- Canada

- /

- Metals and Mining

- /

- CNSX:FLM

TSX Penny Stocks To Watch: Cannabix Technologies And Two More

Reviewed by Simply Wall St

As Canadian markets navigate a landscape of conflicting forces, including persistent inflation and evolving leadership in various sectors, investors are keenly observing opportunities that might arise. Penny stocks, despite their somewhat outdated label, remain an intriguing segment for those seeking potential growth and value. These smaller or newer companies can offer unique investment opportunities when backed by strong financials, making them worthy of attention for those willing to explore beyond the mainstream market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.84 | CA$179.87M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.71 | CA$442.31M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$638.07M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$416.12M | ★★★★★☆ |

| Copper Road Resources (TSXV:CRD) | CA$0.015 | CA$975.24k | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.89 | CA$177.67M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.15 | CA$224.35M | ★★★★☆☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cannabix Technologies (CNSX:BLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cannabix Technologies Inc. is a technology company that develops marijuana and alcohol breathalyzers for employers, law enforcement, workplaces, and laboratories in the United States, with a market cap of CA$57.57 million.

Operations: Cannabix Technologies Inc. currently does not report any revenue segments.

Market Cap: CA$57.57M

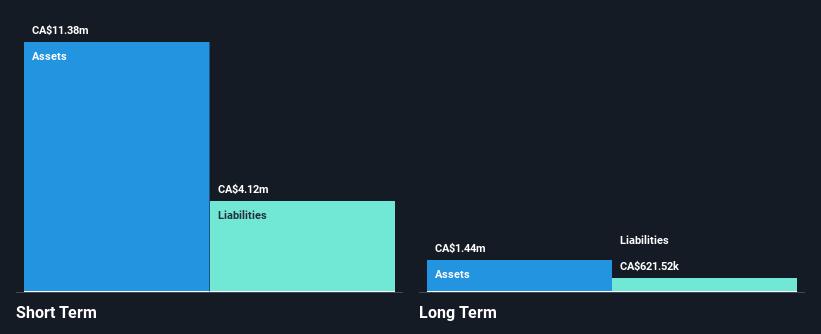

Cannabix Technologies Inc., with a market cap of CA$57.57 million, remains pre-revenue, focusing on advancing its marijuana and alcohol breathalyzer technologies. Recent updates to the Cannabix Marijuana Breathalyzer aim to meet emerging regulatory requirements, enhancing features like ergonomic design and dual sample collection capabilities. The company also achieved a significant milestone with its Breath Logix device receiving positive certification from CEcert GmbH, paving the way for marketing in Australia and other regions. Despite ongoing losses, Cannabix maintains a stable cash runway exceeding one year without long-term liabilities or debt concerns.

- Click to explore a detailed breakdown of our findings in Cannabix Technologies' financial health report.

- Learn about Cannabix Technologies' historical performance here.

First Lithium Minerals (CNSX:FLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: First Lithium Minerals Corp. is a mineral exploration and development company operating in Chile, Ontario, and Quebec with a market cap of CA$6.68 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$6.68M

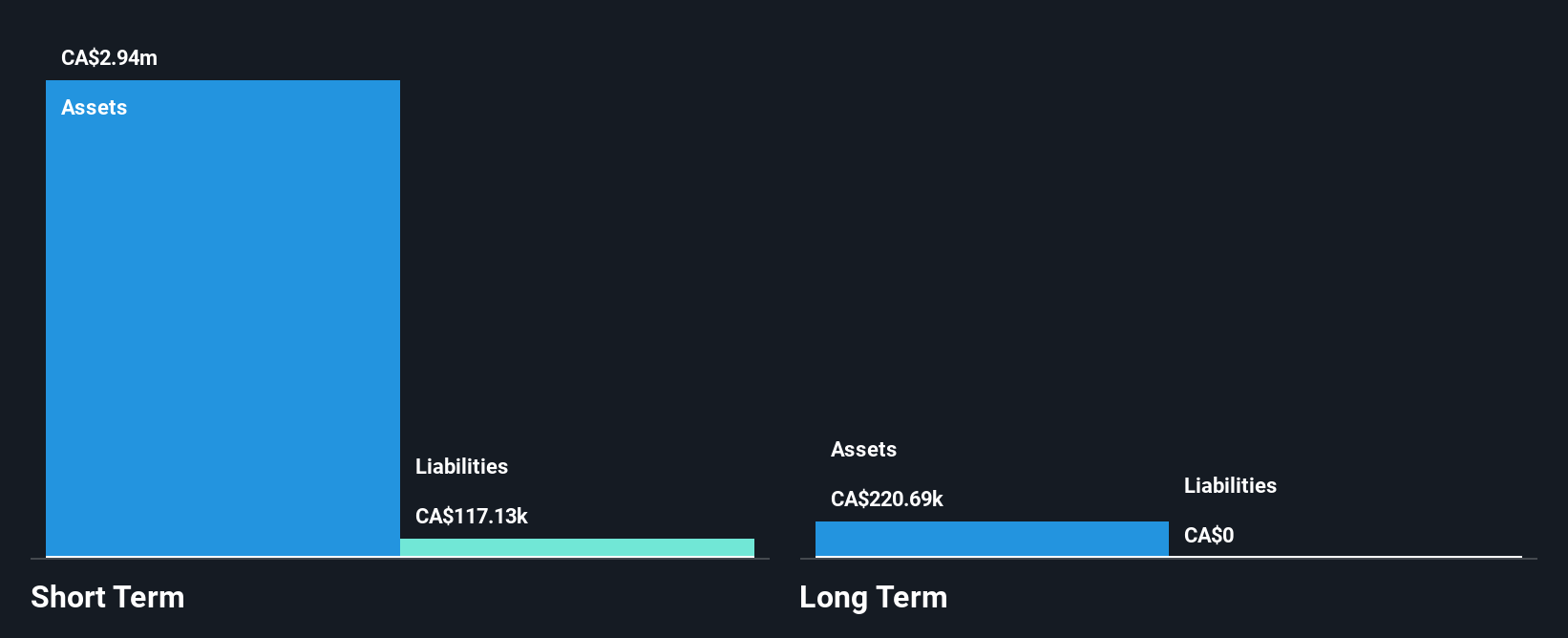

First Lithium Minerals Corp., with a market cap of CA$6.68 million, is pre-revenue and focuses on mineral exploration in Chile, Ontario, and Quebec. The company reported a net loss for the third quarter of 2024 at CA$0.33 million, slightly higher than the previous year's CA$0.28 million. Despite being unprofitable, First Lithium has more cash than debt and no long-term liabilities, ensuring short-term financial stability with assets covering its liabilities effectively. However, its share price remains highly volatile compared to most Canadian stocks and lacks experienced management or board tenure to provide strategic guidance amidst industry challenges.

- Take a closer look at First Lithium Minerals' potential here in our financial health report.

- Understand First Lithium Minerals' track record by examining our performance history report.

BeWhere Holdings (TSXV:BEW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BeWhere Holdings Inc. is an industrial Internet of Things (IIoT) solutions company that designs, manufactures, and sells hardware with sensors and software applications for tracking real-time information on fixed and movable assets, with a market cap of CA$60.55 million.

Operations: The company generates its revenue from the Software & Programming segment, which accounts for CA$16.07 million.

Market Cap: CA$60.55M

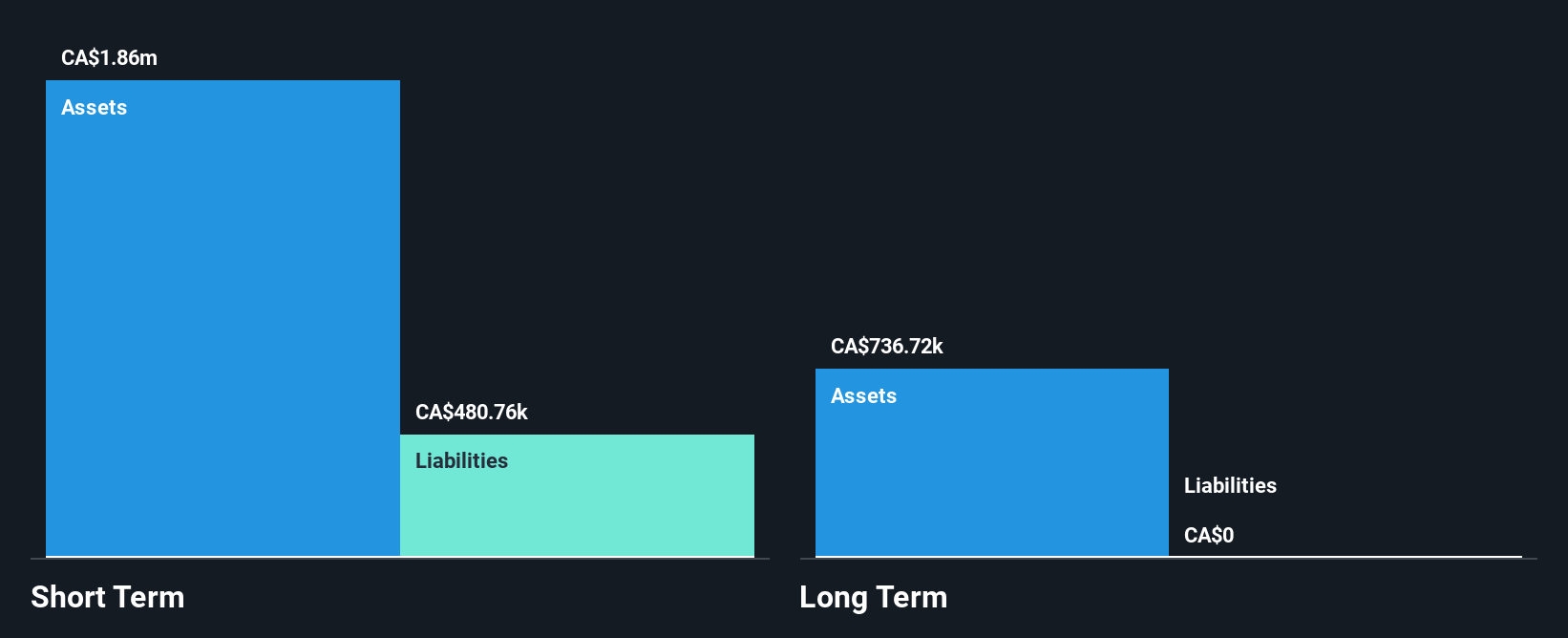

BeWhere Holdings Inc., with a market cap of CA$60.55 million, operates in the IIoT sector, generating CA$16.07 million in revenue from its Software & Programming segment. Recent earnings reports show increased sales and net income compared to the previous year, indicating growth potential despite lower profit margins than last year. The company maintains financial stability with more cash than debt and well-covered liabilities by short-term assets. BeWhere's management and board are experienced, bolstered by Peter Wilcox's recent appointment, enhancing strategic direction with his extensive telecommunications expertise. Additionally, the company has engaged in modest share repurchases recently.

- Jump into the full analysis health report here for a deeper understanding of BeWhere Holdings.

- Gain insights into BeWhere Holdings' past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Click here to access our complete index of 935 TSX Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:FLM

First Lithium Minerals

Operates as a mineral exploration and development company in Chile and Canada.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026