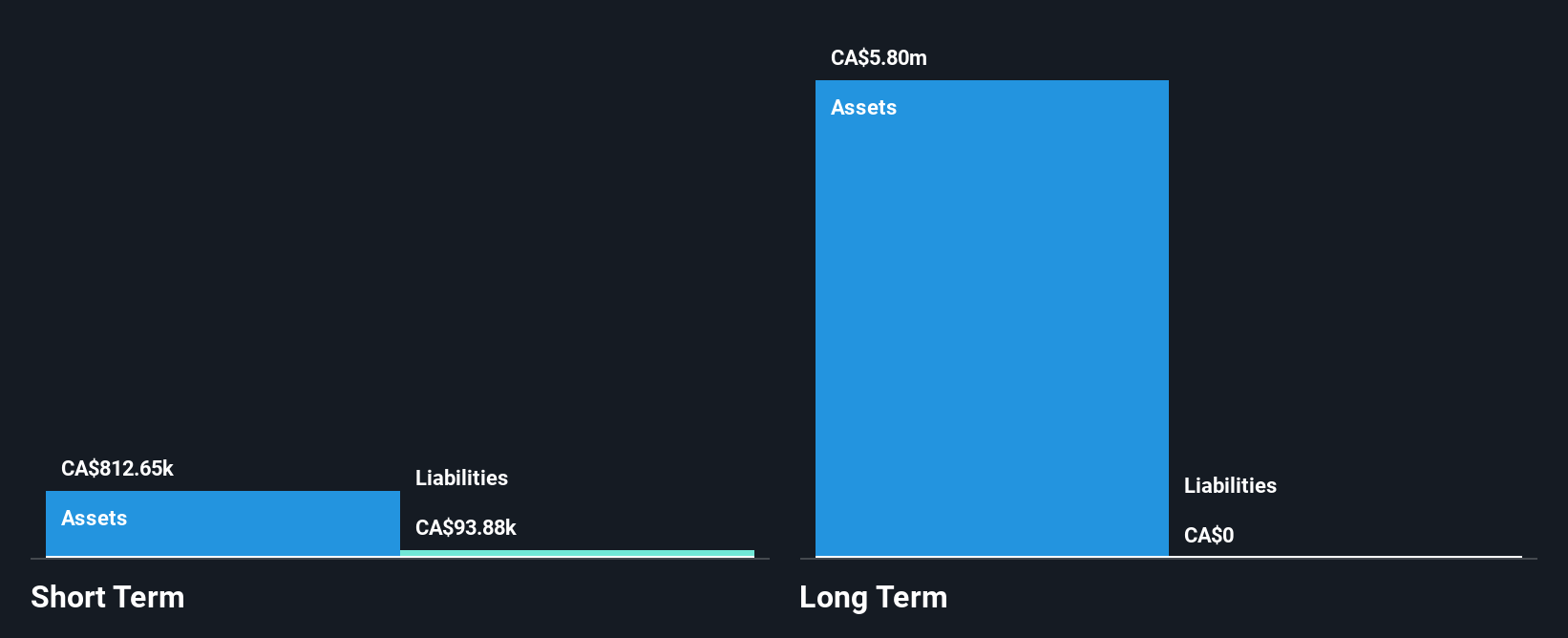

Blockmint Technologies Inc., with a market cap of CA$2.41 million, operates in the blockchain space but remains pre-revenue, having generated less than US$1 million. The company is debt-free and has no long-term liabilities, providing a stable financial base. Its short-term assets significantly exceed its liabilities, ensuring liquidity. Despite being unprofitable, Blockmint has reduced losses by 61.2% annually over five years and maintains a cash runway exceeding three years if free cash flow growth persists at historical rates. Recent earnings reports show an increased net loss compared to the previous year, reflecting ongoing challenges in achieving profitability.

- Jump into the full analysis health report here for a deeper understanding of Blockmint Technologies.

- Learn about Blockmint Technologies' historical performance here.

Condor Resources (TSXV:CN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Resources Inc. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in Canada and Peru, with a market cap of CA$19.76 million.

Operations: Condor Resources Inc. has not reported any revenue segments as it is an exploration stage company focused on mineral properties in Canada and Peru.

Market Cap: CA$19.76M

Condor Resources Inc., with a market cap of CA$19.76 million, is a pre-revenue exploration company focused on mineral properties in Canada and Peru. The company recently expanded its Huiñac Punta silver prospect from 2,000 to 7,200 hectares through new concessions, indicating potential for significant resource development. Despite being unprofitable and reporting a net loss of CA$0.68 million for the past six months, Condor remains debt-free with short-term assets of CA$2.5 million surpassing liabilities of CA$85.7K, ensuring liquidity. Its management team and board are experienced, providing strategic stability as it continues exploration efforts.

- Click to explore a detailed breakdown of our findings in Condor Resources' financial health report.

- Understand Condor Resources' track record by examining our performance history report.

Make It Happen

- Navigate through the entire inventory of 962 TSX Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blockmint Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BKMT

Blockmint Technologies

Engages in the business of developing distributed systems and networks that enables decentralized deployment of blockchain based applications.

Flawless balance sheet low.