- Canada

- /

- Specialty Stores

- /

- TSX:ZZZ

With EPS Growth And More, Sleep Country Canada Holdings (TSE:ZZZ) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Sleep Country Canada Holdings (TSE:ZZZ), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Sleep Country Canada Holdings

Sleep Country Canada Holdings' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Sleep Country Canada Holdings' EPS has grown 28% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about. Getting in to the the finer details, it important to know that the EPS growth has been helped by share buybacks, demonstrating that the business is positioned to return capital to its shareholders.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It was a year of stability for Sleep Country Canada Holdings as both revenue and EBIT margins remained have been flat over the past year. That's not bad, but it doesn't point to ongoing future growth, either.

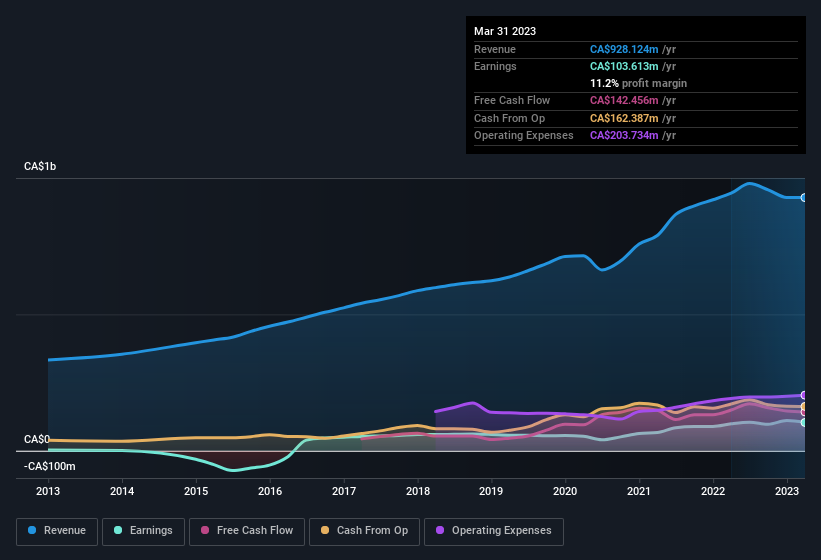

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Sleep Country Canada Holdings' future profits.

Are Sleep Country Canada Holdings Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Sleep Country Canada Holdings followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at CA$17m. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 1.8%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Sleep Country Canada Holdings Deserve A Spot On Your Watchlist?

You can't deny that Sleep Country Canada Holdings has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. What about risks? Every company has them, and we've spotted 3 warning signs for Sleep Country Canada Holdings (of which 1 is potentially serious!) you should know about.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ZZZ

Sleep Country Canada Holdings

Sleep Country Canada Holdings Inc. retails mattress, bedding, and specialty sleep products in Canada.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives