MediaValet Inc.'s (TSE:MVP) CEO Compensation Is Looking A Bit Stretched At The Moment

CEO David MacLaren has done a decent job of delivering relatively good performance at MediaValet Inc. (TSE:MVP) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 23 June 2021. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for MediaValet

Comparing MediaValet Inc.'s CEO Compensation With the industry

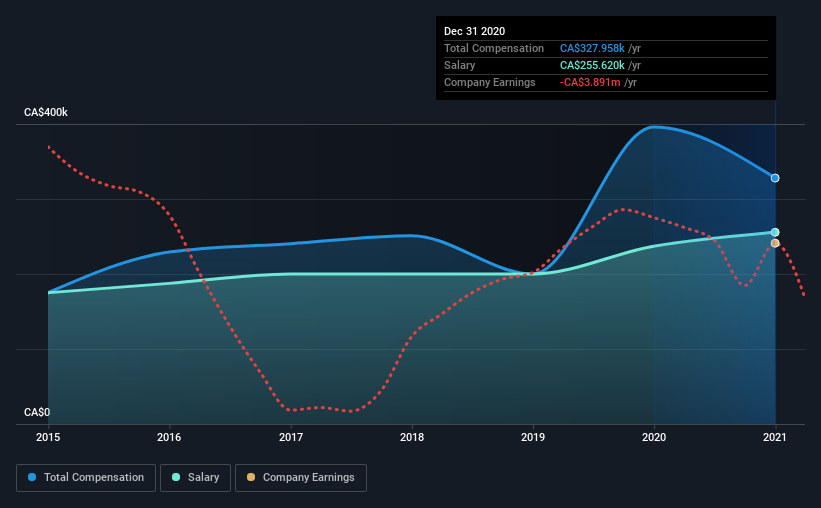

Our data indicates that MediaValet Inc. has a market capitalization of CA$93m, and total annual CEO compensation was reported as CA$328k for the year to December 2020. That's a notable decrease of 17% on last year. In particular, the salary of CA$255.6k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under CA$243m, the reported median total CEO compensation was CA$202k. This suggests that David MacLaren is paid more than the median for the industry. What's more, David MacLaren holds CA$1.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$256k | CA$237k | 78% |

| Other | CA$72k | CA$159k | 22% |

| Total Compensation | CA$328k | CA$396k | 100% |

On an industry level, roughly 71% of total compensation represents salary and 29% is other remuneration. MediaValet is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at MediaValet Inc.'s Growth Numbers

Over the past three years, MediaValet Inc. has seen its earnings per share (EPS) grow by 54% per year. Its revenue is up 34% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has MediaValet Inc. Been A Good Investment?

We think that the total shareholder return of 260%, over three years, would leave most MediaValet Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for MediaValet that you should be aware of before investing.

Important note: MediaValet is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:MVP

MediaValet

MediaValet Inc. develops and delivers enterprise cloud software to manage the digital media assets for companies in various industries.

Limited growth and overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.