Enghouse Systems Limited Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions

It's been a pretty great week for Enghouse Systems Limited (TSE:ENGH) shareholders, with its shares surging 18% to CA$47.90 in the week since its latest annual results. It looks like a credible result overall - although revenues of CA$386m were in line with what analysts predicted, Enghouse Systems surprised by delivering a profit of CA$1.29 per share, a notable 11% above expectations. Earnings are an important time for investors, as they can track a company's performance, look at what top analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest forecasts to see whether analysts have changed their mind on Enghouse Systems after the latest results.

View our latest analysis for Enghouse Systems

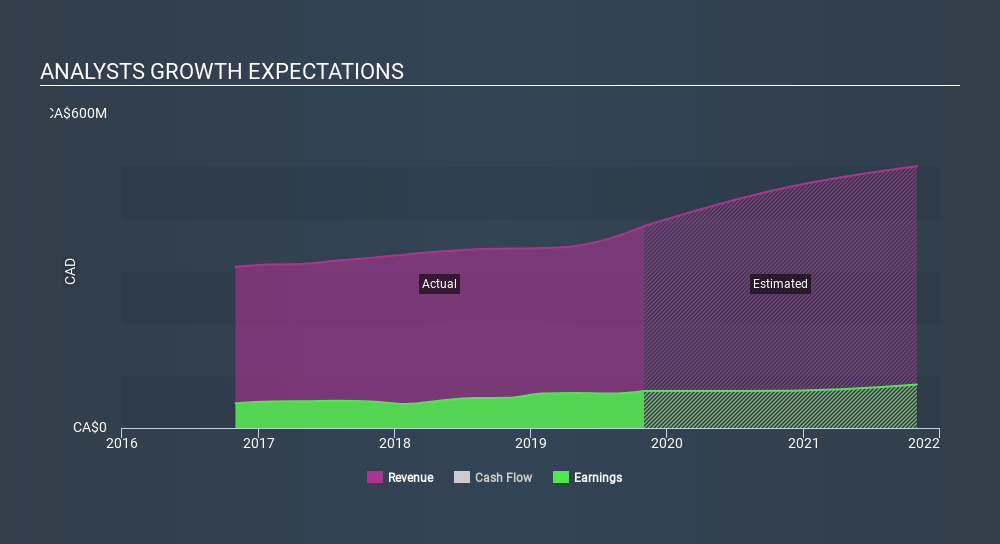

Taking into account the latest results, the latest consensus from Enghouse Systems's four analysts is for revenues of CA$457.1m in 2020, which would reflect a notable 18% improvement in sales compared to the last 12 months. Earnings per share are forecast to be CA$1.29, approximately in line with the last 12 months. In the lead-up to this report, analysts had been modelling revenues of CA$451.3m and earnings per share (EPS) of CA$1.23 in 2020. So the consensus seems to have become somewhat more optimistic on Enghouse Systems's earnings potential following these results.

Analysts have been lifting their price targets on the back of the earnings upgrade, with the consensus price target rising 15% to CA$51.60. The consensus price target just an average of individual analyst targets, so - considering that the price target changed, it would be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Enghouse Systems at CA$50.00 per share, while the most bearish prices it at CA$43.00. Still, with such a tight range of estimates, it suggests analysts have a pretty good idea of what they think the company is worth.

It can also be useful to step back and take a broader view of how analyst forecasts compare to Enghouse Systems's performance in recent years. It's clear from the latest estimates that Enghouse Systems's rate of growth is expected to accelerate meaningfully, with forecast 18% revenue growth noticeably faster than its historical growth of 8.4%p.a. over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 16% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Enghouse Systems is expected to grow at about the same rate as the wider market.

The Bottom Line

The most important thing to take away from this is that analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Enghouse Systems following these results. Happily, there were no real changes to sales forecasts, with the business still expected to grow in line with the overall market. There was also a nice increase in the price target, with analysts feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Enghouse Systems analysts - going out to 2021, and you can see them free on our platform here.

You can also see our analysis of Enghouse Systems's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:ENGH

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026