- Canada

- /

- Retail Distributors

- /

- TSX:UNS

Introducing Uni-Select, The Stock That Slid 54% In The Last Three Years

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Uni-Select Inc. (TSE:UNS) have had an unfortunate run in the last three years. So they might be feeling emotional about the 54% share price collapse, in that time. The more recent news is of little comfort, with the share price down 42% in a year. Furthermore, it's down 40% in about a quarter, which is even more concerning. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for Uni-Select

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed, is to compare the earnings per share (EPS) with the share price.

It's good to see that Uni-Select went from making a loss to making a profit, within the last three years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

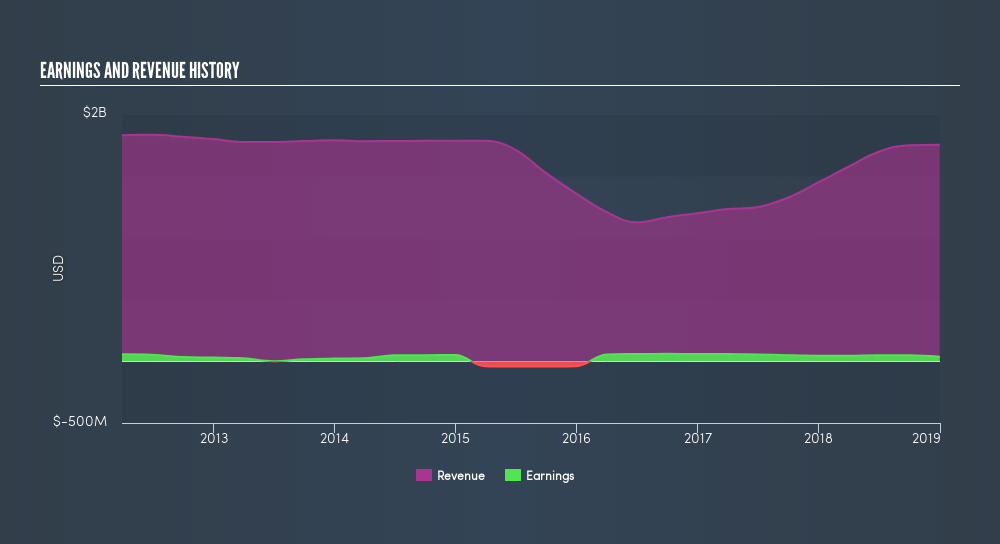

Revenue is actually up 15% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worht worth investigating Uni-Select further; while we may be missing something on this analysis, there might also be an opportunity.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Uni-Select in this interactivegraph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We've already covered Uni-Select's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) and any discounted capital raisings offered to shareholders. Dividends have been really beneficial for Uni-Select shareholders, and that cash payout explains why its TSR of -52%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Investors in Uni-Select had a tough year, with a total loss of 41% (including dividends), against a market gain of about 3.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.5% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. The data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Uni-Select is not the only stock insiders are buying. So take a peek at this freelist of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:UNS

Uni-Select

Uni-Select Inc., together with its subsidiaries, distributes automotive refinish, and industrial coatings and related products in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives