- Canada

- /

- Metals and Mining

- /

- TSX:CS

Green Thumb Industries Leads Three Value Picks On TSX That Investors Might Consider Undervalued

Reviewed by Simply Wall St

The Canadian market has shown robust growth, climbing 1.2% in the last week and achieving an 11% increase over the past year, with earnings expected to grow by 15% annually. In this environment, identifying stocks that appear undervalued could offer potential opportunities for investors looking for value in a rising market.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Calibre Mining (TSX:CXB) | CA$1.83 | CA$3.13 | 41.6% |

| Calian Group (TSX:CGY) | CA$55.40 | CA$110.53 | 49.9% |

| goeasy (TSX:GSY) | CA$187.52 | CA$313.68 | 40.2% |

| Trisura Group (TSX:TSU) | CA$41.58 | CA$80.18 | 48.1% |

| Aura Minerals (TSX:ORA) | CA$12.10 | CA$21.24 | 43% |

| Kinaxis (TSX:KXS) | CA$150.58 | CA$249.54 | 39.7% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Endeavour Mining (TSX:EDV) | CA$28.95 | CA$53.83 | 46.2% |

| Jamieson Wellness (TSX:JWEL) | CA$27.54 | CA$46.69 | 41% |

| Kits Eyecare (TSX:KITS) | CA$8.39 | CA$14.30 | 41.3% |

We're going to check out a few of the best picks from our screener tool

Green Thumb Industries (CNSX:GTII)

Overview: Green Thumb Industries Inc. operates in the United States, focusing on the manufacturing, distribution, marketing, and sales of cannabis products for both medical and adult-use markets, with a market capitalization of approximately CA$3.89 billion.

Operations: The company generates revenue primarily through its retail and consumer packaged goods segments, totaling approximately $806.38 million and $583.78 million respectively.

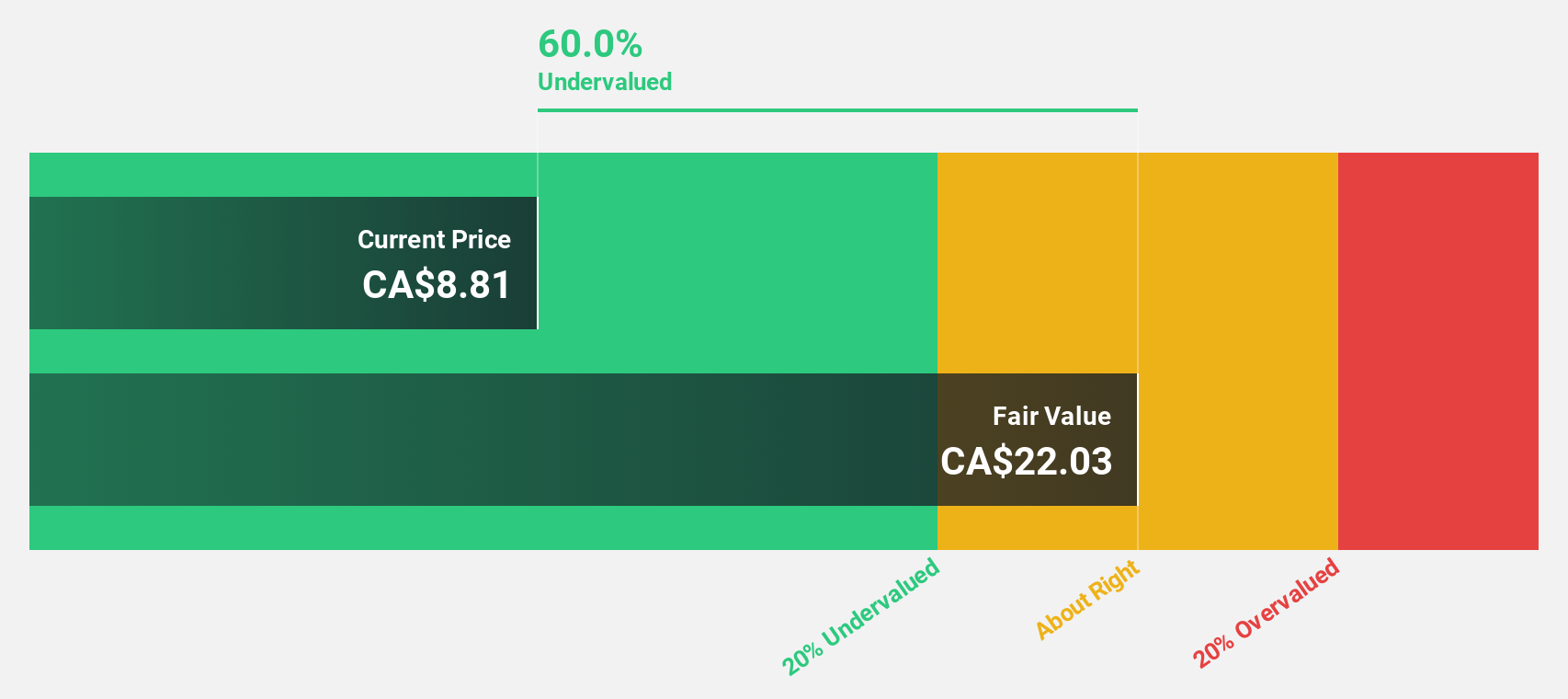

Estimated Discount To Fair Value: 36.7%

Green Thumb Industries, priced at CA$17.13, is currently trading 36.7% below its estimated fair value of CA$27.08, signaling potential undervaluation based on discounted cash flow analysis. Despite a modest forecasted Return on Equity of 7.5%, the company's earnings are expected to grow by a significant 23% annually over the next three years, outpacing the Canadian market's growth rate of 14.7%. Additionally, recent expansions and strategic merger discussions highlight proactive management actions to enhance business scope and market presence.

- Our expertly prepared growth report on Green Thumb Industries implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Green Thumb Industries' balance sheet health report.

Capstone Copper (TSX:CS)

Overview: Capstone Copper Corp. is a copper mining company with operations in the United States, Chile, and Mexico, boasting a market capitalization of CA$7.24 billion.

Operations: The company generates revenue primarily from its mining operations at Cozamin (CA$216.78 million), Mantoverde (CA$307.90 million), Pinto Valley (CA$438.59 million), and Mantos Blancos (CA$379.16 million).

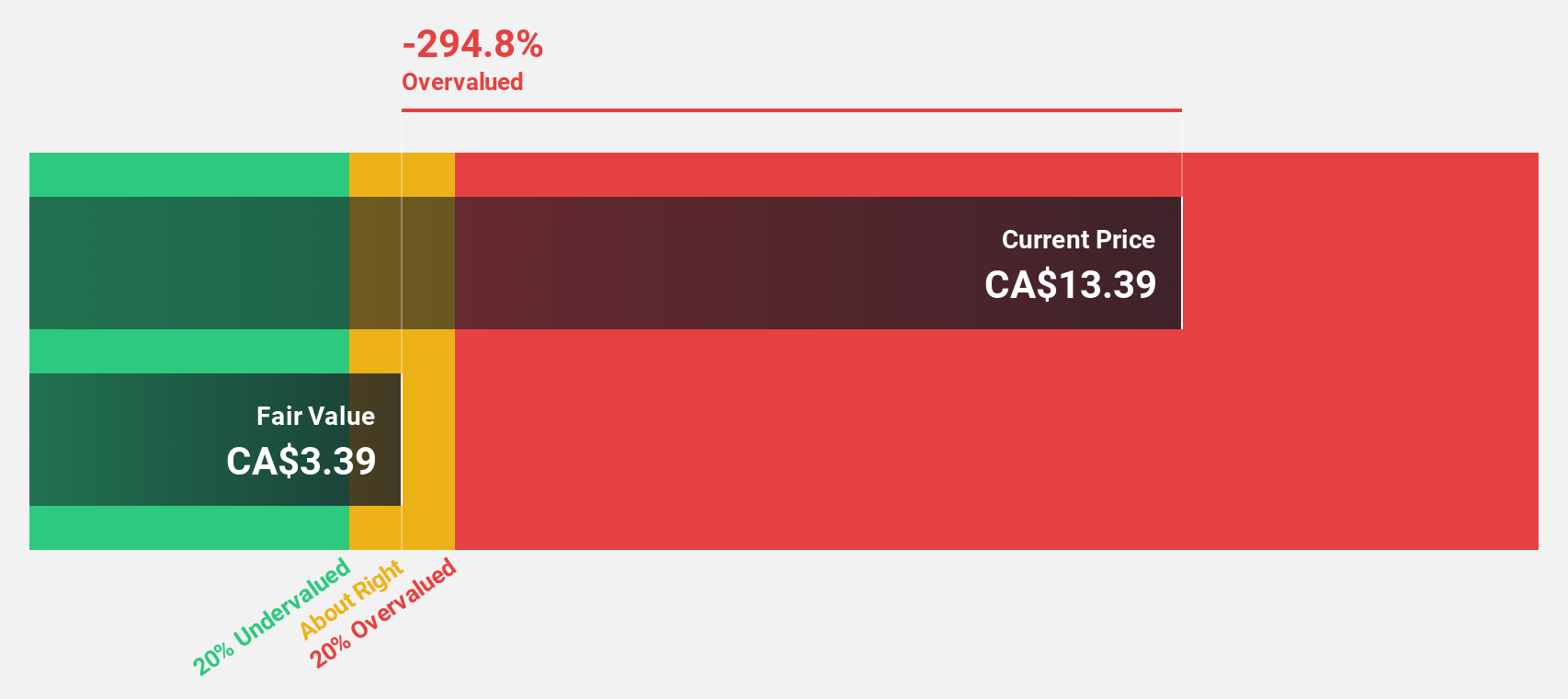

Estimated Discount To Fair Value: 39.5%

Capstone Copper, with a current trading price of CA$9.94, appears undervalued against a fair value estimate of CA$16.42 based on discounted cash flow analysis. Despite recent insider selling and shareholder dilution over the past year, the company's revenue is projected to grow at 18.1% annually, outstripping the Canadian market forecast of 7.2%. Capstone's transition to profitability within three years and its significant expected earnings growth underscore its potential upside despite some operational challenges reflected in a modest anticipated Return on Equity of 10.3%.

- Insights from our recent growth report point to a promising forecast for Capstone Copper's business outlook.

- Navigate through the intricacies of Capstone Copper with our comprehensive financial health report here.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. operates globally, acquiring, building, and managing vertical market software businesses primarily in Canada, the US, and Europe, with a market capitalization of approximately CA$80.74 billion.

Operations: The company generates CA$8.84 billion from its software and programming segment.

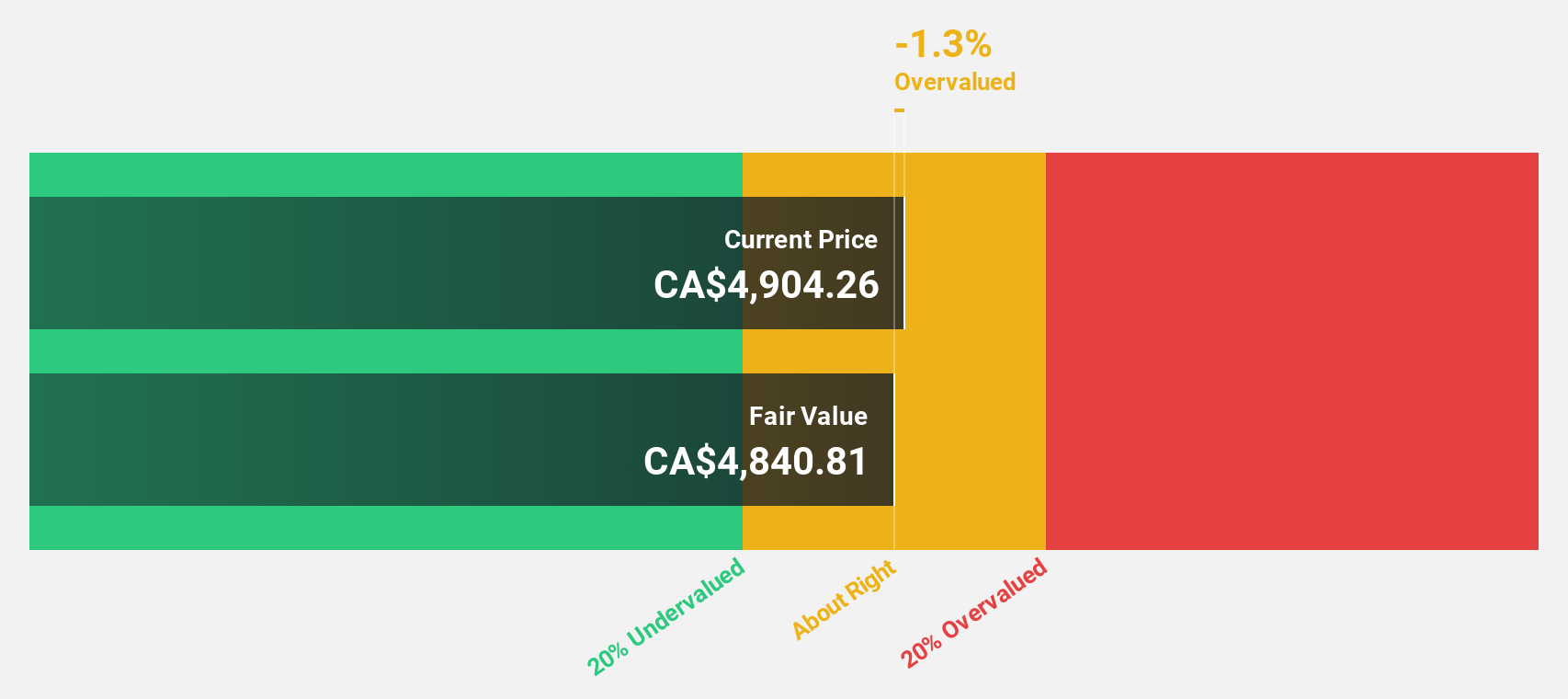

Estimated Discount To Fair Value: 28.3%

Constellation Software, priced at CA$3848.34, trades below its estimated fair value of CA$5367.58, signaling potential undervaluation based on discounted cash flow metrics. With a robust forecast for revenue and earnings growth at 16.1% and 24.43% per year respectively—both outpacing the Canadian market averages—the firm shows promising financial dynamics despite carrying a high level of debt. Recent executive reshuffles aim to bolster its strategic direction, enhancing its competitive edge in software services while maintaining a steady dividend payout evidenced by the recent declaration for July 2024.

- Our growth report here indicates Constellation Software may be poised for an improving outlook.

- Dive into the specifics of Constellation Software here with our thorough financial health report.

Where To Now?

- Navigate through the entire inventory of 24 Undervalued TSX Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives