Exploring High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts in Europe and expectations of similar moves in the U.S., technology stocks, particularly those within the Nasdaq Composite, have shown resilience by reaching record highs despite broader market declines. In this environment, identifying high-growth tech stocks that can potentially enhance a portfolio requires careful consideration of their ability to outperform amidst shifting economic indicators and evolving investor sentiment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Bengo4.comInc (TSE:6027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bengo4.com, Inc. provides online professional consultancy services in Japan and has a market capitalization of approximately ¥58.28 billion.

Operations: Bengo4.com, Inc. generates revenue primarily through its IT/Solutions and Media segments, with the IT/Solutions segment contributing ¥8.36 billion and the Media segment contributing ¥4.72 billion. The company focuses on delivering online professional consultancy services within Japan's market.

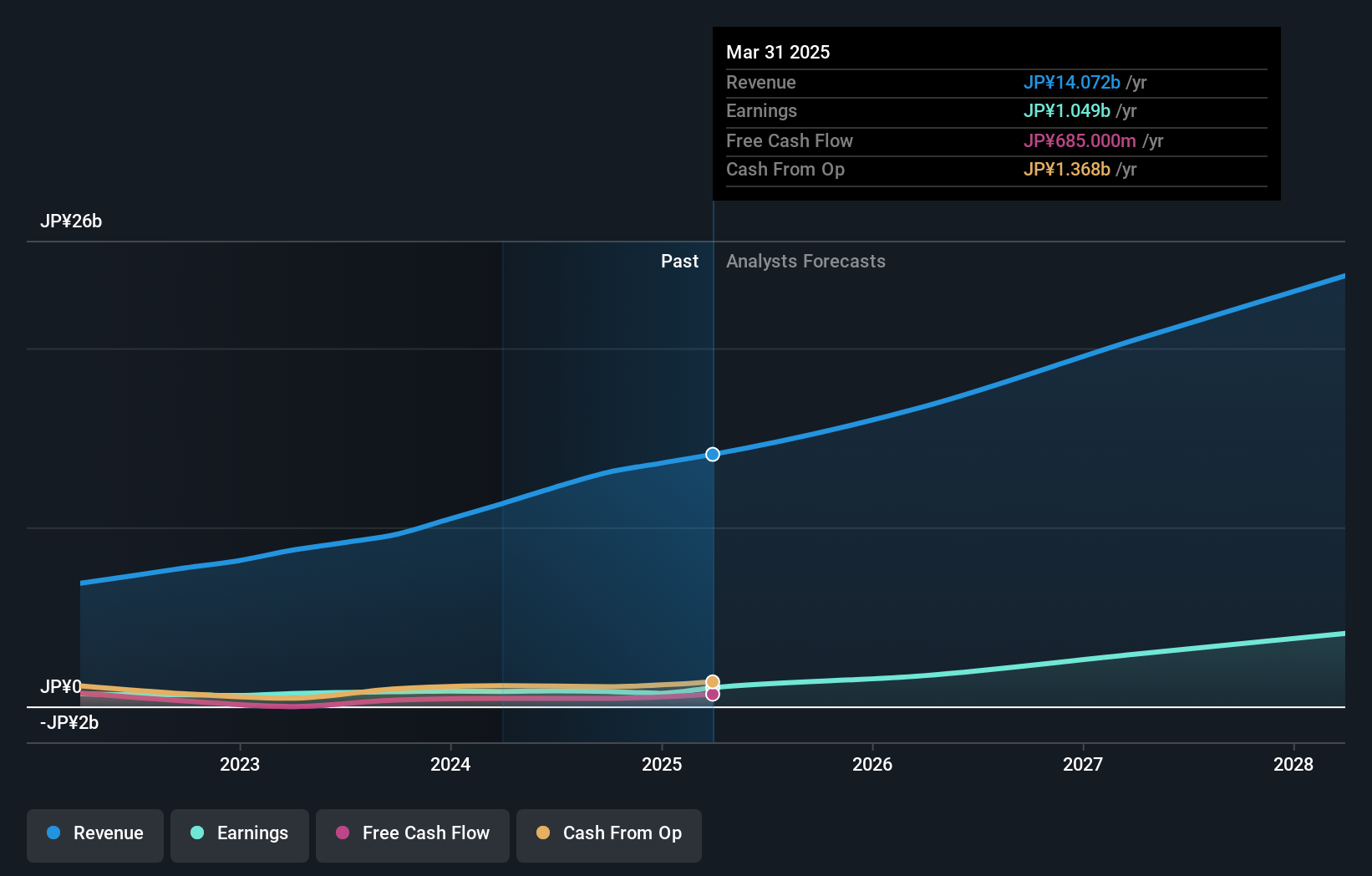

Bengo4.comInc. is navigating the competitive landscape of interactive media and services with a robust financial outlook, as evidenced by its recent corporate guidance predicting net sales reaching JPY 14.74 billion and an operating profit of JPY 1.7 billion for FY2025. This projection aligns with the company's historical performance, where earnings have surged by an average of 33.5% annually over the past five years, significantly outpacing its sector's growth. Despite a volatile share price in recent months, Bengo4.comInc.'s strategic focus on high-quality earnings—underscored by a forecasted annual earnings growth rate of 54.39%—positions it well within a market where technological agility and innovation are paramount. Furthermore, with R&D investments sharpening its competitive edge, the firm is poised to sustain its upward trajectory in an industry driven increasingly by digital transformation demands.

- Dive into the specifics of Bengo4.comInc here with our thorough health report.

Review our historical performance report to gain insights into Bengo4.comInc's's past performance.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. operates as a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$2.14 billion.

Operations: The company generates revenue primarily from its educational software segment, amounting to $209.17 million. Its AI-powered learning platform serves clients in North America and internationally.

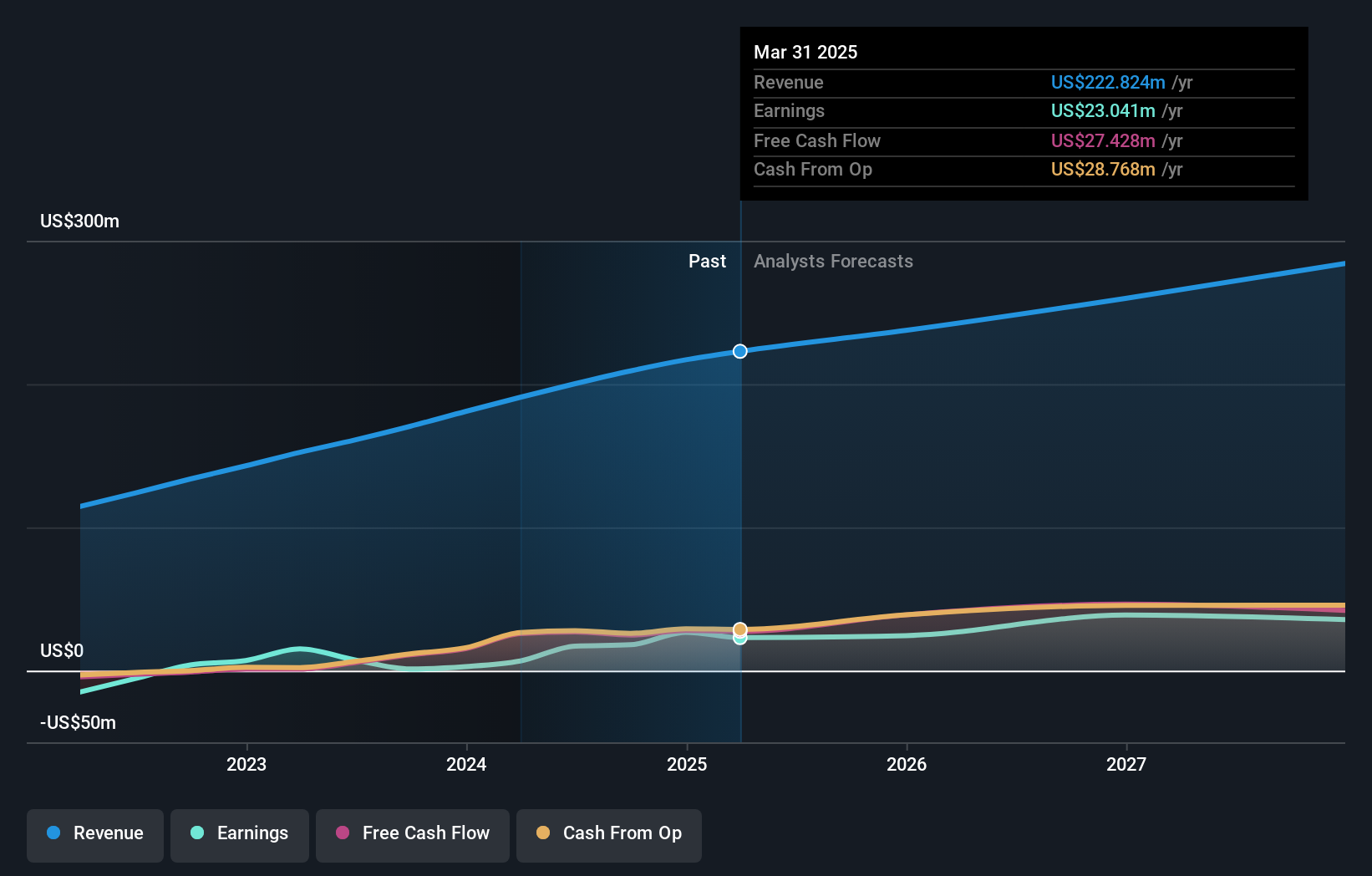

Docebo's strategic alliances, notably with Class Technologies and Deloitte, underscore its commitment to enhancing virtual instructor-led training and building robust learning ecosystems. These partnerships not only expand its service capabilities but also integrate cutting-edge AI to measure and enhance learner engagement—critical as firms increasingly adopt digital transformation strategies. Financially, Docebo is poised for significant growth with a projected revenue increase of 19.5% for FY2024, complemented by a remarkable past year’s earnings surge of 1381.8%. This financial trajectory, combined with an aggressive R&D investment strategy that sharpens its competitive edge in the fast-evolving tech landscape, positions Docebo as a formidable player in the corporate learning sector.

- Click here to discover the nuances of Docebo with our detailed analytical health report.

Gain insights into Docebo's historical performance by reviewing our past performance report.

HIVE Digital Technologies (TSXV:HIVE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. is involved in the mining and sale of digital currencies across Canada, Sweden, and Iceland, with a market cap of CA$726.38 million.

Operations: HIVE Digital Technologies generates revenue primarily from the mining and sale of digital currencies, reporting $123.02 million in this segment. The company operates across Canada, Sweden, and Iceland.

HIVE Digital Technologies, amidst a challenging landscape, has demonstrated robust operational advancements and strategic growth initiatives. Recent upgrades in mining efficiency, marked by the acquisition of 11,500 advanced ASIC miners, underscore a commitment to enhancing productivity and energy efficiency—key factors in sustaining long-term growth in the blockchain sector. Financially, despite a current unprofitability status with a net loss reduction to $4.41 million from last year's $40.8 million over six months, HIVE's revenue trajectory shows promise with an annual increase forecasted at 45.9%. These figures reflect not just recovery but also an aggressive push towards leveraging technological advancements to optimize operations and potentially pivot towards profitability in the near future.

Where To Now?

- Access the full spectrum of 1267 High Growth Tech and AI Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Operates as a learning management software company that provides artificial intelligence (AI)-powered learning platform in North America and internationally.

Outstanding track record with flawless balance sheet.