The Bull Case For CGI (TSX:GIB.A) Could Change Following Successful Rockville Municipal Cloud System Upgrade - Learn Why

Reviewed by Simply Wall St

- Earlier this month, CGI Technologies and Solutions completed the launch of an upgraded cloud-based financial and administrative system for the City of Rockville, Maryland, enhancing operations across finance, procurement, inventory, human resources, and reporting functions.

- This transformation not only deepens CGI's partnership with Rockville but also positions the firm as a vital contributor to municipal digital modernization and transparency initiatives.

- We'll explore how this successful municipal system upgrade strengthens CGI's position in government modernization, shaping its investment narrative going forward.

CGI Investment Narrative Recap

To be a shareholder in CGI, you need to believe in the company's ability to drive digital modernization for governments while delivering consistent earnings through solid managed services and IP solutions. This latest successful ERP upgrade for Rockville, Maryland highlights CGI’s execution strength in the public sector; however, its impact on the most important short-term catalyst, managed services contract momentum, remains relatively minor, and does not materially change the biggest short-term risk tied to restructuring costs and acquisition integration. Of CGI’s recent announcements, the extension with Suffolk County, NY for cloud-based financial systems modernization stands out. This partnership reinforces CGI’s growing foothold in mission-critical, long-term government projects, aligning directly with catalysts like rising demand for managed services and cloud-based solutions, and helping offset potential near-term revenue timing risks from contract transitions. By contrast, investors should take note that despite these high-profile wins, risks remain around restructuring costs and the integration of new acquisitions if utilization rates lag...

Read the full narrative on CGI (it's free!)

CGI is forecast to achieve CA$17.7 billion in revenue and CA$2.2 billion in earnings by 2028. This outlook is based on an annual revenue growth rate of 6.0% and a CA$0.5 billion increase in earnings from the current CA$1.7 billion.

Uncover how CGI's forecasts yield a CA$187.49 fair value, a 36% upside to its current price.

Exploring Other Perspectives

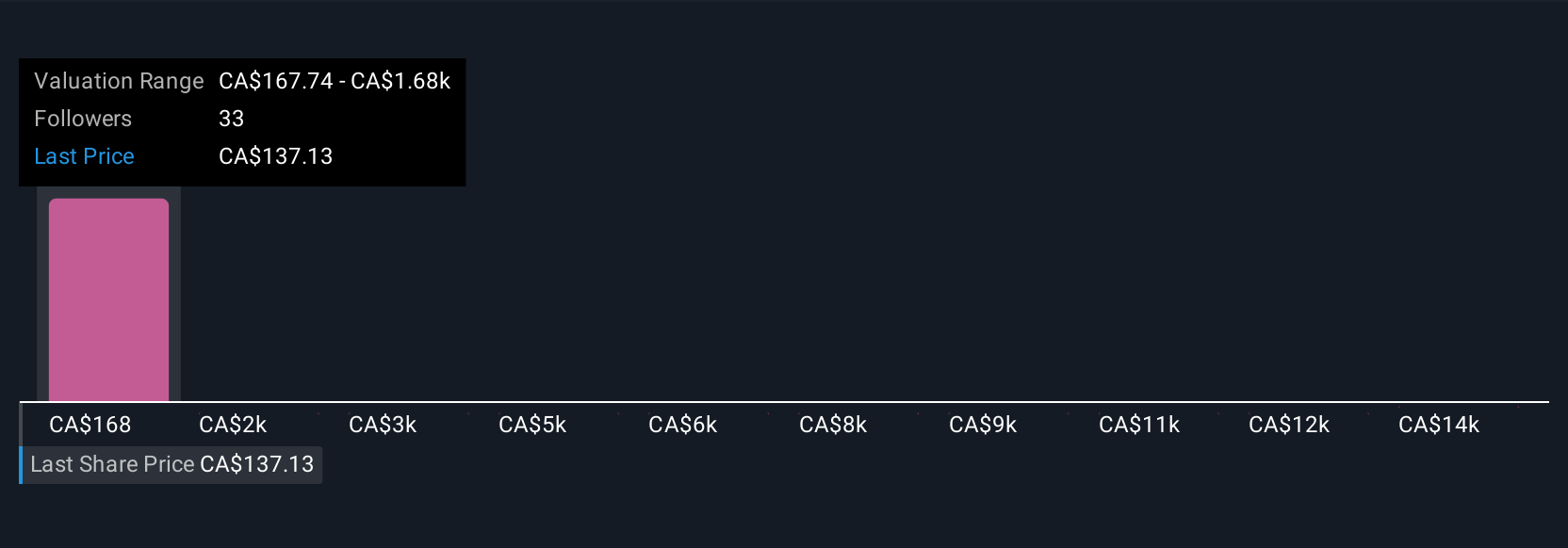

Five retail investors in the Simply Wall St Community estimate CGI’s fair value ranging from CA$166.96 to CA$15,301.68 per share. While public sector contract momentum supports the business case, these widely varied forecasts show that expectations for CGI’s future performance can be sharply different, consider reviewing several viewpoints before making any conclusions.

Explore 5 other fair value estimates on CGI - why the stock might be worth just CA$166.96!

Build Your Own CGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CGI research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free CGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CGI's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GIB.A

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives