- Canada

- /

- Metals and Mining

- /

- TSX:BTO

3 TSX Stocks Estimated To Be Undervalued In September 2024

Reviewed by Simply Wall St

As the Canadian market navigates a seasonally volatile period and reacts to softer economic data, investors are closely watching for opportunities amid the fluctuations. In this environment, identifying undervalued stocks becomes crucial, as these equities have the potential to offer significant value when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.41 | CA$22.17 | 48.5% |

| Alvopetro Energy (TSXV:ALV) | CA$5.09 | CA$9.17 | 44.5% |

| Kinaxis (TSX:KXS) | CA$152.58 | CA$284.00 | 46.3% |

| Calian Group (TSX:CGY) | CA$44.07 | CA$72.82 | 39.5% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Bragg Gaming Group (TSX:BRAG) | CA$6.53 | CA$10.68 | 38.8% |

| Endeavour Mining (TSX:EDV) | CA$28.46 | CA$53.26 | 46.6% |

| NanoXplore (TSX:GRA) | CA$2.30 | CA$4.22 | 45.5% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

| Boyd Group Services (TSX:BYD) | CA$217.77 | CA$343.85 | 36.7% |

Let's review some notable picks from our screened stocks.

B2Gold (TSX:BTO)

Overview: B2Gold Corp. is a gold producer company with a market cap of CA$4.78 billion.

Operations: B2Gold Corp. generates revenue from three primary segments: Fekola Mine ($1.07 billion), Masbate Mine ($412.67 million), and Otjikoto Mine ($456.41 million).

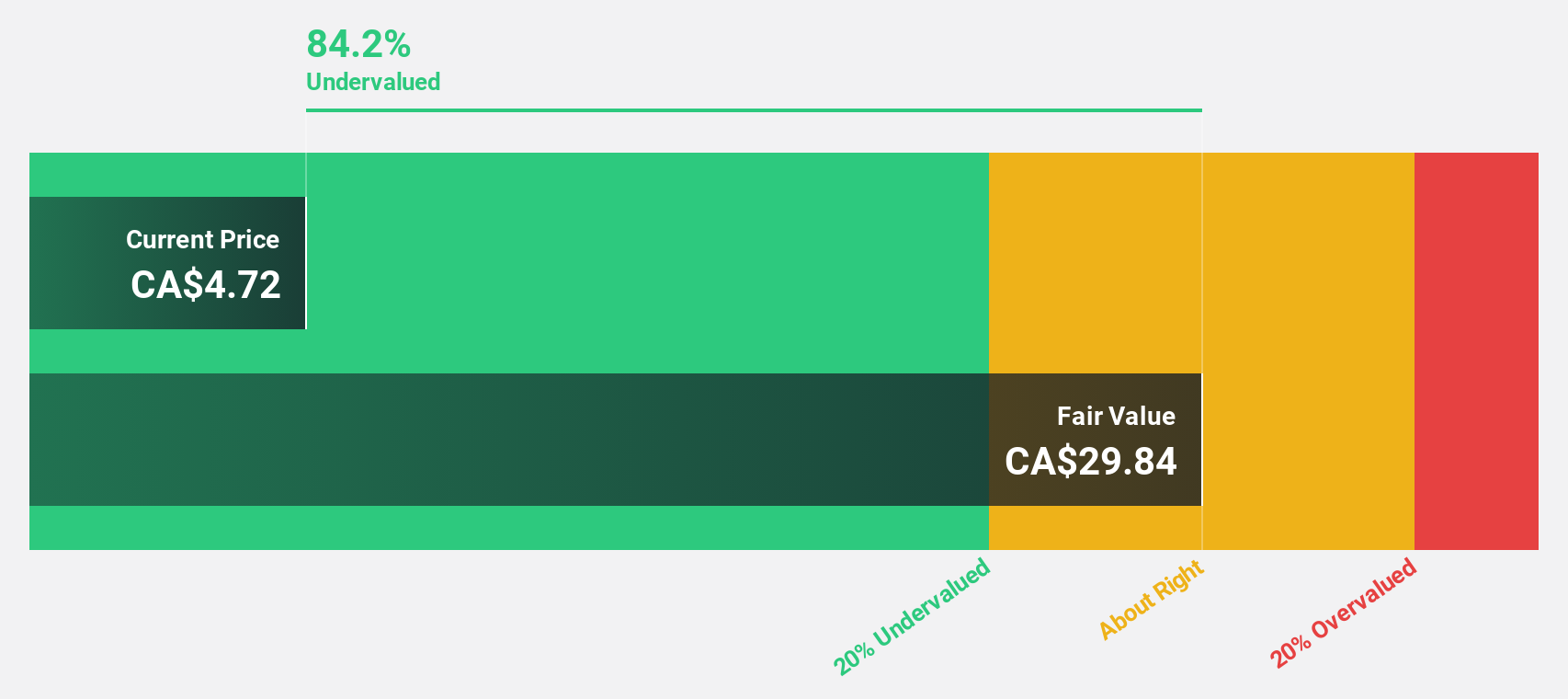

Estimated Discount To Fair Value: 14.2%

B2Gold's recent impairments of $215.22 million and reduced gold production have impacted its financials, resulting in a net loss of $24 million for Q2 2024. Despite these setbacks, the stock appears undervalued based on discounted cash flow analysis and trades below fair value estimates at CA$3.72 versus CA$4.34. While revenue growth is forecasted at 10.5% annually, profitability is expected within three years, making it a potential candidate for investors seeking undervalued stocks based on cash flows in Canada.

- Our expertly prepared growth report on B2Gold implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of B2Gold with our comprehensive financial health report here.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, with a market cap of CA$6.88 billion, operates as a gold mining company in West Africa through its subsidiaries.

Operations: The company's revenue segments are comprised of $612.70 million from Houndé Mine, $509.60 million from Sabodala Massawa Mine, $308.40 million from Mana Mine Burkina Faso, and $708.10 million from Ity Mine Côte D’Ivoire.

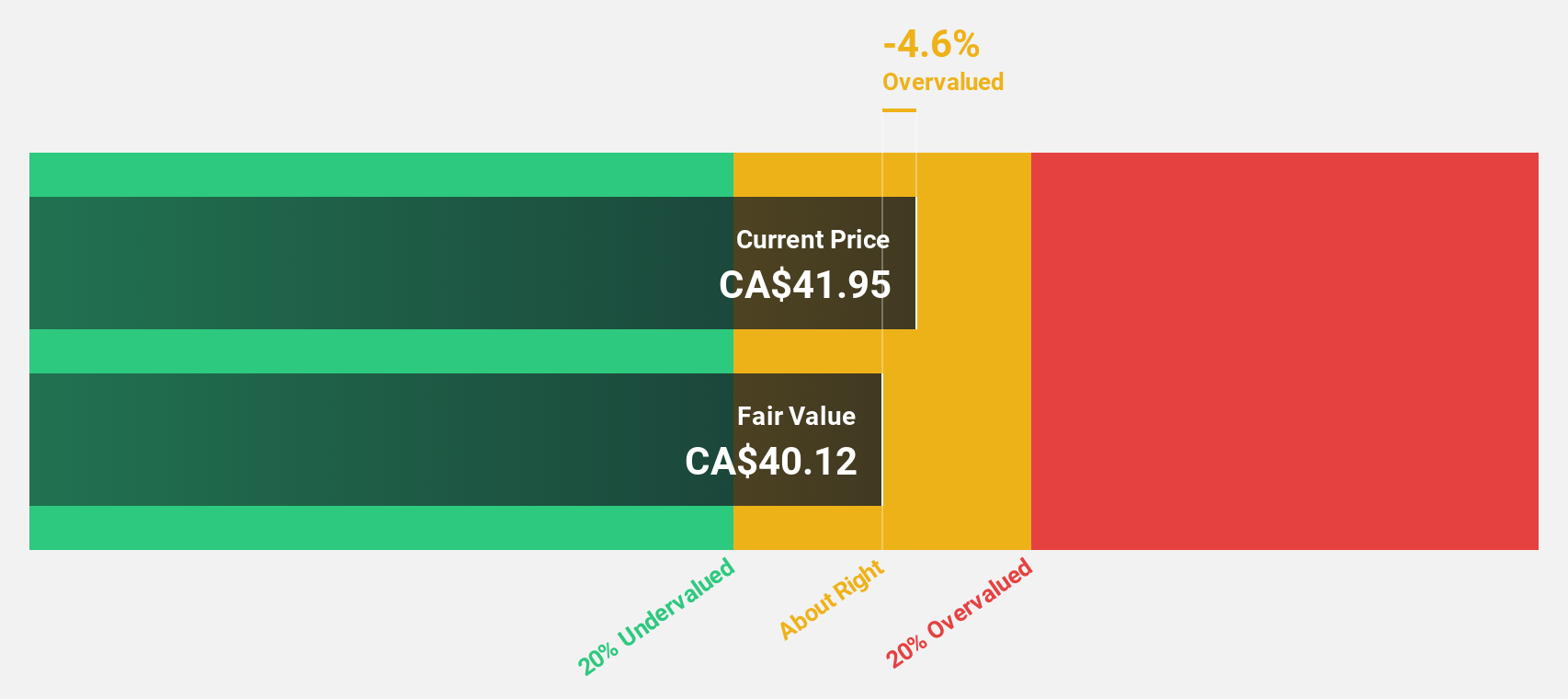

Estimated Discount To Fair Value: 46.6%

Endeavour Mining's recent settlement agreement will bring in $60 million in cash and a 3% royalty on gold sales from the Wahgnion mine, potentially boosting its cash flows. Despite reporting a net loss of $65.8 million for Q2 2024, the company’s stock is trading significantly below its estimated fair value of CA$53.26 at CA$28.46. Analysts forecast strong revenue growth of 11.5% annually, with profitability expected within three years, underscoring its undervaluation based on discounted cash flow analysis.

- Insights from our recent growth report point to a promising forecast for Endeavour Mining's business outlook.

- Dive into the specifics of Endeavour Mining here with our thorough financial health report.

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada, with a market cap of CA$4.24 billion.

Operations: The company's revenue segment includes software and programming, generating $457.72 million.

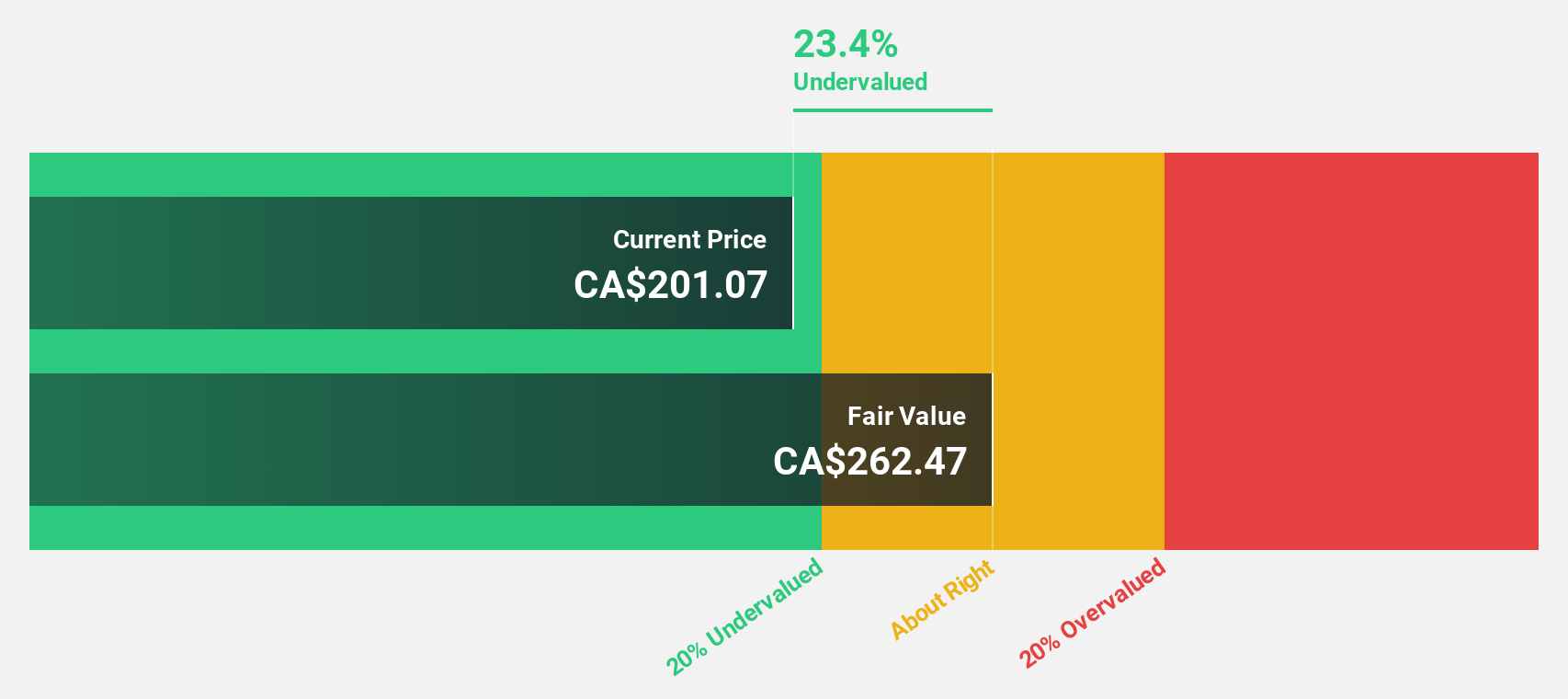

Estimated Discount To Fair Value: 46.3%

Kinaxis is trading 46.3% below its estimated fair value of CA$284, making it highly undervalued based on discounted cash flow analysis. Despite recent executive departures and investor activism urging a sale, the company’s earnings are forecast to grow 47.31% annually, significantly outpacing the Canadian market's average growth rate of 15.2%. With robust earnings growth and a strong competitive position in supply chain planning, Kinaxis presents an attractive investment opportunity amidst current market conditions.

- In light of our recent growth report, it seems possible that Kinaxis' financial performance will exceed current levels.

- Get an in-depth perspective on Kinaxis' balance sheet by reading our health report here.

Next Steps

- Unlock more gems! Our Undervalued TSX Stocks Based On Cash Flows screener has unearthed 26 more companies for you to explore.Click here to unveil our expertly curated list of 29 Undervalued TSX Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B2Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTO

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives