How New Jersey’s 10-Year SIROMS Contract Extension Could Shape CGI’s (TSX:GIB.A) Public Sector Trajectory

Reviewed by Sasha Jovanovic

- On September 26, 2025, the State of New Jersey announced it has awarded CGI Inc. a new 10-year contract to continue developing and supporting its State Integrated Recovery Operations Management Systems (SIROMS) platform, which manages disaster recovery and federal funding.

- The selection reinforces CGI's long-standing relationship with New Jersey and highlights the company’s expanding presence in U.S. public-sector IT services, particularly in disaster response technology.

- We'll assess how the long-term New Jersey contract renewal strengthens CGI's revenue visibility and outlook in its public-sector portfolio.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CGI Investment Narrative Recap

Being a shareholder in CGI is essentially a belief in the company's ability to secure major, multi-year contracts in digital transformation and managed services, especially within the public sector. The recent 10-year contract renewal with New Jersey strengthens visibility in public-sector revenue, but does not fully offset short-term concerns around softness in larger enterprise deals and lingering macroeconomic uncertainty, which remain the central catalysts and risks to monitor.

Among recent announcements, the sizeable three-year extension for managed services in California is most relevant, reflecting CGI's ongoing success in locking in substantial government clients. This speaks directly to the importance of public-sector deal flow as a counterbalance to unpredictable enterprise cycles and international market headwinds.

However, investors should also be aware, unlike with public-sector contracts, reliance on cyclical enterprise clients exposes CGI to...

Read the full narrative on CGI (it's free!)

CGI's narrative projects CA$17.9 billion revenue and CA$2.3 billion earnings by 2028. This requires 4.8% yearly revenue growth and a CA$0.6 billion earnings increase from CA$1.7 billion today.

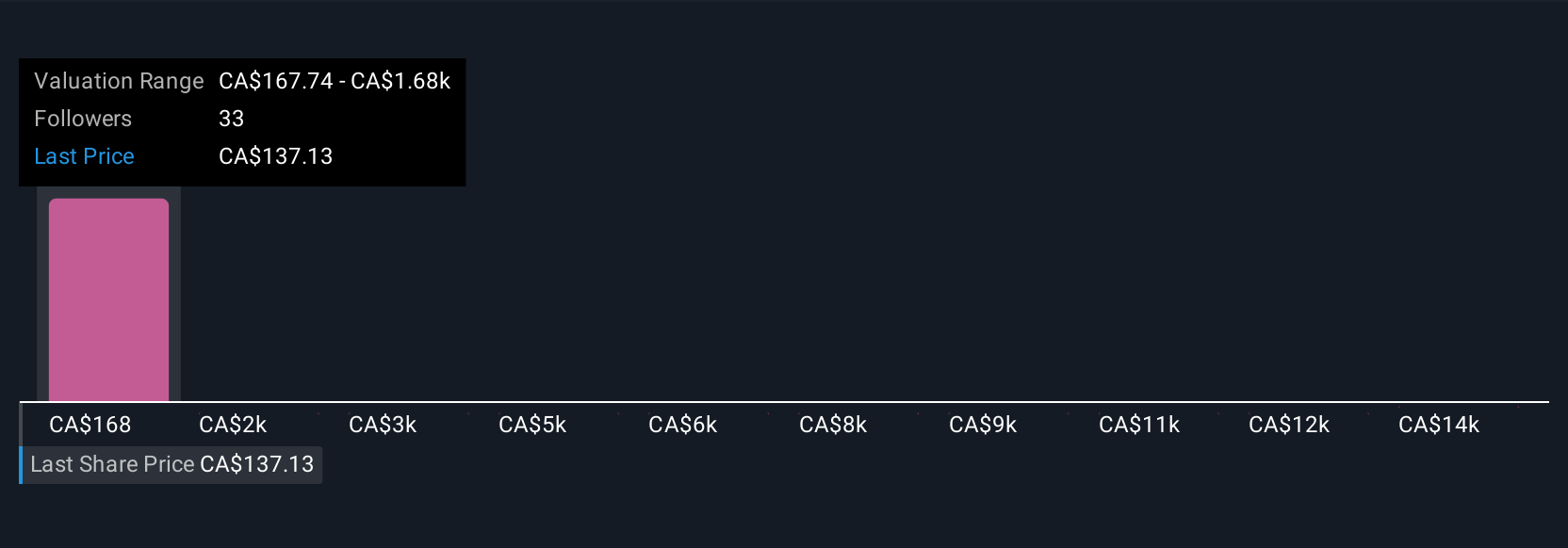

Uncover how CGI's forecasts yield a CA$171.17 fair value, a 36% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s seven fair value estimates for CGI range from CA$125.70 to a striking CA$15,301.68, displaying sharp differences in outlook. While many see upside linked to recurring revenue from large contracts, a key risk remains client budget cycles and rebidding pressures that could weigh on near-term revenue clarity, make sure to compare these views for a fuller picture of where CGI may head next.

Explore 7 other fair value estimates on CGI - why the stock might be worth just CA$125.70!

Build Your Own CGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CGI research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free CGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CGI's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GIB.A

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives