- Canada

- /

- Consumer Finance

- /

- TSX:PRL

3 TSX Stocks Trading Up To 31.6 Percent Below Estimated Intrinsic Value

Reviewed by Simply Wall St

The Canadian stock market has experienced significant fluctuations in 2025, with the TSX rebounding to new all-time highs after a mid-year decline driven by U.S. policy shifts and trade tensions. In this environment of volatility and policy uncertainty, identifying undervalued stocks can provide investors with opportunities to capitalize on discrepancies between current market prices and estimated intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$44.24 | CA$85.65 | 48.3% |

| Triple Flag Precious Metals (TSX:TFPM) | CA$31.51 | CA$46.70 | 32.5% |

| Timbercreek Financial (TSX:TF) | CA$7.59 | CA$11.07 | 31.4% |

| TerraVest Industries (TSX:TVK) | CA$166.14 | CA$316.27 | 47.5% |

| Sandstorm Gold (TSX:SSL) | CA$13.38 | CA$19.58 | 31.6% |

| Magna Mining (TSXV:NICU) | CA$1.79 | CA$3.43 | 47.8% |

| Lithium Royalty (TSX:LIRC) | CA$5.37 | CA$8.84 | 39.2% |

| K92 Mining (TSX:KNT) | CA$14.72 | CA$21.49 | 31.5% |

| High Tide (TSXV:HITI) | CA$3.21 | CA$4.56 | 29.6% |

| Alphamin Resources (TSXV:AFM) | CA$0.90 | CA$1.31 | 31.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada, with a market cap of CA$5.70 billion.

Operations: The company generates revenue from its software and programming segment, amounting to $496.53 million.

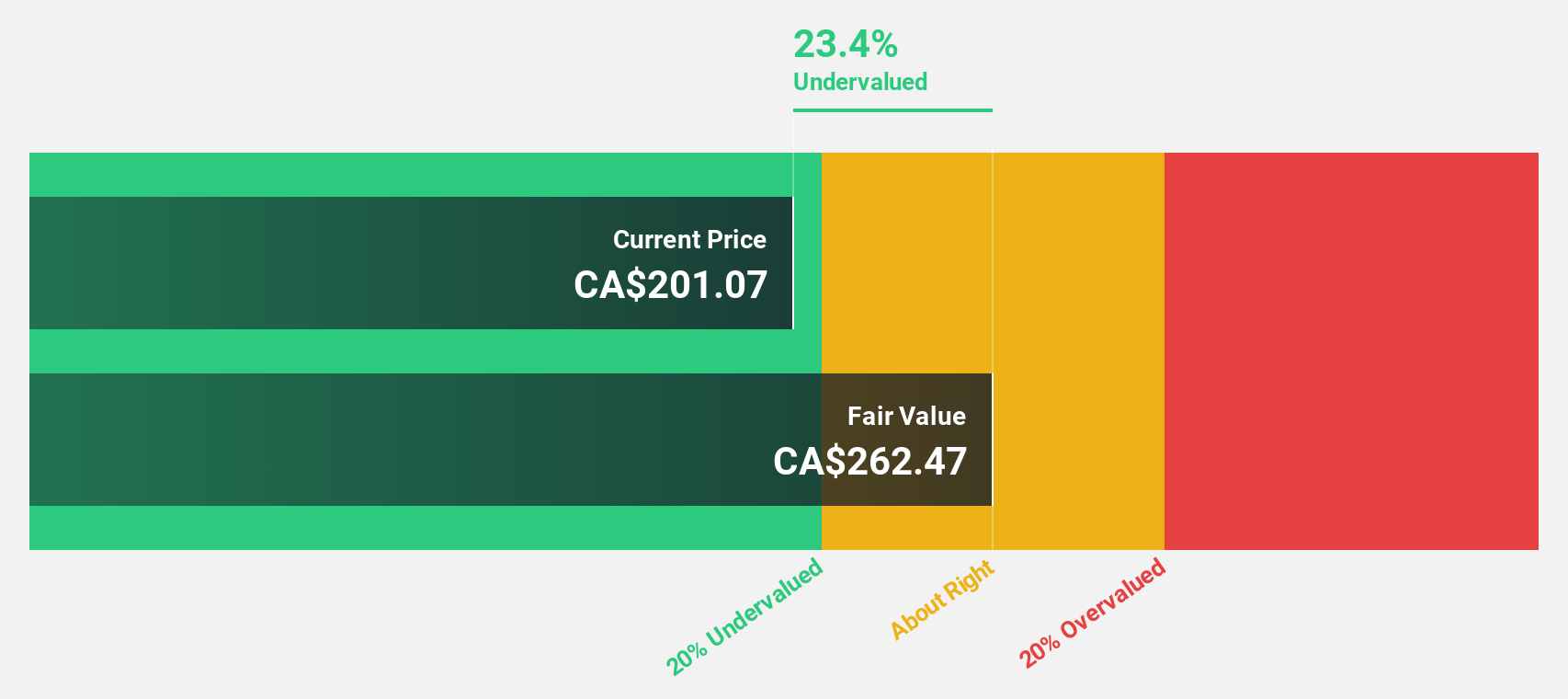

Estimated Discount To Fair Value: 23.6%

Kinaxis is trading at CA$201.38, which is 23.6% below its estimated fair value of CA$263.7, suggesting potential undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow significantly at 55% annually, outpacing the Canadian market's 12.4%. Despite a dip in profit margins from last year, recent partnerships and product launches like Maestro enhance operational resilience and visibility, potentially driving future cash flow improvements.

- The growth report we've compiled suggests that Kinaxis' future prospects could be on the up.

- Navigate through the intricacies of Kinaxis with our comprehensive financial health report here.

Propel Holdings (TSX:PRL)

Overview: Propel Holdings Inc., along with its subsidiaries, operates as a financial technology company and has a market cap of CA$1.49 billion.

Operations: The company generates revenue of $492.16 million by offering lending-related services to borrowers, banks, and other institutions.

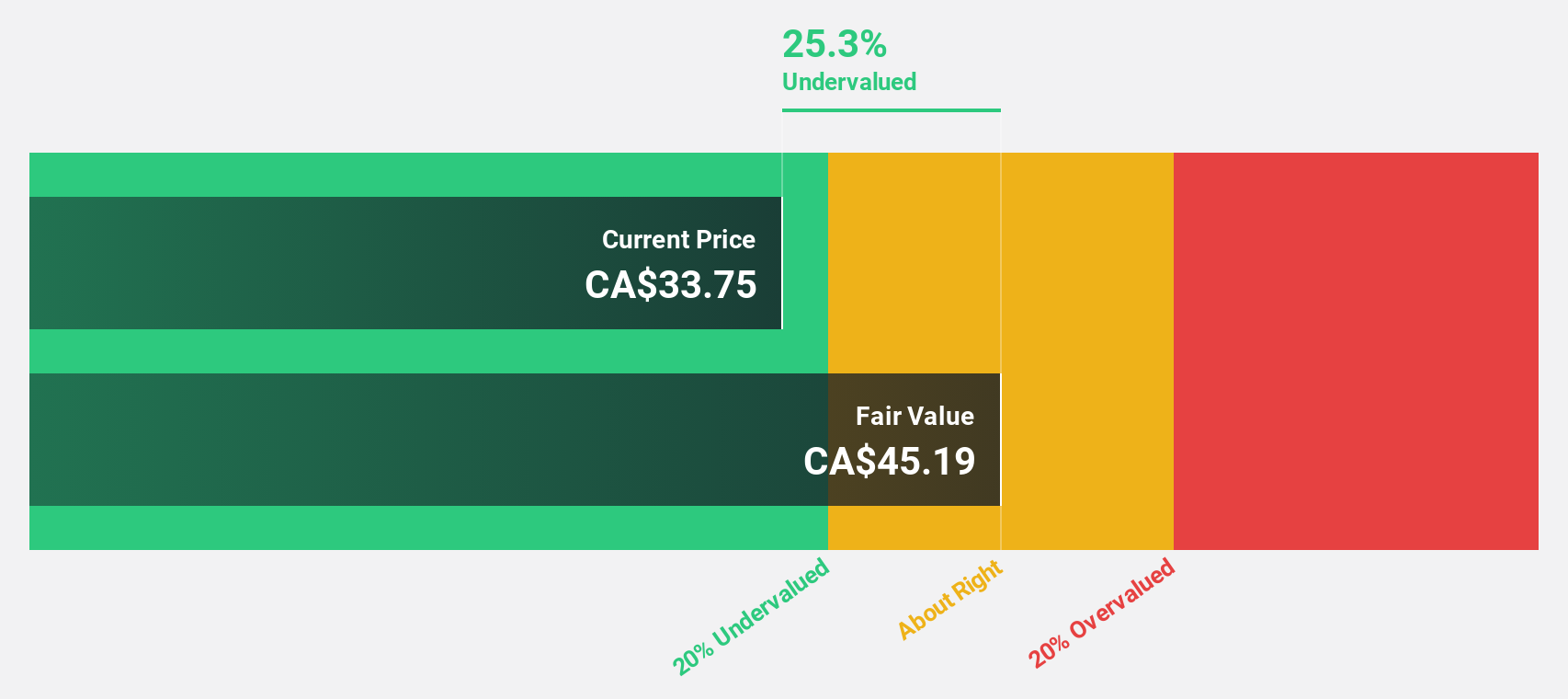

Estimated Discount To Fair Value: 13.7%

Propel Holdings, trading at CA$38.1, is undervalued compared to its fair value of CA$44.17 based on discounted cash flow analysis. Despite a dividend yield of 1.85% not being fully covered by free cash flows, earnings are projected to grow significantly at 33% annually over the next three years, outpacing the Canadian market's growth rate. Recent financial results showed strong revenue and net income growth, although debt coverage by operating cash flow remains a concern.

- Insights from our recent growth report point to a promising forecast for Propel Holdings' business outlook.

- Unlock comprehensive insights into our analysis of Propel Holdings stock in this financial health report.

Sandstorm Gold (TSX:SSL)

Overview: Sandstorm Gold Ltd. is a gold royalty company with a market cap of CA$4.09 billion.

Operations: The company's revenue segments include Antamina, Peru: $9.49 million; Chapada, Brazil: $18.33 million; Aurizona, Brazil: $8.61 million; Caserones, Chile: $10.69 million; Mercedes, Mexico: $9.18 million; Cerro Moro Argentina: $16.90 million; Blyvoor, South Africa: $5.24 million; Houndé, Burkina Faso: $5.33 million; Bonikro, Cote D'Ivoire: $15.82 million; Vale Royalties, Brazil: $5.69 million; Fruta Del Norte, Ecuador: $10.88 million and Relief Canyon in the United States generating the highest at $21.33 million.

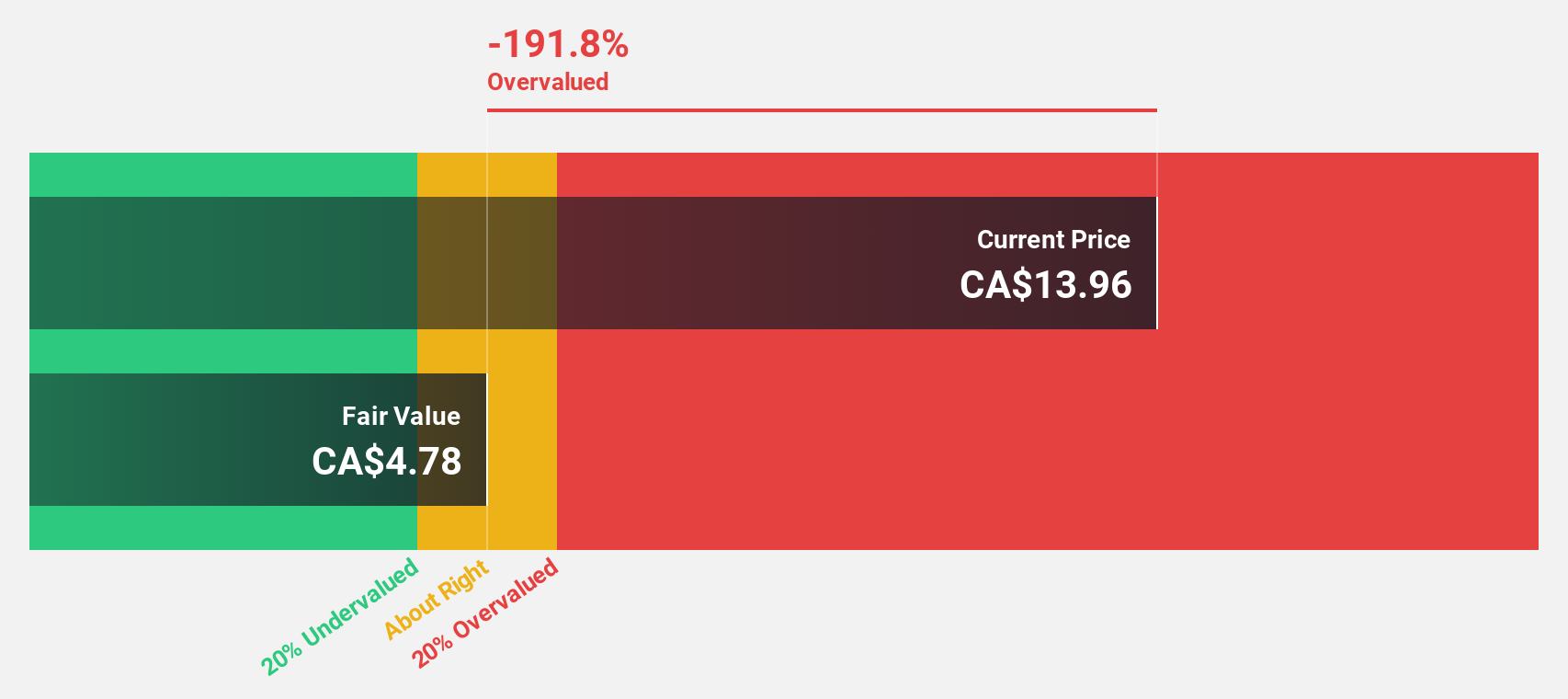

Estimated Discount To Fair Value: 31.6%

Sandstorm Gold, trading at CA$13.38, is undervalued relative to its fair value estimate of CA$19.58 based on discounted cash flow analysis. The company's earnings are forecasted to grow significantly at 36.7% annually over the next three years, surpassing the Canadian market's growth rate. Recent earnings reports showed a turnaround with net income reaching US$10.5 million from a prior loss, highlighting improved financial performance despite slower revenue growth projections compared to its earnings growth expectations.

- In light of our recent growth report, it seems possible that Sandstorm Gold's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Sandstorm Gold's balance sheet health report.

Key Takeaways

- Get an in-depth perspective on all 25 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRL

Exceptional growth potential with proven track record.

Market Insights

Community Narratives