Investors Appear Satisfied With Intermap Technologies Corporation's (TSE:IMP) Prospects As Shares Rocket 31%

Despite an already strong run, Intermap Technologies Corporation (TSE:IMP) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days were the cherry on top of the stock's 425% gain in the last year, which is nothing short of spectacular.

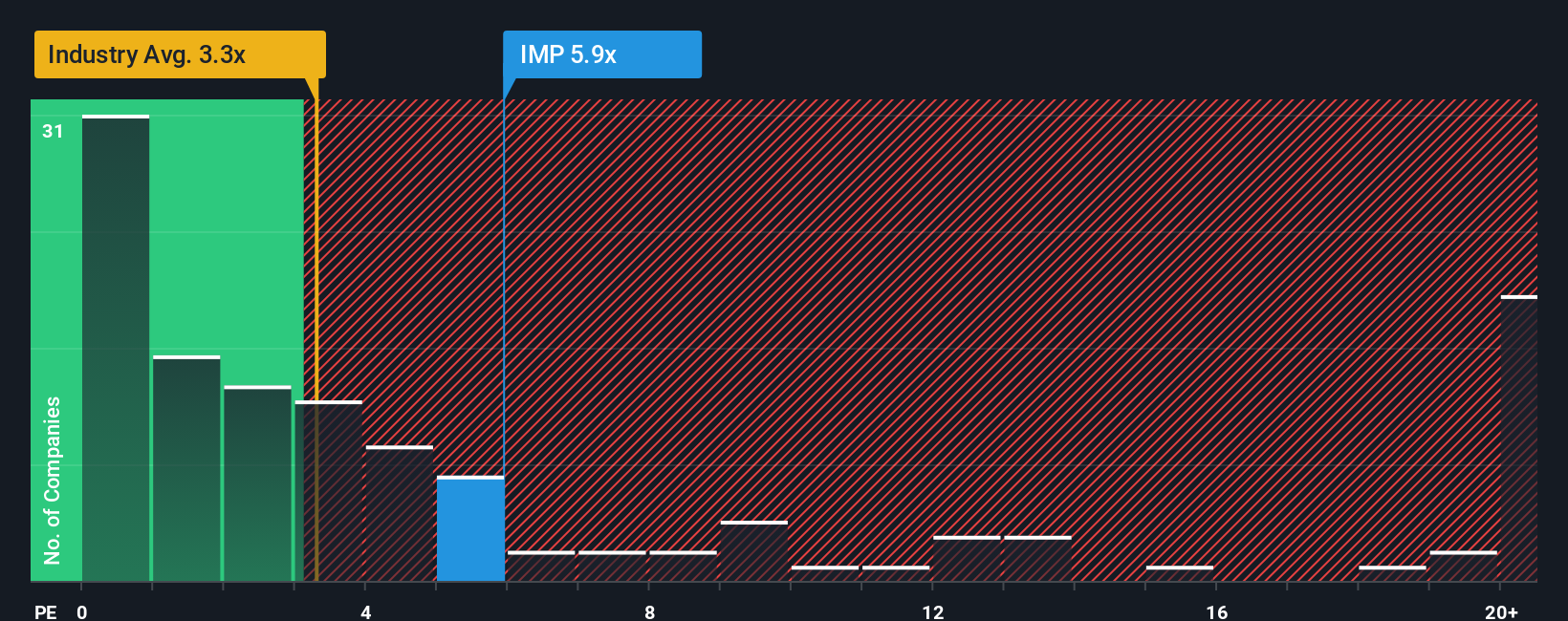

Following the firm bounce in price, given around half the companies in Canada's Software industry have price-to-sales ratios (or "P/S") below 3.3x, you may consider Intermap Technologies as a stock to avoid entirely with its 5.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Intermap Technologies

What Does Intermap Technologies' P/S Mean For Shareholders?

Intermap Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Intermap Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Intermap Technologies' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 242%. The latest three year period has also seen an excellent 190% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 54% per annum as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 28% per annum growth forecast for the broader industry.

With this information, we can see why Intermap Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Intermap Technologies' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Intermap Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Intermap Technologies you should be aware of, and 1 of them is a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IMP

Intermap Technologies

A geospatial intelligence company, provides various geospatial solutions and analytics in the United States, the Asia Pacific, and Europe.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026