Investors Could Be Concerned With Computer Modelling Group's (TSE:CMG) Returns On Capital

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at Computer Modelling Group (TSE:CMG), they do have a high ROCE, but we weren't exactly elated from how returns are trending.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Computer Modelling Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.27 = CA$30m ÷ (CA$164m - CA$54m) (Based on the trailing twelve months to June 2024).

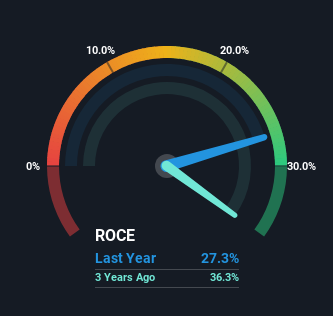

Therefore, Computer Modelling Group has an ROCE of 27%. That's a fantastic return and not only that, it outpaces the average of 16% earned by companies in a similar industry.

See our latest analysis for Computer Modelling Group

Above you can see how the current ROCE for Computer Modelling Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Computer Modelling Group .

So How Is Computer Modelling Group's ROCE Trending?

In terms of Computer Modelling Group's historical ROCE movements, the trend isn't fantastic. To be more specific, while the ROCE is still high, it's fallen from 37% where it was five years ago. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. If these investments prove successful, this can bode very well for long term stock performance.

The Bottom Line On Computer Modelling Group's ROCE

While returns have fallen for Computer Modelling Group in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. Furthermore the stock has climbed 54% over the last five years, it would appear that investors are upbeat about the future. So while the underlying trends could already be accounted for by investors, we still think this stock is worth looking into further.

If you want to continue researching Computer Modelling Group, you might be interested to know about the 3 warning signs that our analysis has discovered.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CMG

Computer Modelling Group

A software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Q3 Outlook modestly optimistic

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale