Did Business Growth Power VSBLTY Groupe Technologies' (CSE:VSBY) Share Price Gain of 144%?

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the VSBLTY Groupe Technologies Corp. (CSE:VSBY) share price has soared 144% return in just a single year. Better yet, the share price has gained 340% in the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. VSBLTY Groupe Technologies hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for VSBLTY Groupe Technologies

With just US$1,028,026 worth of revenue in twelve months, we don't think the market considers VSBLTY Groupe Technologies to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that VSBLTY Groupe Technologies will significantly advance the business plan before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Of course, if you time it right, high risk investments like this can really pay off, as VSBLTY Groupe Technologies investors might know.

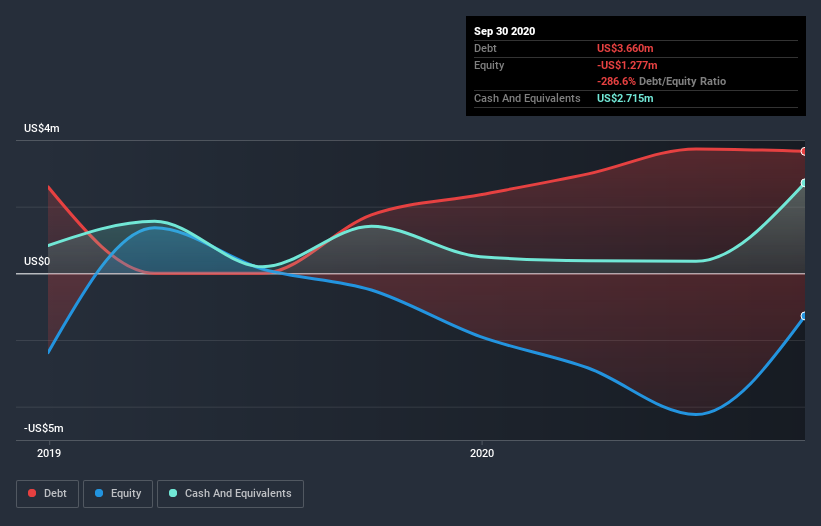

Our data indicates that VSBLTY Groupe Technologies had US$2.5m more in total liabilities than it had cash, when it last reported in September 2020. That makes it extremely high risk, in our view. So the fact that the stock is up 86% in the last year shows that high risks can lead to high rewards, sometimes. Investors must really like its potential. The image below shows how VSBLTY Groupe Technologies' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that VSBLTY Groupe Technologies shareholders have gained 144% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 340% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that VSBLTY Groupe Technologies is showing 6 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

VSBLTY Groupe Technologies is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

When trading VSBLTY Groupe Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade VSBLTY Groupe Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About CNSX:VSBY

VSBLTY Groupe Technologies

Operates as a software provider of artificial intelligence security and retail analytics technology solutions.

Medium-low with imperfect balance sheet.