How Investors Are Reacting To Constellation Software (TSX:CSU) Leadership Change After Mark Leonard’s Resignation

Reviewed by Sasha Jovanovic

- Constellation Software Inc. recently announced that longtime founder and President Mark Leonard has resigned for health reasons, with Chief Operating Officer Mark Miller appointed as the new President effective immediately.

- This executive transition has prompted shareholder communications, including a scheduled live Q&A webcast to address questions and provide insight into the company's succession plans.

- We’ll explore how investor uncertainty around Constellation’s leadership change shapes the company's long-term investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Constellation Software's Investment Narrative?

Being a shareholder in Constellation Software has always meant buying into the company’s decentralized acquisition-driven model and its steady commitment to compounding growth across vertical software markets. Leadership continuity has been an anchor for this story, so Mark Leonard’s departure as President is an important event, especially as recent share price drops suggest the market is reassessing short-term risks. The company’s near-term catalysts, such as ongoing M&A and dividend streams, remain in focus and operationally nothing fundamental in the business model appears to have shifted with Mark Miller’s appointment. The insider share purchases and robust board structure may temper immediate concerns, yet this leadership transition brings increased scrutiny to succession execution, especially after weaker recent earnings. While the big picture investment case endures, investor attention on top management and profit stability is likely higher for now.

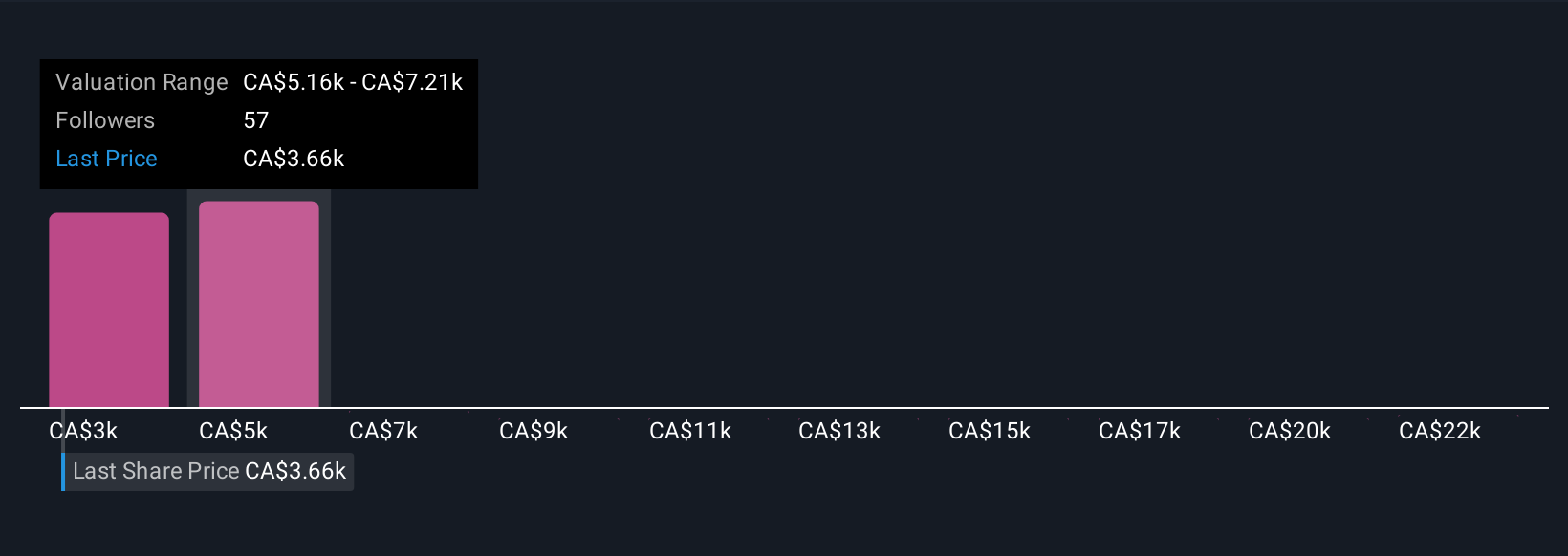

But the impact from elevated management risk is not something every investor sees coming. Constellation Software's shares have been on the rise but are still potentially undervalued by 22%. Find out what it's worth.Exploring Other Perspectives

Explore 22 other fair value estimates on Constellation Software - why the stock might be worth over 2x more than the current price!

Build Your Own Constellation Software Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Software research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Constellation Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Software's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives