Constellation Software's (TSE:CSU) Performance Is Even Better Than Its Earnings Suggest

The subdued stock price reaction suggests that Constellation Software Inc.'s (TSE:CSU) strong earnings didn't offer any surprises. We think that investors have missed some encouraging factors underlying the profit figures.

View our latest analysis for Constellation Software

Examining Cashflow Against Constellation Software's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

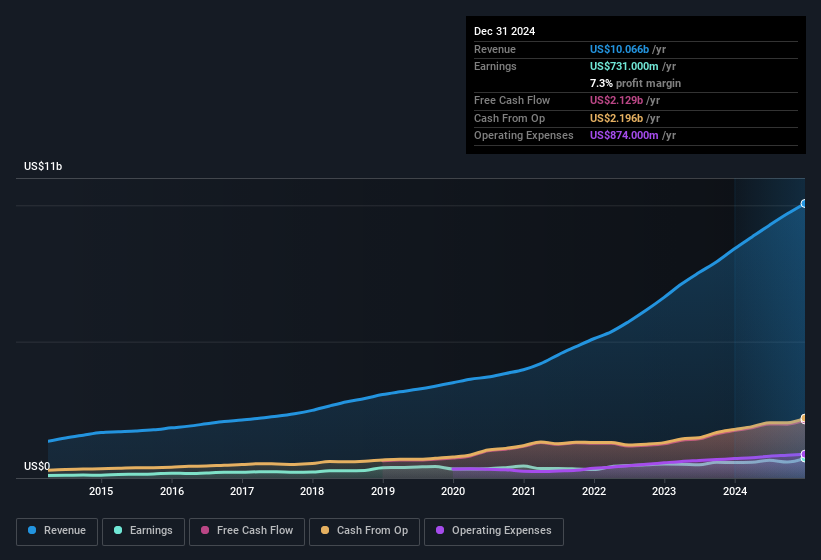

Constellation Software has an accrual ratio of -0.30 for the year to December 2024. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. Indeed, in the last twelve months it reported free cash flow of US$2.1b, well over the US$731.0m it reported in profit. Constellation Software's free cash flow improved over the last year, which is generally good to see.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Constellation Software's Profit Performance

Happily for shareholders, Constellation Software produced plenty of free cash flow to back up its statutory profit numbers. Because of this, we think Constellation Software's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And on top of that, its earnings per share have grown at an extremely impressive rate over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example - Constellation Software has 1 warning sign we think you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Constellation Software's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion