The big shareholder groups in Uni-Select Inc. (TSE:UNS) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. We also tend to see lower insider ownership in companies that were previously publicly owned.

Uni-Select is not a large company by global standards. It has a market capitalization of CA$305m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions own shares in the company. We can zoom in on the different ownership groups, to learn more about Uni-Select.

Check out our latest analysis for Uni-Select

What Does The Institutional Ownership Tell Us About Uni-Select?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

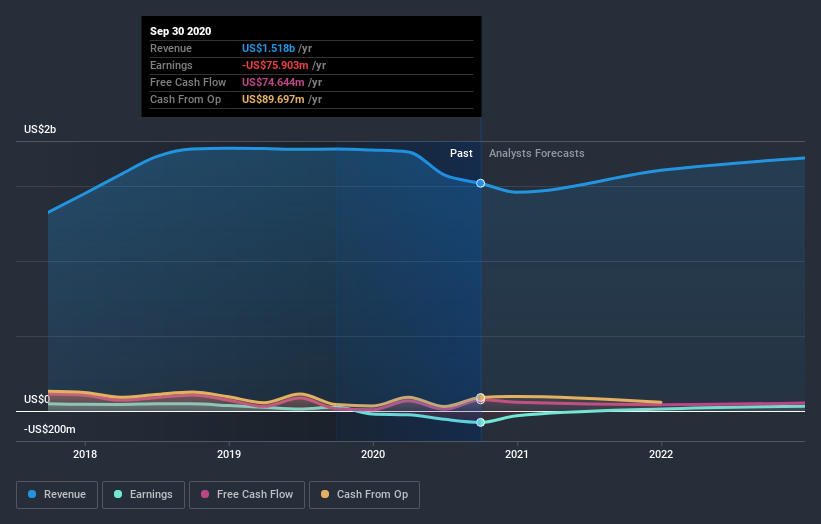

We can see that Uni-Select does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Uni-Select, (below). Of course, keep in mind that there are other factors to consider, too.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. Uni-Select is not owned by hedge funds. Our data shows that EdgePoint Investment Group Inc. is the largest shareholder with 15% of shares outstanding. For context, the second largest shareholder holds about 11% of the shares outstanding, followed by an ownership of 9.9% by the third-largest shareholder.

Our research also brought to light the fact that roughly 54% of the company is controlled by the top 5 shareholders suggesting that these owners wield significant influence on the business.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Uni-Select

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own less than 1% of Uni-Select Inc.. It has a market capitalization of just CA$305m, and the board has only CA$413k worth of shares in their own names. I generally like to see a board more invested. However it might be worth checking if those insiders have been buying.

General Public Ownership

With a 37% ownership, the general public have some degree of sway over Uni-Select. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

With a stake of 9.5%, private equity firms could influence the Uni-Select board. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Uni-Select (1 is potentially serious!) that you should be aware of before investing here.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Uni-Select or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:UNS

Uni-Select

Uni-Select Inc., together with its subsidiaries, distributes automotive refinish, and industrial coatings and related products in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives