- New Zealand

- /

- Oil and Gas

- /

- NZSE:CHI

Global Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

Amid recent developments in global markets, the Federal Reserve's decision to cut interest rates for the first time this year has propelled major U.S. stock indexes to record highs and sparked a rally in small-cap stocks, with the Russell 2000 Index gaining 2.16%. This environment of lower borrowing costs can be particularly beneficial for small-cap companies, which are often more sensitive to interest rate changes than their larger counterparts. In such conditions, identifying small-cap stocks with strong fundamentals and potential insider confidence can be key factors for investors seeking opportunities in undervalued segments of the market.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GDI Integrated Facility Services | 18.6x | 0.3x | 3.34% | ★★★★★☆ |

| Bytes Technology Group | 17.1x | 4.3x | 12.75% | ★★★★☆☆ |

| East West Banking | 3.3x | 0.8x | 13.04% | ★★★★☆☆ |

| Cettire | NA | 0.3x | 41.15% | ★★★★☆☆ |

| BWP Trust | 10.0x | 13.1x | 13.64% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.79% | ★★★★☆☆ |

| Sagicor Financial | 7.5x | 0.4x | -79.69% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.2x | 6.9x | 10.92% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.8x | 1.8x | 18.65% | ★★★☆☆☆ |

| CVS Group | 45.9x | 1.3x | 37.05% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

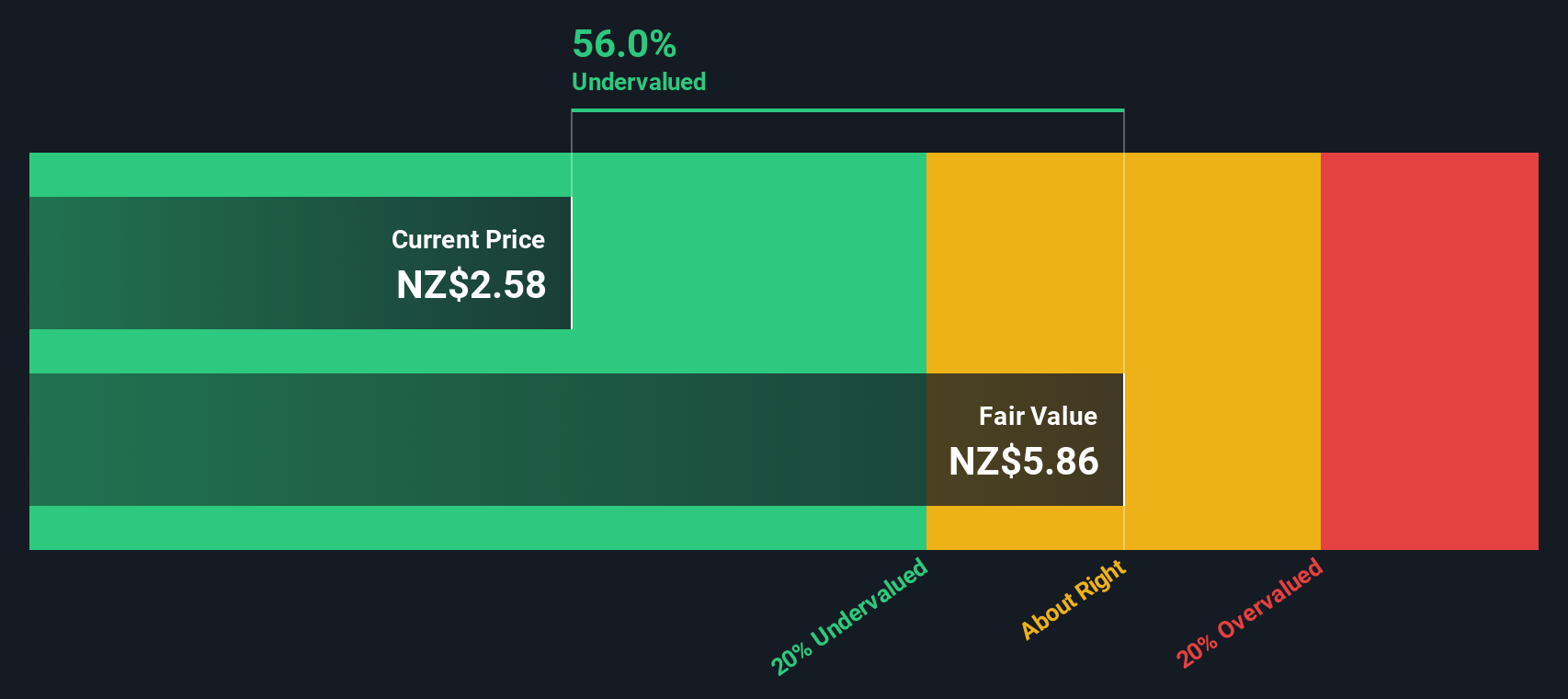

Channel Infrastructure NZ (NZSE:CHI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Channel Infrastructure NZ operates as a key infrastructure provider in New Zealand, focusing on delivering essential services with a market capitalization of approximately NZ$0.28 billion.

Operations: Channel Infrastructure NZ's revenue primarily stems from its infrastructure segment, with a recent quarterly revenue of NZ$140.19 million. The company has seen fluctuations in its net income margin, which was -0.60% in 2021 and improved to 18.70% by mid-2025. Gross profit margin has shown a positive trend, reaching 87.28% in the latest period analyzed, indicating effective cost management relative to revenue growth over time.

PE: 38.4x

Channel Infrastructure NZ, a smaller company in the infrastructure sector, is drawing interest due to its potential for growth and insider confidence. Recent earnings show sales of NZ$70.2 million for the half-year ending June 2025, with net income at NZ$13.1 million. A dividend increase to NZ$0.0625 per share was announced for September 2025. The company entered a promising project development agreement with Seadra Energy for a biorefinery at Marsden Point, aiming to enhance long-term contracted revenues by 2026 through strategic reinvestment and infrastructure expansion plans.

- Unlock comprehensive insights into our analysis of Channel Infrastructure NZ stock in this valuation report.

Gain insights into Channel Infrastructure NZ's past trends and performance with our Past report.

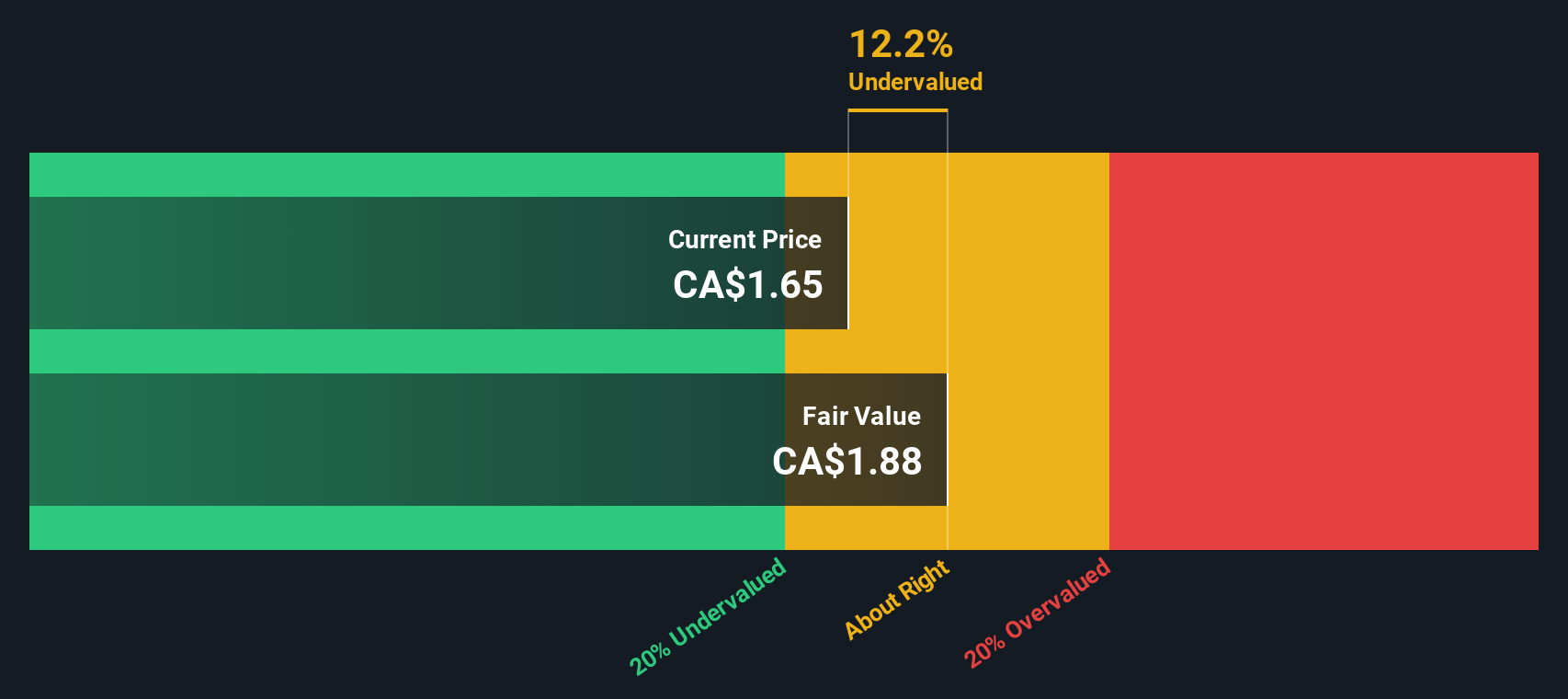

Computer Modelling Group (TSX:CMG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Computer Modelling Group specializes in developing software for reservoir simulation and modeling, with a market cap of CA$0.83 billion.

Operations: The company primarily generates revenue from its Software & Programming segment, with the latest reported revenue at CA$128.56 million. The gross profit margin has seen fluctuations, peaking at 90.29% in recent periods before slightly decreasing to 80.78%. Operating expenses have consistently been a significant part of the cost structure, with R&D and Sales & Marketing being notable components.

PE: 24.5x

Computer Modelling Group, a smaller company in the tech sector, has seen insider confidence with recent share purchases by executives. Despite a forecasted 6.74% annual earnings growth, the company faces challenges from its reliance on external borrowing for funding. Recent leadership changes include appointing Andrew Pastor as Chair and Vipin Khullar as CFO to bolster strategic direction. While sales dipped slightly to CAD 29.63 million in Q1 2025, strategic shifts could position CMG for future growth amidst industry fluctuations.

Meren Energy (TSX:MER)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Meren Energy is a company involved in the exploration and production of oil and gas, with a market cap of $3.45 billion.

Operations: Meren Energy's financial data shows no revenue generation until 2025, with a gross profit margin of 32.98% in Q1 2025 and 96.43% in Q2 2025. The company has experienced fluctuations in net income, with significant non-operating expenses impacting its financials over the years. General and administrative expenses have been a recurring cost, reaching $40.8 million in Q1 2025 and decreasing to $30.1 million by Q2 2025.

PE: -3.9x

Meren Energy, a smaller company in the energy sector, presents an interesting case for value-seeking investors. Recent insider confidence is evident as President Roger Tucker acquired 40,000 shares for approximately US$66,400. Despite past shareholder dilution and reliance on external borrowing for funding, Meren's earnings have shown significant improvement with net income rising to US$54 million in the first half of 2025 from US$3.9 million a year prior. The company has also revised its production guidance upwards and continues to distribute dividends, reflecting stable financial health amidst organizational changes like merging executive roles to enhance operational efficiency across regions such as Nigeria and South Africa.

Turning Ideas Into Actions

- Get an in-depth perspective on all 107 Undervalued Global Small Caps With Insider Buying by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:CHI

Channel Infrastructure NZ

Provides infrastructure solutions to meet fuel and energy needs in New Zealand.

Adequate balance sheet and fair value.

Market Insights

Community Narratives