3 Undervalued Small Caps With Recent Insider Activity In Global

Reviewed by Simply Wall St

In the current global market landscape, smaller-cap indexes have shown robust performance, with the S&P MidCap 400 and Russell 2000 indexes experiencing notable gains. This positive momentum in small-cap stocks comes amid accelerated U.S. job growth and mixed economic signals, such as contracting manufacturing activity alongside expanding services sectors. In this environment, identifying promising small-cap stocks often involves looking for those with strong fundamentals and recent insider activity, which can signal confidence from those closest to the company’s operations.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 6.9x | 3.1x | 21.62% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.3x | 6.9x | 28.02% | ★★★★★☆ |

| A.G. BARR | 19.2x | 1.8x | 47.11% | ★★★★☆☆ |

| Hemisphere Energy | 5.1x | 2.1x | 11.60% | ★★★★☆☆ |

| Sagicor Financial | 10.5x | 0.4x | -174.78% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.7x | 0.5x | -176.55% | ★★★★☆☆ |

| Seeing Machines | NA | 3.0x | 43.41% | ★★★★☆☆ |

| Absolent Air Care Group | 24.5x | 1.9x | 46.68% | ★★★☆☆☆ |

| CVS Group | 45.4x | 1.3x | 38.12% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.7x | 1.8x | 12.19% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

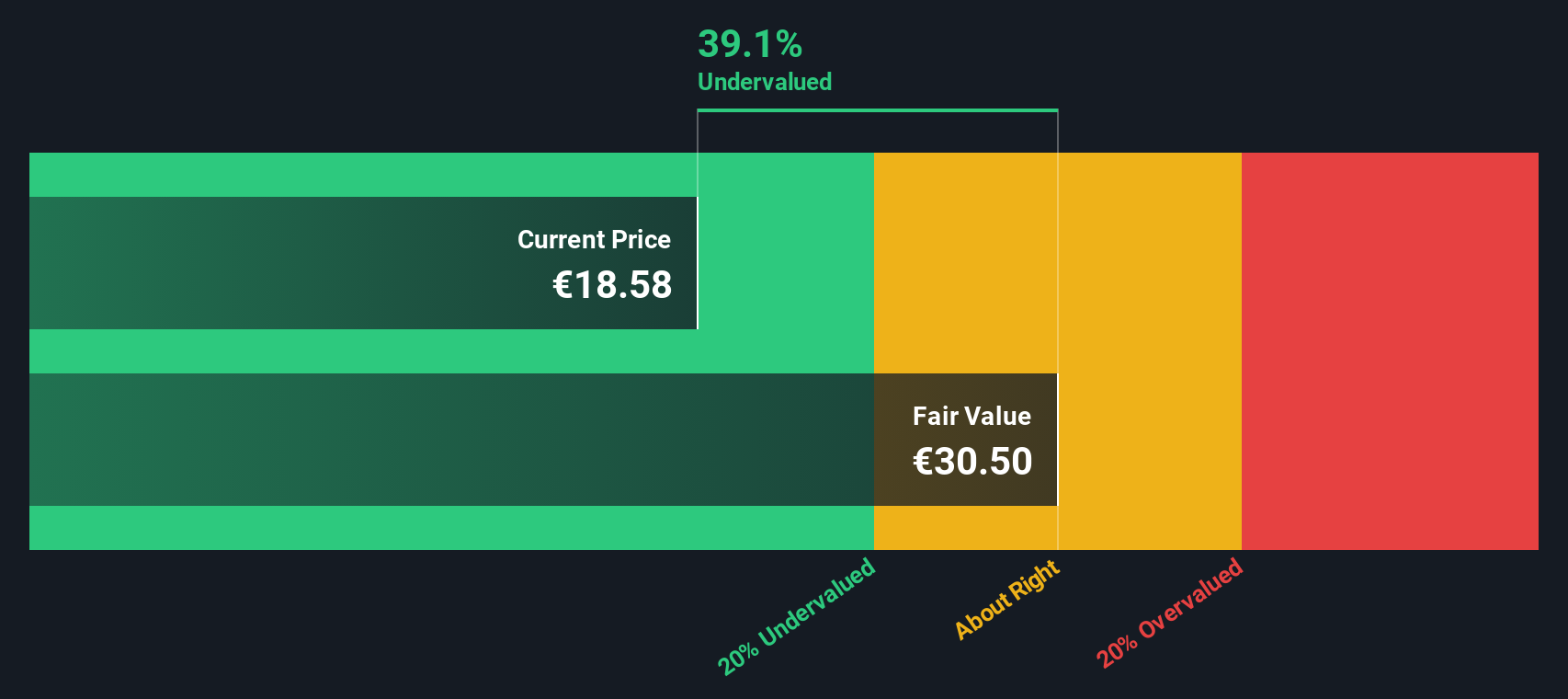

Corbion (ENXTAM:CRBN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Corbion operates in the biotechnology sector, focusing on health and nutrition as well as functional ingredients and solutions, with a market capitalization of approximately €1.92 billion.

Operations: The company generates revenue primarily from Functional Ingredients & Solutions (€997.9 million) and Health & Nutrition (€290.2 million). Over recent periods, the gross profit margin has shown variability, reaching 23.71% in 2024-06-30 after a low of 22.38% in 2023-12-31. Operating expenses, including significant allocations to General & Administrative and Sales & Marketing, have consistently impacted net income margins which were at 5.37% as of the latest period ending in September 2024.

PE: 23.7x

Corbion, a smaller company in its sector, is navigating financial challenges with high debt levels, relying solely on external borrowing for funding. Despite this riskier position, their earnings are projected to grow at 22.72% annually. Recent insider confidence was shown through share purchases in early 2025. Changes in leadership occurred as Ilona Haaijer became the new Chair of the Supervisory Board in May 2025. A dividend increase to €0.64 per share was approved for 2024, reflecting potential shareholder value enhancement amidst these developments.

- Get an in-depth perspective on Corbion's performance by reading our valuation report here.

Examine Corbion's past performance report to understand how it has performed in the past.

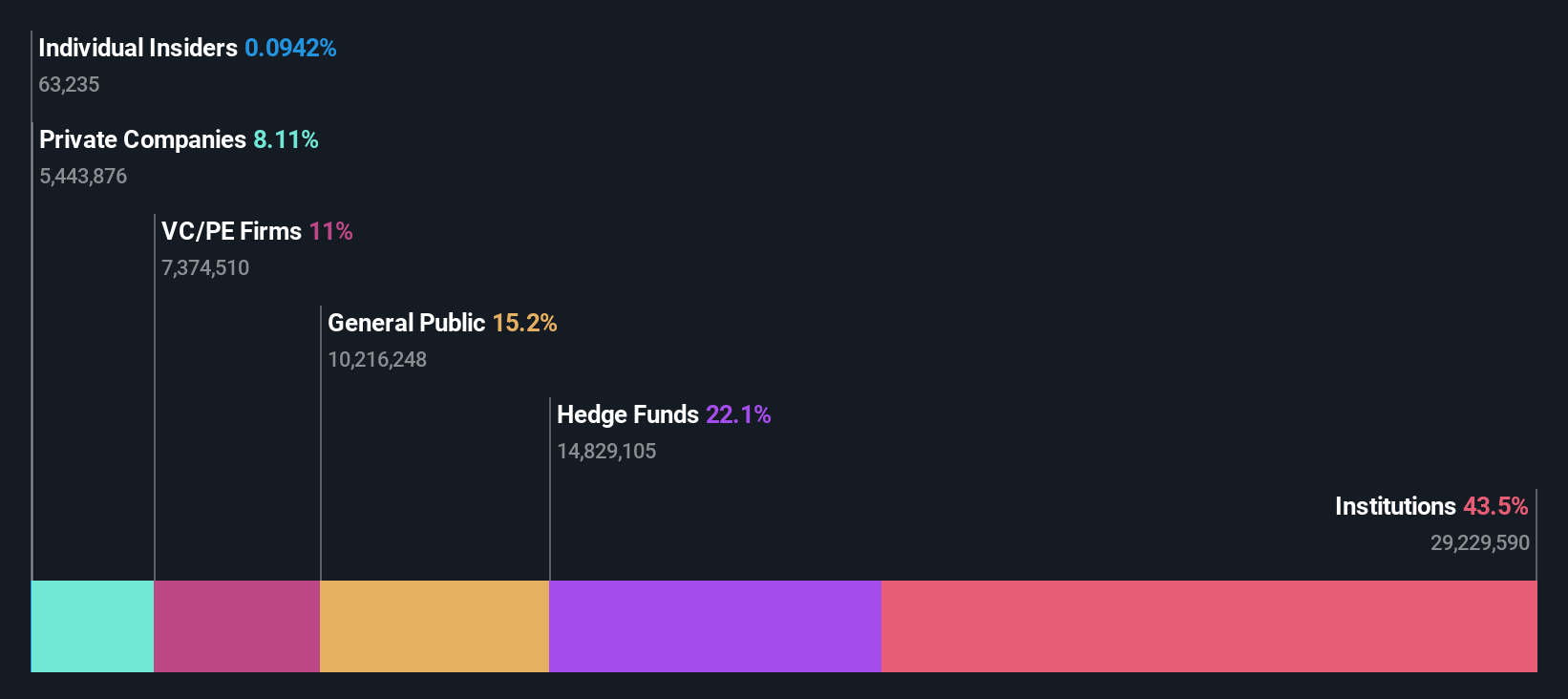

Dye & Durham (TSX:DND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dye & Durham is a Canadian company specializing in providing cloud-based software and technology solutions for legal and business professionals, with a market cap of approximately CA$1.36 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, with the latest reported figure being CA$469.07 million. The gross profit margin has shown an upward trend, reaching 90.32% recently. Operating expenses and non-operating expenses are significant components of the cost structure, impacting net income figures, which have been negative in recent periods.

PE: -4.5x

Dye & Durham, a smaller company in the market, is catching attention due to insider confidence shown by Avjitpal Kamboj's purchase of 10,681 shares for approximately C$100K. Despite facing challenges like unprofitability and reliance on external borrowing for funding, the company is actively addressing legacy issues and innovating its product suite. Recent leadership changes with experienced executives like George Tsivin as CEO could steer strategic growth. Investor activism has prompted board reconsiderations, highlighting potential shifts in governance that may affect future performance.

- Unlock comprehensive insights into our analysis of Dye & Durham stock in this valuation report.

Gain insights into Dye & Durham's historical performance by reviewing our past performance report.

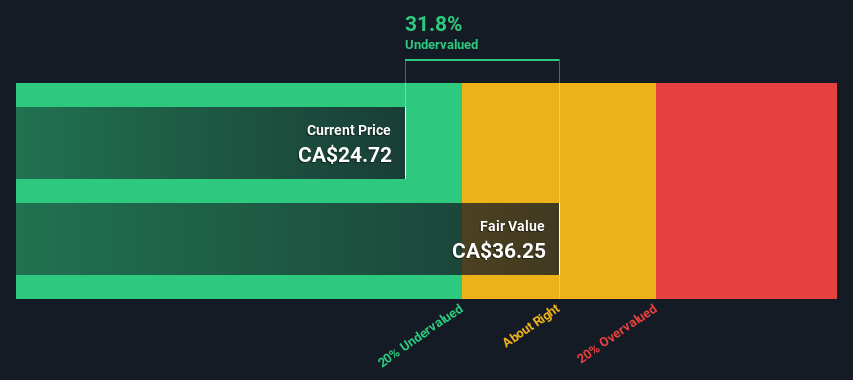

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Westshore Terminals Investment operates as a key player in the transportation infrastructure sector, primarily focusing on coal export terminal operations with a market capitalization of approximately CA$1.92 billion.

Operations: The company's revenue primarily stems from its transportation infrastructure segment, with recent figures reaching CA$402.78 million. Cost of Goods Sold (COGS) is a significant expense, impacting the gross profit margin, which was recorded at 47.72% in the latest period. Operating expenses and non-operating expenses also play a role in determining net income, which amounted to CA$111.48 million for the same period.

PE: 14.9x

Westshore Terminals Investment Corporation, known for its small-cap status, recently announced a dividend of C$0.375 per share payable by July 15, 2025. The company reported first-quarter revenue of C$82.81 million and net income of C$11.47 million, both slightly down from the previous year. Insider confidence is evident with recent executive changes; Glenn Dudar becomes CEO amid strategic shifts like a share repurchase program targeting up to 807,118 shares by April 2026.

Summing It All Up

- Gain an insight into the universe of 137 Undervalued Global Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DND

Dye & Durham

Provides cloud-based software and technology solutions for law firms, financial service institutions, sole-practitioner law firms, and government organizations in Canada, Australia, South Africa, Ireland, and the United Kingdom.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives