- Canada

- /

- Metals and Mining

- /

- TSXV:CKG

TSX Penny Stock Discoveries: Thinkific Labs And Two More Top Picks

Reviewed by Simply Wall St

Recent signals from the Bank of Canada and the Federal Reserve have buoyed Canadian equities to new highs, with a supportive stance on interest rates providing a favorable backdrop for investors. Amid this economic landscape, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities despite their somewhat outdated name. In this article, we explore three such stocks that exhibit strong financial foundations and potential for growth, highlighting their appeal as hidden gems in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.12 | CA$54.1M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.30 | CA$251.96M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.23 | CA$121.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.47 | CA$3.93M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.33 | CA$851.58M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.93 | CA$150.14M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.00 | CA$184.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and manages a cloud-based platform serving Canada, the United States, and international markets with a market cap of CA$120.18 million.

Operations: The company generates revenue of $72.08 million from the development, marketing, and support management of its cloud-based platform.

Market Cap: CA$120.18M

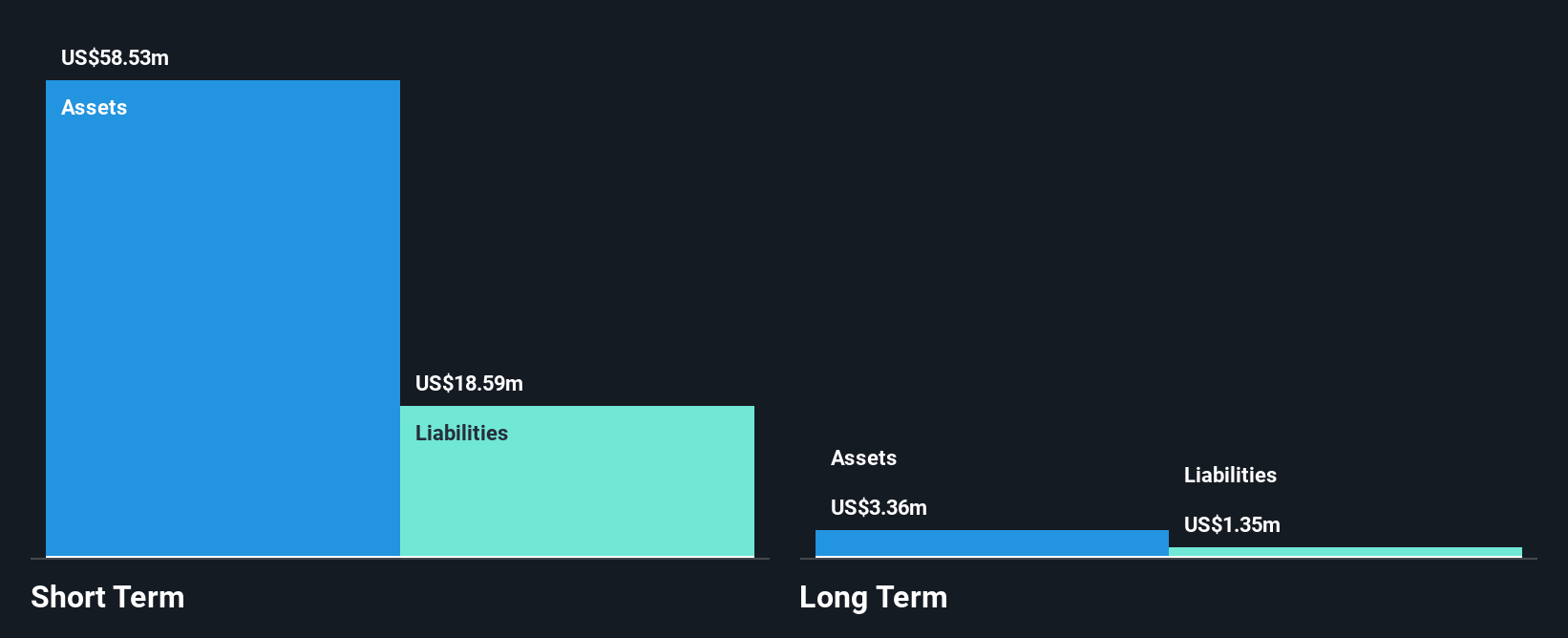

Thinkific Labs Inc., with a market cap of CA$120.18 million, has shown mixed performance as a penny stock. Despite its revenue growth to US$72.08 million, the company's return on equity remains low at 0.6%, and earnings are forecasted to decline significantly by 91.5% annually over the next three years. However, it trades at a substantial discount to its estimated fair value and maintains strong liquidity with short-term assets exceeding liabilities substantially. Recent activities include filing for a CA$300 million shelf registration and executing share buybacks, indicating strategic moves towards capital management and shareholder value enhancement amidst challenging profit margins.

- Unlock comprehensive insights into our analysis of Thinkific Labs stock in this financial health report.

- Explore Thinkific Labs' analyst forecasts in our growth report.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that specializes in acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$178.79 million.

Operations: Chesapeake Gold Corp. does not report any revenue segments.

Market Cap: CA$178.79M

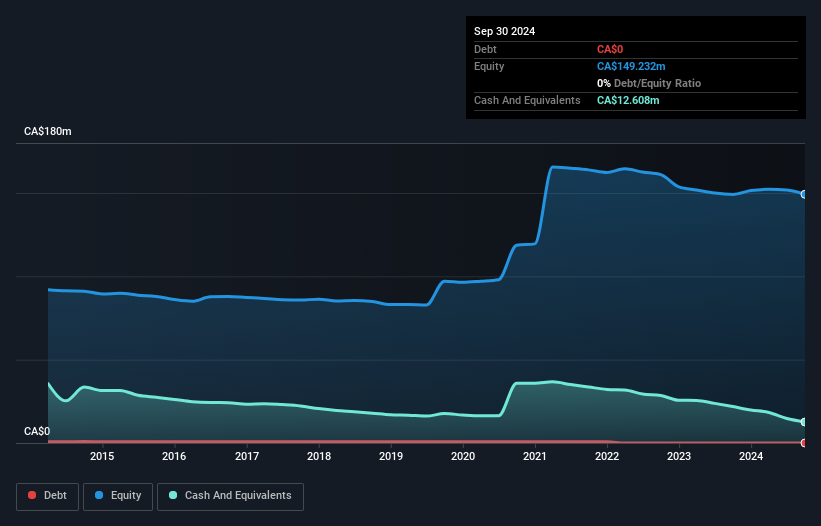

Chesapeake Gold Corp., with a market cap of CA$178.79 million, is pre-revenue and currently unprofitable, as evidenced by its recent third-quarter net loss of CA$1.77 million. The company maintains a debt-free status and has not significantly diluted shareholders over the past year. Its exploration agreement extension for the Metates property in Mexico highlights ongoing development efforts, while proprietary sulphide leach testwork progresses on schedule. Despite high share price volatility and insider selling over the past three months, Chesapeake's short-term assets exceed both short-term and long-term liabilities, providing some financial stability amidst operational challenges.

- Click here to discover the nuances of Chesapeake Gold with our detailed analytical financial health report.

- Assess Chesapeake Gold's previous results with our detailed historical performance reports.

Pan Global Resources (TSXV:PGZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pan Global Resources Inc. is a mineral exploration company focused on exploring and evaluating mineral properties in Spain, with a market cap of CA$43.03 million.

Operations: Pan Global Resources Inc. currently does not report any revenue segments.

Market Cap: CA$43.03M

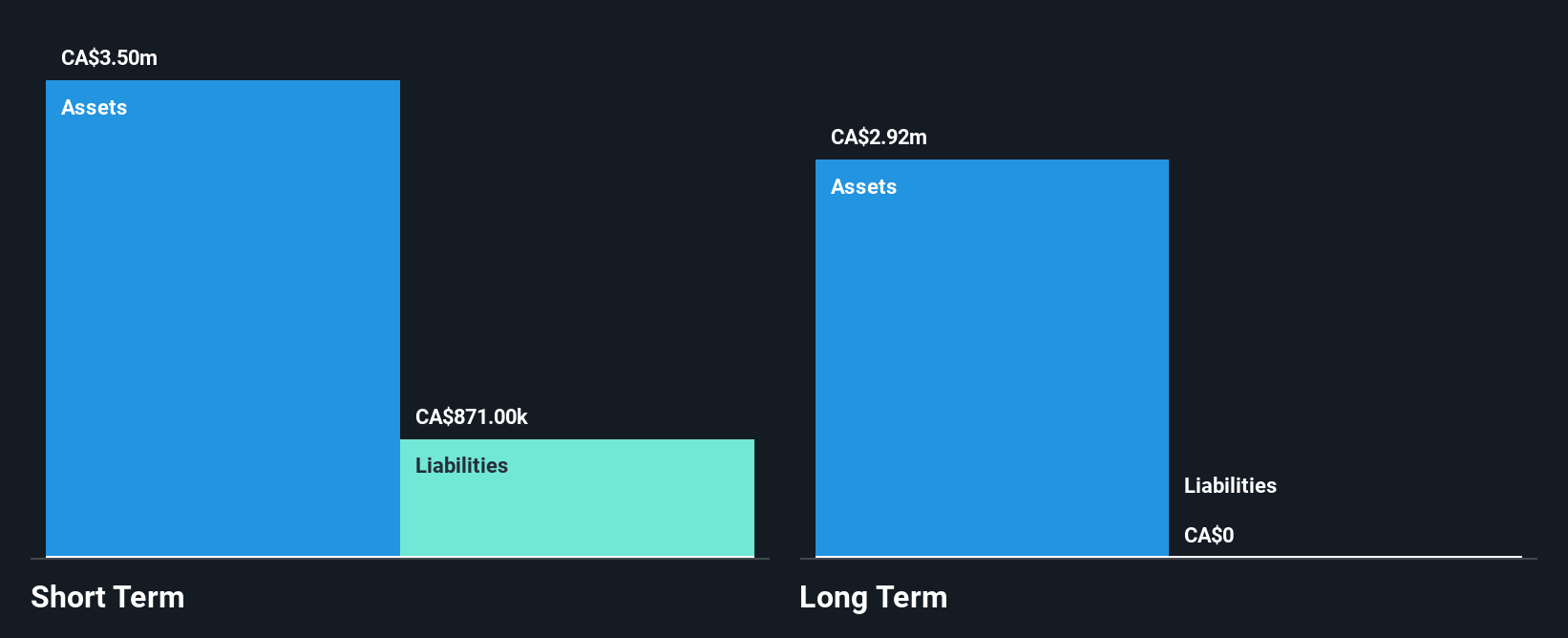

Pan Global Resources Inc., with a market cap of CA$43.03 million, is pre-revenue and unprofitable, reporting increased net losses for the recent quarter. Despite this, the company remains debt-free and has not significantly diluted shareholders recently. Recent capital raised through private placements bolsters its cash position temporarily. The company is advancing exploration at its Escacena and Carmenes projects in Spain, with promising assay results indicating potential gold mineralization expansion. These developments suggest active exploration efforts but highlight financial constraints due to limited revenue generation capacity and reliance on external funding for operations continuation.

- Take a closer look at Pan Global Resources' potential here in our financial health report.

- Explore historical data to track Pan Global Resources' performance over time in our past results report.

Next Steps

- Access the full spectrum of 392 TSX Penny Stocks by clicking on this link.

- Curious About Other Options? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CKG

Chesapeake Gold

A mineral exploration and evaluation company, focuses on acquisition, evaluation, and development of precious metal deposits in North and Central America.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion