CGI (TSX:GIB.A) Lands Major Texas Contract: Reassessing the Stock's Value After a Key Government Win

Reviewed by Simply Wall St

CGI (TSX:GIB.A) just landed a multi-year contract with the Texas Comptroller of Public Accounts to overhaul the state’s financial backbone. The deal will see CGI replace several legacy systems with their Advantage® enterprise resource planning solution, a cloud-based platform built specifically for government. For investors, this is more than just another press release. It highlights CGI’s growing presence in the public sector and underscores demand for their software-as-a-service government solutions, which could lead to new, longer-term revenue streams.

This new contract comes at an interesting time for CGI’s stock. Shares are down 9% over the past year, trailing the TSX and reversing the longer trend that saw a solid 47% return in five years. Despite steady annual growth in both revenue and net income, market momentum has cooled this year. The price action suggests some investors are weighing near-term headwinds against CGI’s proven ability to win significant contracts and deliver on longer-term projects.

It raises the question of whether this contract win represents a turning point for CGI investors, offering a chance to acquire the stock at a lower valuation, or if the market has already factored in these future opportunities.

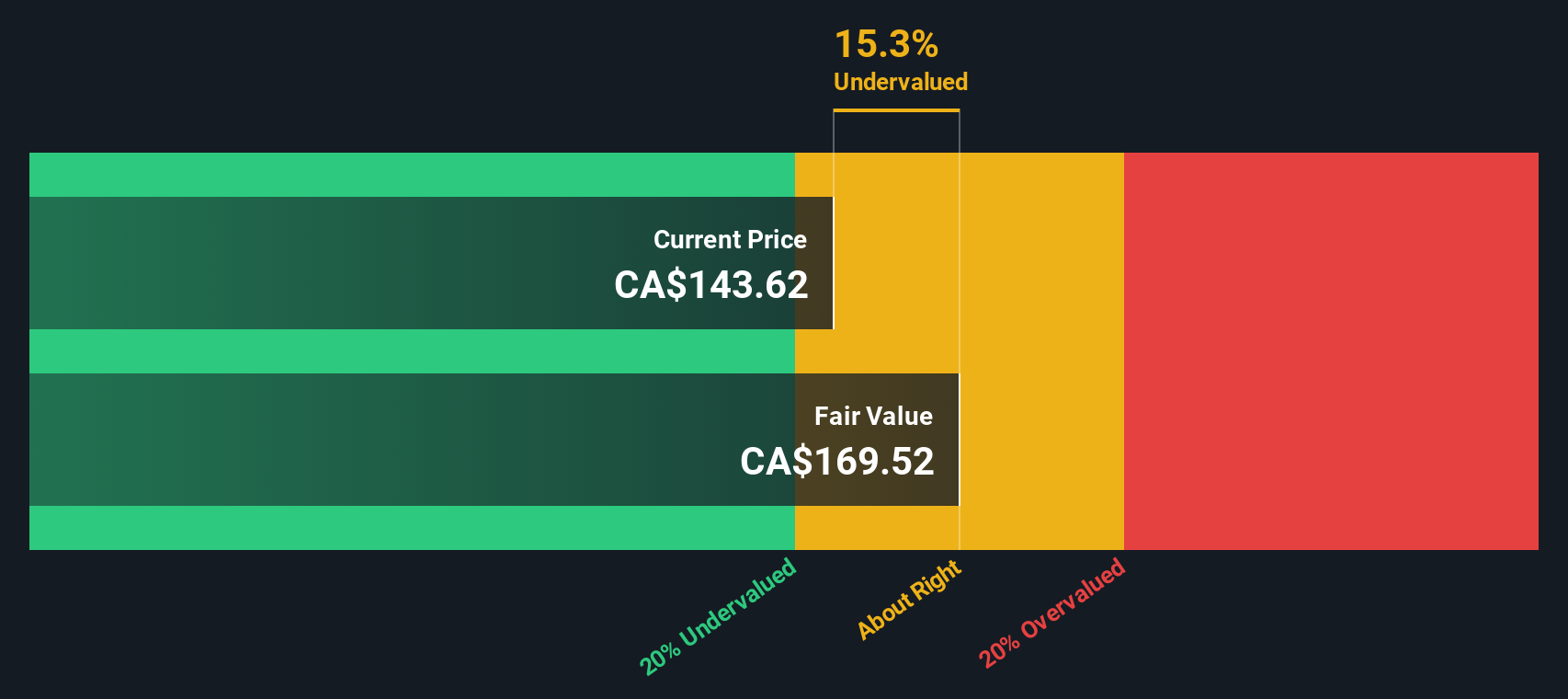

Most Popular Narrative: 21.7% Undervalued

According to community narrative, CGI is currently considered materially undervalued compared to consensus fair value estimates that anticipate robust future earnings growth and margin expansion for the company.

The ongoing acceleration in digital transformation initiatives, particularly in cloud migration, AI-driven automation, and data analytics, continues to boost client demand for CGI's managed services and proprietary IP across both public and private sectors. This trend is likely to drive sustained revenue growth and an increasing proportion of higher-margin recurring revenue. Rising global cybersecurity risks and heightened regulatory demands are translating to strong, durable demand for CGI's data protection and security-focused offerings. This is supporting a robust pipeline in government and financial services verticals and is providing a multi-year tailwind for bookings and backlog.

What is fueling this bullish take? There is a hidden lever in CGI’s future financials that separates it from its peers and could reshape its valuation trajectory. These factors include strong growth assumptions, margin expansion, and a strategic focus on scalable solutions. Want to uncover the forecasts that underpin this price estimate and what is really driving analyst agreement?

Result: Fair Value of $171.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing macroeconomic uncertainty and integration challenges from recent acquisitions could weigh on CGI’s organic growth and margin improvement, which may temper the bullish outlook.

Find out about the key risks to this CGI narrative.Another View: Discounted Cash Flow Perspective

Taking a different approach, our DCF model also points toward undervaluation. This reinforces the earlier view but relies on future cash flows instead of profit multiples. Could this signal a real opportunity, or are there risks hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CGI Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can shape your own narrative in just a few minutes and do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding CGI.

Ready for Your Next Investment Move?

Keep your momentum going and seize your edge by searching beyond just one stock. The Simply Wall Street Screener offers unique opportunities tailored to your strategy. Miss them and you could miss out on the market’s next big story. Get started now:

- Uncover potential in fast-growing firms shaping tomorrow’s innovations by targeting AI penny stocks.

- Access reliable income streams with leading businesses offering attractive yields through dividend stocks with yields > 3%.

- Spot overlooked gems trading below their true worth when you scrutinize undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GIB.A

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives