BlackBerry (TSX:BB): Evaluating Valuation After Leadership Change at QNX Division

Reviewed by Simply Wall St

BlackBerry (TSX:BB) has just named John Wall as the new President of its QNX division, taking over from Mattias Eriksson. Wall’s deep involvement in QNX since 1993 raises interesting prospects for the division’s direction.

See our latest analysis for BlackBerry.

The leadership shakeup comes as BlackBerry’s stock has shown some resilience this year, with the share price climbing 3.6% year-to-date and a one-year total shareholder return of nearly 54%. This suggests investor confidence may be on the rebound. Despite this positive long-term momentum, recent weeks have been choppier. This hints at a wait-and-see attitude as the company’s new strategy unfolds.

If leadership changes spark your curiosity about what’s next in tech, this could be the perfect moment to discover See the full list for free.

That raises a key question for investors: given BlackBerry’s recent gains and new leadership, does the current stock price offer untapped value, or has the market already accounted for the company’s next phase of growth?

Price-to-Earnings of 122x: Is it justified?

Based on the price-to-earnings ratio, BlackBerry's shares are trading at 122 times earnings, which puts them well above both industry averages and peer comparisons. With a recent closing price of CA$5.71, this valuation suggests investors are pricing in strong future growth. However, it raises questions about whether the optimism is supported by fundamentals.

The price-to-earnings ratio is a key metric for tech companies, reflecting how much investors are willing to pay for each dollar of current earnings. In sectors with significant innovation or transformative products, high multiples can sometimes be justified by anticipation of breakthrough profits or market leadership. For BlackBerry, now in a phase of transformation, the company's transition from hardware to security software and automotive platform leader is already factored into the premium that investors are currently willing to pay.

However, BlackBerry's price-to-earnings multiple is much higher than the Canadian software sector average of 47.7x and its peer group at 73.9x. Even against the estimated fair price-to-earnings ratio of 37.6x, the valuation looks steep. These high comparative numbers mean the market expects BlackBerry to deliver on significant profit growth or unique upside. Otherwise, the price could face downward pressure to align with sector norms or the broader market's sense of fair value.

Explore the SWS fair ratio for BlackBerry

Result: Price-to-Earnings of 122x (OVERVALUED)

However, slowing revenue growth and a recent dip in BlackBerry's share price could present challenges to the current optimism and test investor confidence moving forward.

Find out about the key risks to this BlackBerry narrative.

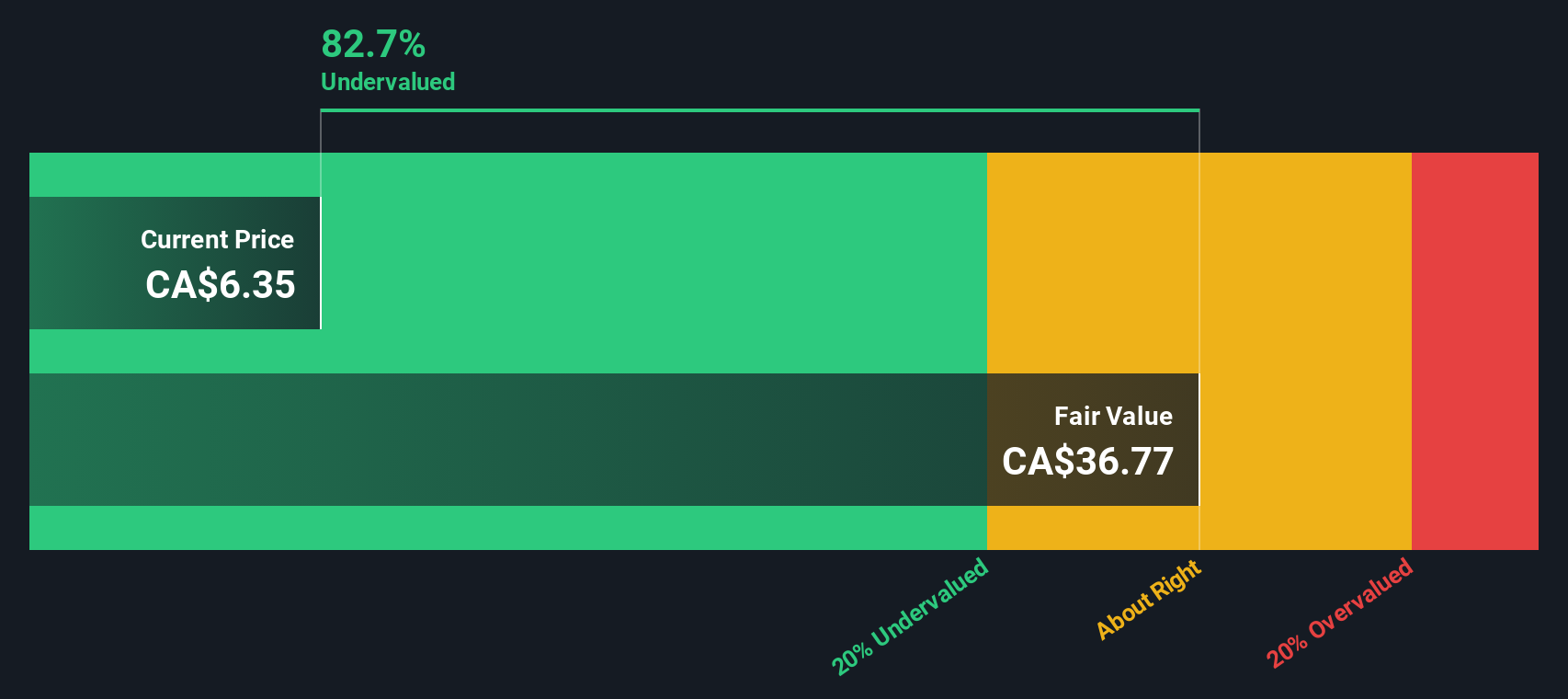

Another View: DCF Suggests Undervaluation

While the current market valuation looks steep based on earnings multiples, the SWS DCF model presents a different perspective. According to this model, BlackBerry's shares are trading at about 85% below their estimated fair value. This difference presents a critical question for investors: is market caution overshadowing growth potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BlackBerry for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BlackBerry Narrative

If you want to dig into the data yourself or take a different approach, you can put together your own narrative in just a few minutes. Do it your way.

A great starting point for your BlackBerry research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next winning stock slip by. Use the Simply Wall Street Screener to uncover fresh opportunities before the crowd moves in:

- Spot emerging innovators by reviewing these 933 undervalued stocks based on cash flows where strong cash flow meets attractive prices in today’s market.

- Take advantage of companies revolutionizing healthcare by checking out smart picks among these 30 healthcare AI stocks for the next medical breakthrough.

- Capture reliable income streams by identifying high-yield opportunities now with these 15 dividend stocks with yields > 3% delivering above-average returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackBerry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BB

BlackBerry

Provides intelligent security software and services to enterprises and governments worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.