- Canada

- /

- Specialty Stores

- /

- TSX:ROOT

There's No Escaping Roots Corporation's (TSE:ROOT) Muted Revenues Despite A 32% Share Price Rise

Roots Corporation (TSE:ROOT) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 24% is also fairly reasonable.

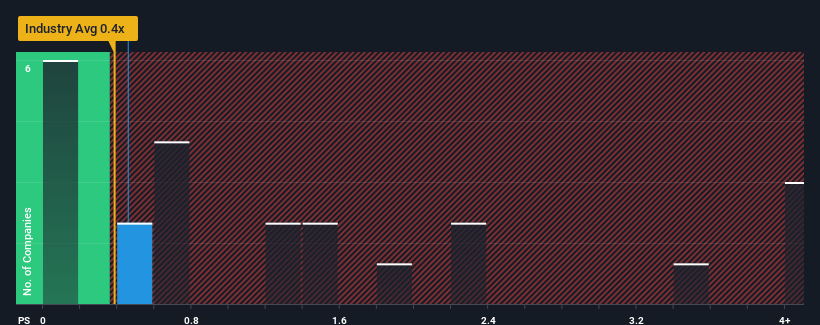

Even after such a large jump in price, when close to half the companies operating in Canada's Specialty Retail industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Roots as an enticing stock to check out with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about Roots. View them for free.View our latest analysis for Roots

What Does Roots' Recent Performance Look Like?

Recent times haven't been great for Roots as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Roots' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Roots' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 4.0% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 0.7% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 11%, which is noticeably more attractive.

In light of this, it's understandable that Roots' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Roots' P/S Mean For Investors?

Roots' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Roots maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Roots.

If these risks are making you reconsider your opinion on Roots, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ROOT

Roots

Designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.