- Canada

- /

- Metals and Mining

- /

- TSX:OLA

TSX Value Stocks That May Be Trading Below Their Worth June 2025

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by trade developments and central bank meetings, investors are keenly watching for signs of volatility amid ongoing fiscal debates. Despite these challenges, the underlying fundamentals remain solid, providing a steady foundation for those seeking value opportunities in equities. In this context, identifying undervalued stocks can be particularly rewarding as they may offer potential upside when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VersaBank (TSX:VBNK) | CA$15.11 | CA$26.15 | 42.2% |

| TerraVest Industries (TSX:TVK) | CA$169.63 | CA$299.97 | 43.5% |

| OceanaGold (TSX:OGC) | CA$6.61 | CA$12.18 | 45.7% |

| Magna Mining (TSXV:NICU) | CA$1.73 | CA$3.06 | 43.4% |

| Lithium Royalty (TSX:LIRC) | CA$5.22 | CA$8.45 | 38.2% |

| Kolibri Global Energy (TSX:KEI) | CA$9.28 | CA$17.86 | 48% |

| Groupe Dynamite (TSX:GRGD) | CA$16.12 | CA$28.78 | 44% |

| First Majestic Silver (TSX:AG) | CA$11.41 | CA$20.33 | 43.9% |

| Endeavour Silver (TSX:EDR) | CA$6.84 | CA$11.88 | 42.4% |

| Alphamin Resources (TSXV:AFM) | CA$0.80 | CA$1.32 | 39.6% |

Let's dive into some prime choices out of the screener.

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$5.62 billion.

Operations: The company generates revenue from its cloud-based subscription software for supply chain operations, amounting to $496.53 million.

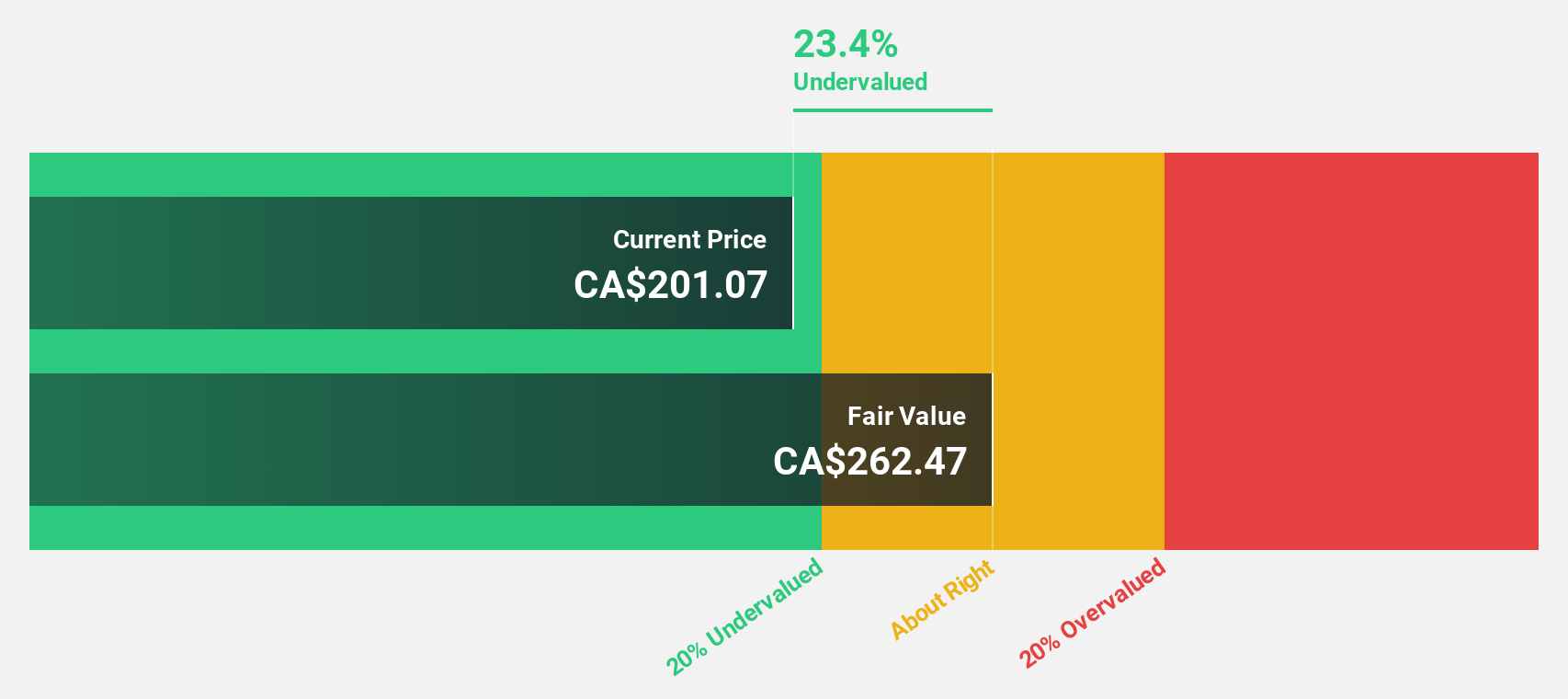

Estimated Discount To Fair Value: 19.4%

Kinaxis, trading at CA$199.51, is 19.4% below its estimated fair value of CA$247.51, indicating potential undervaluation based on discounted cash flow analysis. Despite lower profit margins compared to last year, earnings are forecasted to grow significantly at 54.99% annually over the next three years, outpacing the Canadian market's growth rate of 12.6%. Recent product advancements and strategic partnerships enhance its AI-driven supply chain solutions, potentially boosting future cash flows and operational resilience amidst industry disruptions.

- According our earnings growth report, there's an indication that Kinaxis might be ready to expand.

- Click to explore a detailed breakdown of our findings in Kinaxis' balance sheet health report.

Orla Mining (TSX:OLA)

Overview: Orla Mining Ltd. is involved in the acquisition, exploration, development, and exploitation of mineral properties with a market cap of CA$4.94 billion.

Operations: Orla Mining Ltd. generates its revenue through the acquisition, exploration, development, and exploitation of mineral properties.

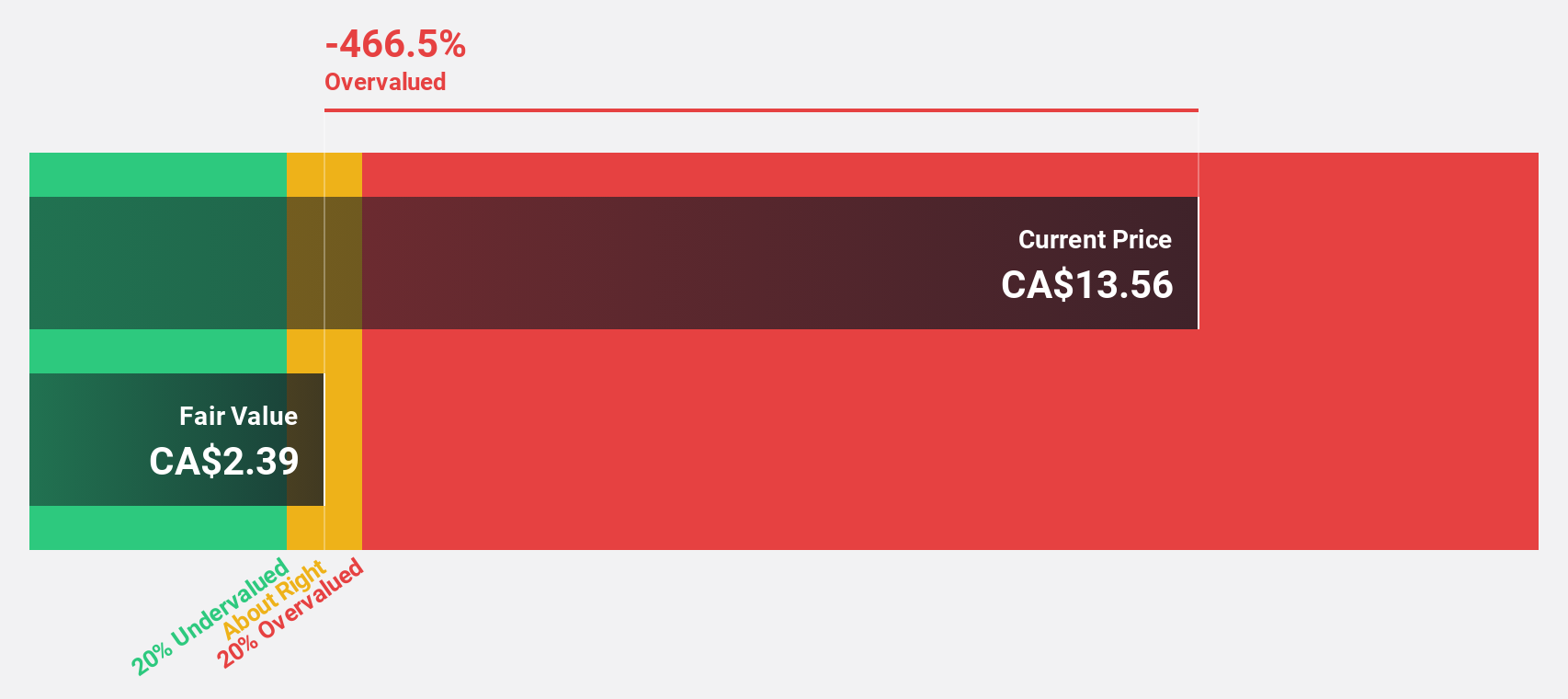

Estimated Discount To Fair Value: 14.6%

Orla Mining, currently priced at CA$14.8, is trading below its estimated fair value of CA$17.33, suggesting potential undervaluation based on cash flow analysis. Despite a high level of debt and recent net losses, Orla's earnings are forecasted to grow significantly at 41.63% annually over the next three years, surpassing the Canadian market growth rate of 12.6%. Recent updates include a significant increase in gold production guidance and new resource estimates for Camino Rojo, enhancing future cash flow prospects.

- Upon reviewing our latest growth report, Orla Mining's projected financial performance appears quite optimistic.

- Dive into the specifics of Orla Mining here with our thorough financial health report.

Propel Holdings (TSX:PRL)

Overview: Propel Holdings Inc., along with its subsidiaries, operates as a financial technology company and has a market cap of CA$1.31 billion.

Operations: The company's revenue primarily comes from providing lending-related services to borrowers, banks, and other institutions, amounting to $492.16 million.

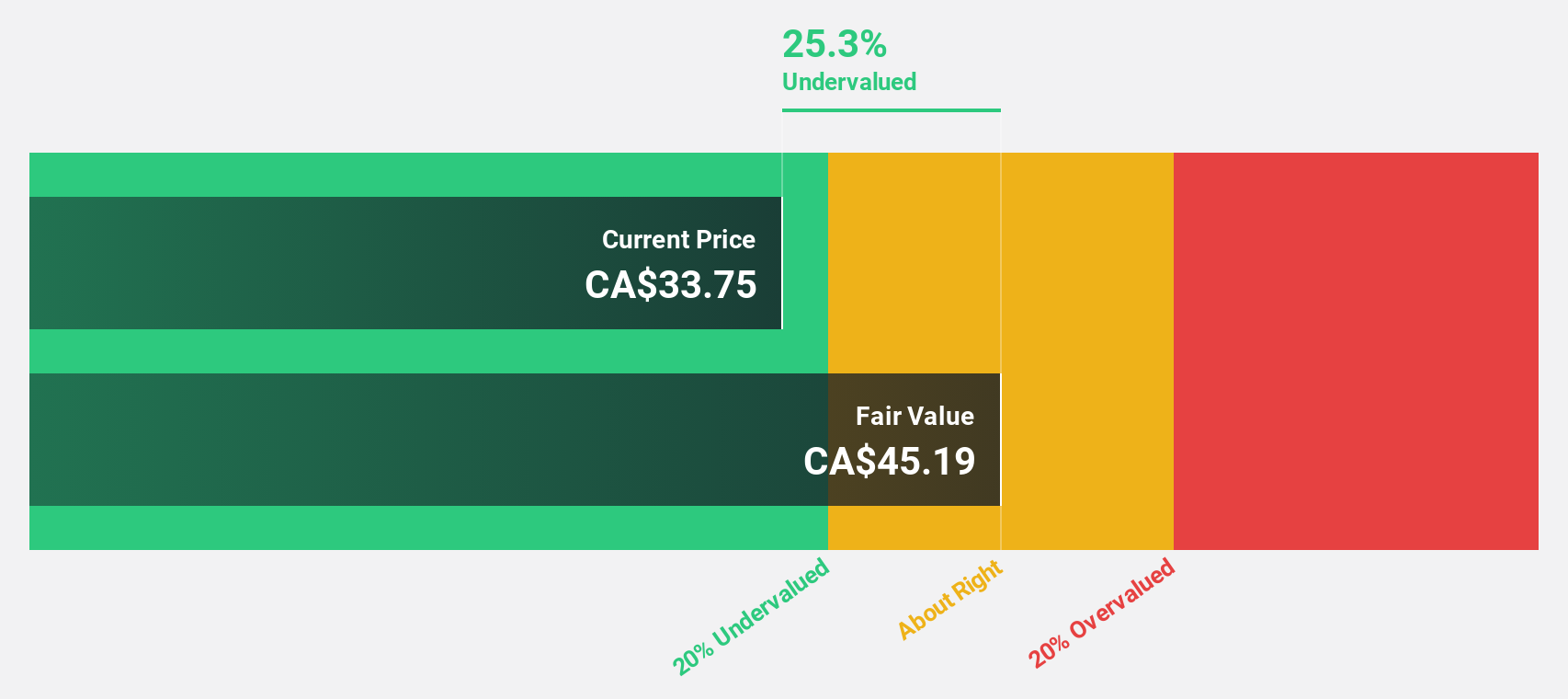

Estimated Discount To Fair Value: 26.6%

Propel Holdings, trading at CA$33.2, is significantly undervalued with a fair value estimate of CA$45.21 based on discounted cash flow analysis. Recent earnings report shows strong growth with revenue at US$138.94 million and net income rising to US$23.5 million for Q1 2025, reflecting robust financial health despite debt not being well covered by operating cash flow. Propel's forecasted annual profit and revenue growth rates exceed market averages, highlighting potential long-term value appreciation.

- In light of our recent growth report, it seems possible that Propel Holdings' financial performance will exceed current levels.

- Get an in-depth perspective on Propel Holdings' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Discover the full array of 23 Undervalued TSX Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OLA

Orla Mining

Acquires, explores, develops, and exploits mineral properties.

High growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success