Will Dollarama’s (TSX:DOL) Global Expansion Strategy Deliver Sustainable Growth Across Economic Cycles?

Reviewed by Sasha Jovanovic

- In recent news, Dollarama expanded its international reach by acquiring Australia's largest discount retailer and opening its first Dollarcity store in Mexico, reinforcing its status as Canada's top value-priced retailer with over 1,600 stores worldwide.

- This move highlights Dollarama’s ability to generate steady cash flows and preserve growth potential across different economic cycles, positioning the company as a resilient player in global discount retailing.

- We'll explore how Dollarama's acquisition-led international expansion supports its long-term growth outlook and shapes its investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dollarama Investment Narrative Recap

To be a Dollarama shareholder means believing in the company's ability to grow through disciplined international expansion, resilient consumer demand, and consistent operational execution. The recent acquisition in Australia and new store opening in Mexico broaden Dollarama’s addressable market but do not materially impact the most important short-term catalyst: execution of the Australian integration. The main risk remains successful integration and adaptation of The Reject Shop, with potential challenges in consumer acceptance and operational alignment.

Among Dollarama's recent announcements, the reaffirmation of its Fiscal 2026 comparable store sales growth guidance (3.0% to 4.0%) is especially relevant. This guidance signals steady organic growth ambitions alongside international expansion, underpinning ongoing confidence in its Canadian network while it manages the operational complexities tied to integrating new geographies.

Yet, even with this growth focus, investors should be aware that the Australian acquisition introduces substantial execution risk and the possibility that integration setbacks could...

Read the full narrative on Dollarama (it's free!)

Dollarama's narrative projects CA$9.1 billion revenue and CA$1.6 billion earnings by 2028. This requires 10.9% yearly revenue growth and a CA$0.3 billion earnings increase from CA$1.3 billion.

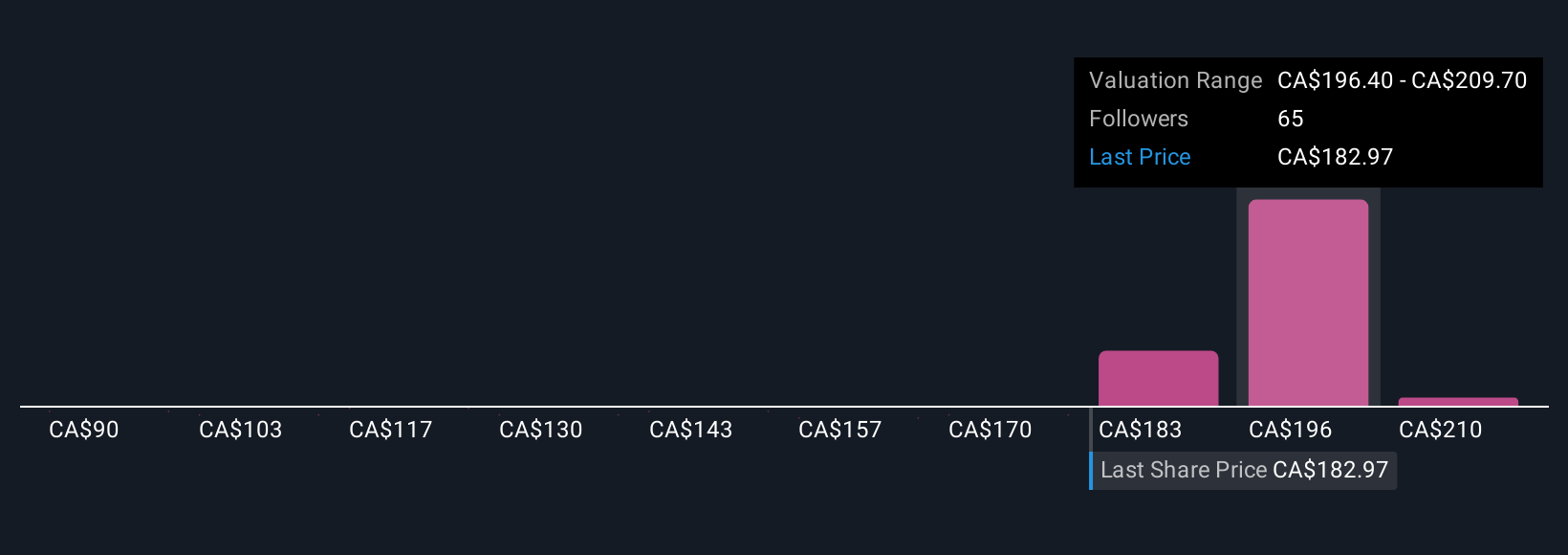

Uncover how Dollarama's forecasts yield a CA$198.81 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Fifteen Simply Wall St Community members estimate Dollarama’s fair value between CA$96.78 and CA$223, reflecting a broad spread of independent outlooks. With the recent international expansion, the success and speed of integrating new operations may weigh heavily on whether Dollarama meets or misses future growth targets.

Explore 15 other fair value estimates on Dollarama - why the stock might be worth 49% less than the current price!

Build Your Own Dollarama Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollarama research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dollarama research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollarama's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives