We Ran A Stock Scan For Earnings Growth And Descartes Systems Group (TSE:DSG) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Descartes Systems Group (TSE:DSG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Descartes Systems Group with the means to add long-term value to shareholders.

Our analysis indicates that DSG is potentially undervalued!

How Fast Is Descartes Systems Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Descartes Systems Group has achieved impressive annual EPS growth of 38%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

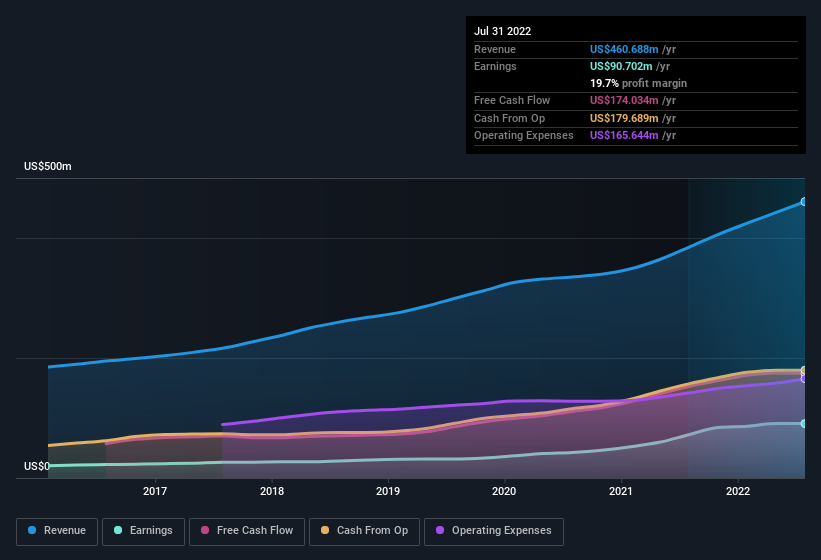

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Descartes Systems Group shareholders can take confidence from the fact that EBIT margins are up from 24% to 27%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Descartes Systems Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Descartes Systems Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that Descartes Systems Group insiders spent a whopping US$1.1m on stock in just one year, without so much as a single sale. Knowing this, Descartes Systems Group will have have all eyes on them in anticipation for the what could happen in the near future. Zooming in, we can see that the biggest insider purchase was by Chief Financial Officer Allan Brett for CA$879k worth of shares, at about CA$87.89 per share.

The good news, alongside the insider buying, for Descartes Systems Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$26m worth of its stock. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.3%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Descartes Systems Group Deserve A Spot On Your Watchlist?

Descartes Systems Group's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Descartes Systems Group belongs near the top of your watchlist. If you think Descartes Systems Group might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Keen growth investors love to see insider buying. Thankfully, Descartes Systems Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DSG

Descartes Systems Group

Provides global logistics technology solutions worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives