Coveo Solutions (TSX:CVO) Is Up 13.5% After Canada AI MOU And CFO Shift - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Coveo Solutions’ previously announced chief financial officer transition, with Brandon Nussey stepping down by February 2026 and long-time finance leader Karine Hamel becoming interim CFO, has begun.

- Separately, the Government of Canada disclosed a memorandum of understanding with Coveo to explore using its AI-Relevance Platform to enhance federal digital services, underscoring public-sector interest in the company’s technology.

- We’ll now examine how this Canadian government AI collaboration may influence Coveo’s long-term AI platform adoption and investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Coveo Solutions Investment Narrative Recap

To own Coveo, you need to believe its AI relevance platform can stay differentiated, win larger enterprise workloads and eventually scale toward better economics, despite ongoing losses and intense competition. The new memorandum with the Government of Canada looks more like early validation than a near term financial catalyst, while the key near term risk remains that bigger AI and search vendors crowd its space and pressure pricing and win rates.

The recent CFO transition plan, with long time finance leader Karine Hamel stepping in as interim CFO, matters here because it comes just as Coveo is trying to prove operating discipline and consistency in its AI investment cycle. For investors watching the Canadian government AI collaboration, stable financial leadership may help the company support long sales cycles with public institutions without losing focus on efficiency and product innovation in its core enterprise markets.

Yet investors should be aware that competition from large platforms could still...

Read the full narrative on Coveo Solutions (it's free!)

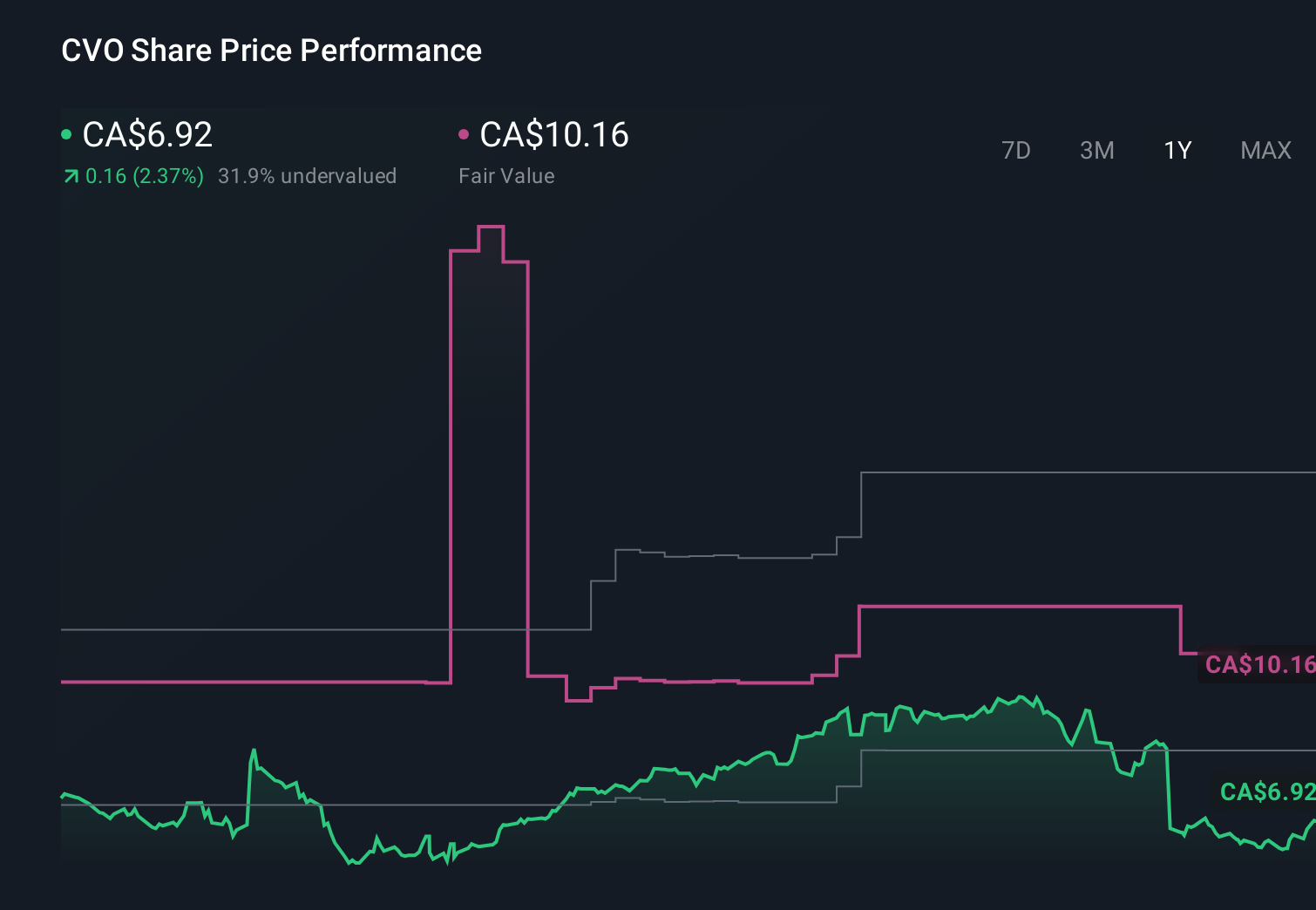

Coveo Solutions' narrative projects $205.2 million revenue and $23.9 million earnings by 2028. This requires 14.5% yearly revenue growth and a $46.6 million earnings increase from $-22.7 million.

Uncover how Coveo Solutions' forecasts yield a CA$10.16 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members currently estimate Coveo’s fair value between CA$6.55 and CA$12.96, showing just how far opinions can stretch. When you set those views against the risk that larger AI and software vendors could erode Coveo’s pricing power, it becomes even more important to compare several contrasting cases before deciding how this business might perform.

Explore 3 other fair value estimates on Coveo Solutions - why the stock might be worth as much as 88% more than the current price!

Build Your Own Coveo Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coveo Solutions research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Coveo Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coveo Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CVO

Coveo Solutions

Provides software-as-a-service artificial intelligence (AI) platform in Canada, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion