- Canada

- /

- Construction

- /

- TSX:BDGI

TSX Value Stocks Including Badger Infrastructure Solutions That May Be Trading At A Discount

Reviewed by Simply Wall St

As the U.S. government shutdown introduces uncertainty into global markets, Canada's TSX remains a focal point for investors seeking stability and potential value opportunities. In this environment, identifying undervalued stocks can be crucial, as they may offer attractive entry points amid market fluctuations driven by macroeconomic events.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WELL Health Technologies (TSX:WELL) | CA$5.77 | CA$9.83 | 41.3% |

| Vitalhub (TSX:VHI) | CA$11.27 | CA$18.84 | 40.2% |

| Savaria (TSX:SIS) | CA$21.65 | CA$41.11 | 47.3% |

| OceanaGold (TSX:OGC) | CA$32.69 | CA$54.15 | 39.6% |

| Meren Energy (TSX:MER) | CA$1.82 | CA$3.09 | 41.2% |

| Magellan Aerospace (TSX:MAL) | CA$17.25 | CA$28.22 | 38.9% |

| Haivision Systems (TSX:HAI) | CA$5.12 | CA$9.43 | 45.7% |

| GURU Organic Energy (TSX:GURU) | CA$5.48 | CA$8.97 | 38.9% |

| Bird Construction (TSX:BDT) | CA$30.49 | CA$56.89 | 46.4% |

| 5N Plus (TSX:VNP) | CA$18.25 | CA$33.61 | 45.7% |

Here we highlight a subset of our preferred stocks from the screener.

Badger Infrastructure Solutions (TSX:BDGI)

Overview: Badger Infrastructure Solutions Ltd. offers non-destructive excavating and related services across Canada and the United States, with a market cap of CA$2.15 billion.

Operations: The company generates revenue of $777.39 million from its non-destructive excavating and related services in Canada and the United States.

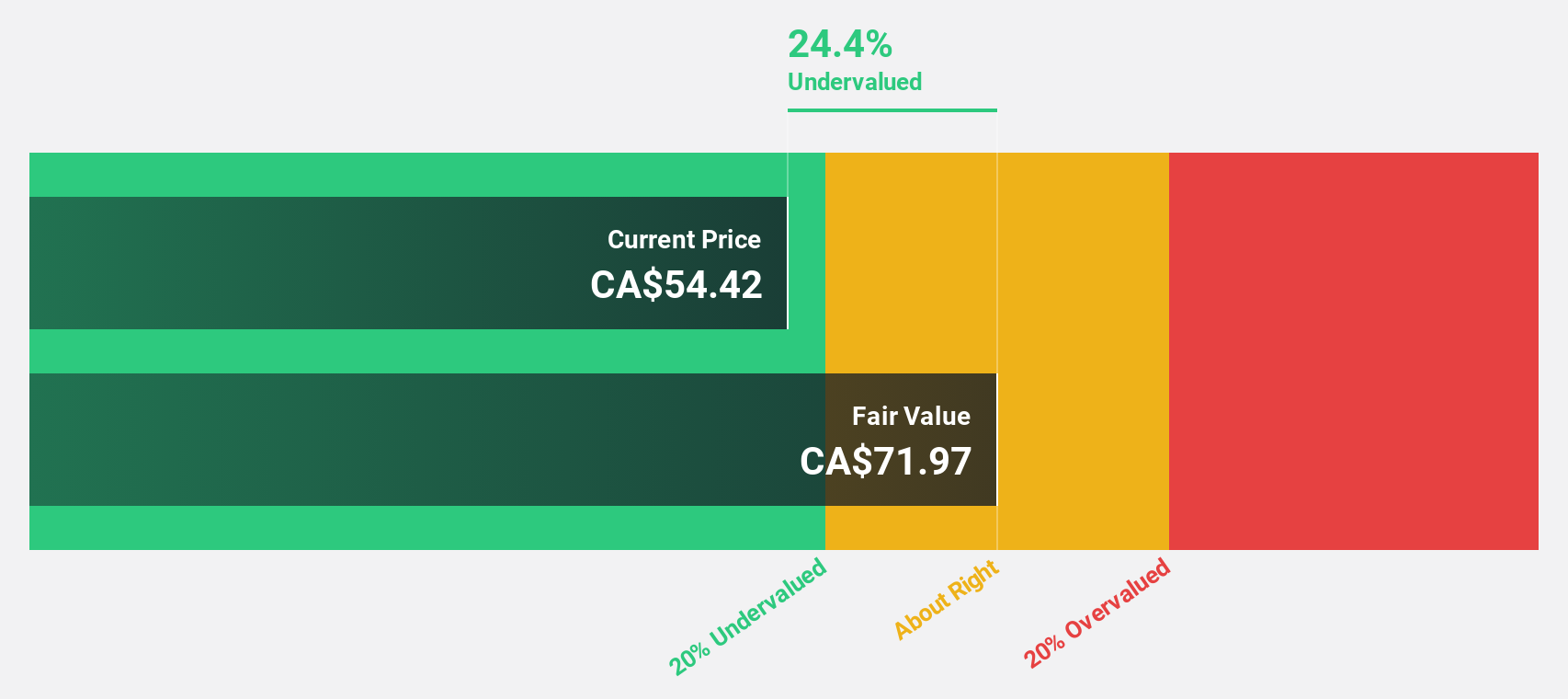

Estimated Discount To Fair Value: 17.7%

Badger Infrastructure Solutions, trading at CA$64.68, is undervalued based on discounted cash flow analysis with an estimated fair value of CA$78.61. Recent earnings reveal strong performance, with net income rising to US$18.5 million in Q2 2025 from US$11.91 million a year prior. The company has initiated a significant share buyback program to repurchase 8.63% of its shares by August 2026, potentially enhancing shareholder value through reduced share count and increased earnings per share.

- According our earnings growth report, there's an indication that Badger Infrastructure Solutions might be ready to expand.

- Get an in-depth perspective on Badger Infrastructure Solutions' balance sheet by reading our health report here.

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$5.24 billion.

Operations: The company's revenue primarily stems from its Supply Chain Management Software and Solutions segment, which generated $514.67 million.

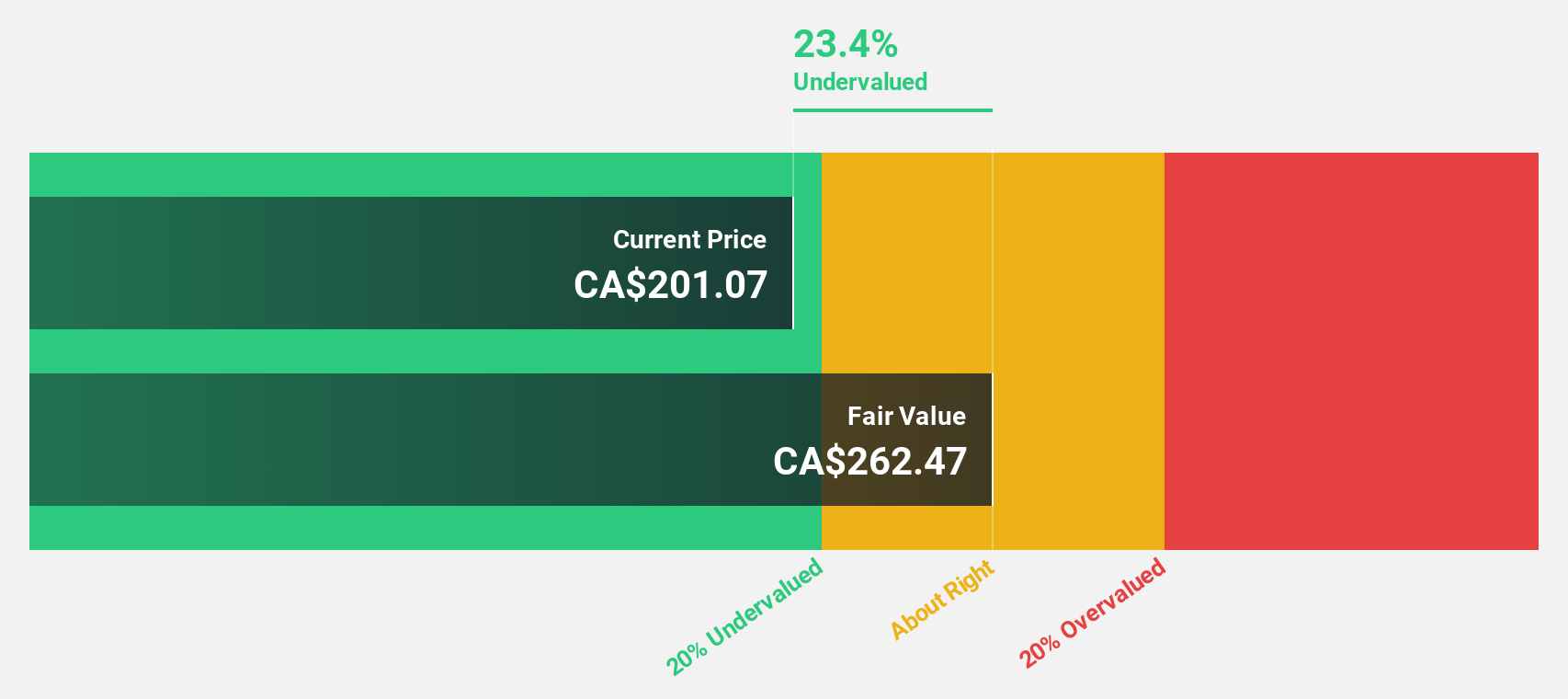

Estimated Discount To Fair Value: 32.4%

Kinaxis, trading at CA$185.61, is significantly undervalued with a fair value estimate of CA$274.67 based on discounted cash flow analysis. Recent earnings show robust growth, with Q2 2025 net income reaching US$18.44 million, up from US$3.43 million the previous year. The company has strengthened its market position through strategic partnerships and client acquisitions like Sobi and Shimadzu, enhancing its supply chain capabilities while forecasting annual profit growth substantially above the Canadian market average.

- Upon reviewing our latest growth report, Kinaxis' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Kinaxis.

OceanaGold (TSX:OGC)

Overview: OceanaGold Corporation is a gold and copper producer involved in the exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand, with a market cap of approximately CA$7.57 billion.

Operations: The company's revenue is derived from its operations at Haile ($663.90 million), Waihi ($191.90 million), Didipio ($357.50 million), and Macraes ($351.50 million).

Estimated Discount To Fair Value: 39.6%

OceanaGold, trading at CA$32.69, is significantly undervalued with a fair value estimate of CA$54.15. The company's earnings are expected to grow significantly over the next three years, outpacing the Canadian market's average growth rate. Recent exploration successes at Haile Gold Mine and strategic expansions in the U.S., including an option agreement for an 80% interest in the Brewer Project, support future growth prospects and enhance its cash flow potential.

- In light of our recent growth report, it seems possible that OceanaGold's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of OceanaGold.

Make It Happen

- Access the full spectrum of 28 Undervalued TSX Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success