We note that the Tecsys Inc. (TSE:TCS) Executive Chairman, David Brereton, recently sold CA$79k worth of stock for CA$32.72 per share. However we note that the sale only shrunk their holding by 0.3%.

Tecsys Insider Transactions Over The Last Year

The CEO, President & Director, Peter Brereton, made the biggest insider sale in the last 12 months. That single transaction was for CA$3.0m worth of shares at a price of CA$41.00 each. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The silver lining is that this sell-down took place above the latest price (CA$31.81). So it is hard to draw any strong conclusion from it.

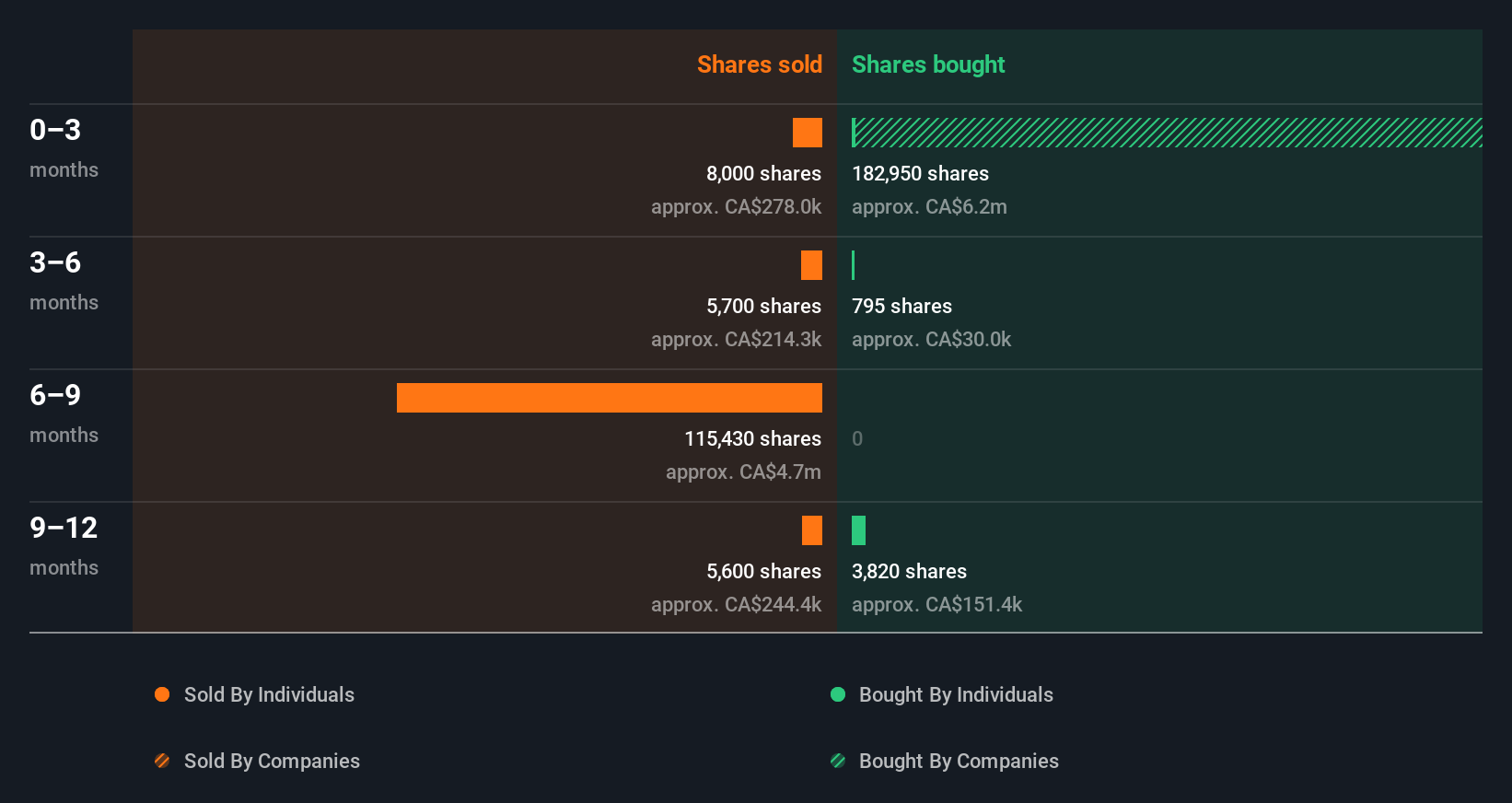

Happily, we note that in the last year insiders paid CA$217k for 5.62k shares. On the other hand they divested 134.73k shares, for CA$5.5m. All up, insiders sold more shares in Tecsys than they bought, over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Check out our latest analysis for Tecsys

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insider Ownership Of Tecsys

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 8.4% of Tecsys shares, worth about CA$40m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Tecsys Insider Transactions Indicate?

The stark truth for Tecsys is that there has been more insider selling than insider buying in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. On the plus side, Tecsys makes money, and is growing profits. While insiders do own shares, they don't own a heap, and they have been selling. We're in no rush to buy! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example, Tecsys has 2 warning signs (and 1 which is significant) we think you should know about.

But note: Tecsys may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tecsys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TCS

Tecsys

Engages in the development, marketing, and sale of enterprise-wide supply chain management software and related services in Canada, the United States, Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion