Will Canadian Tire’s Expanded Indigenous Partnership and Data Breach Reshape Brand Narrative for TSX:CTC.A?

Reviewed by Sasha Jovanovic

- Earlier this month, the Gord Downie & Chanie Wenjack Fund announced an expanded partnership with Canadian Tire Corporation, which will now support The Blanket Fund, a national initiative aimed at empowering Indigenous cultural, artistic, and educational projects following Canadian Tire’s acquisition of Hudson’s Bay Company’s intellectual property.

- This collaboration reinforces Canadian Tire’s pledge to donate all net proceeds from the iconic Hudson’s Bay Point Blanket, guaranteeing a minimum of CA$1,000,000 annually to Indigenous-led initiatives through targeted grant programs.

- We’ll explore how the recent data breach affecting e-commerce customer information may alter risk and trust considerations within Canadian Tire’s investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Canadian Tire Corporation Investment Narrative Recap

To have conviction as a Canadian Tire Corporation shareholder, you need to believe that its investments in digital infrastructure, private-label expansion, and loyalty platforms can drive both growth and efficiency, despite ongoing challenges from e-commerce competitors and shifting consumer behavior. The recent data breach appears to have a limited impact on the most important near-term catalyst, which remains the successful execution of digital and omnichannel improvements, but it reinforces cyber risk as a prominent concern. On balance, neither the new Indigenous partnership nor the breach materially alters the current top catalyst or risk for the business.

Among recent announcements, the completion of a substantial share repurchase program, over 1.5 million shares bought back for CA$250.1 million, stands out. While not directly tied to the data breach, this action is highly relevant to the company's ability to provide ongoing shareholder value, especially as it works to boost confidence and offset any trust issues that arise from operational risks.

Yet, despite digital gains, it’s important to recognize the ongoing exposure to margin pressures, especially as competition continues to intensify from global e-commerce...

Read the full narrative on Canadian Tire Corporation (it's free!)

Canadian Tire Corporation is projected to generate CA$16.9 billion in revenue and CA$732.2 million in earnings by 2028. This outlook reflects an annual revenue decline of 0.4% and a CA$83.4 million decrease in earnings from the current level of CA$815.6 million.

Uncover how Canadian Tire Corporation's forecasts yield a CA$174.91 fair value, in line with its current price.

Exploring Other Perspectives

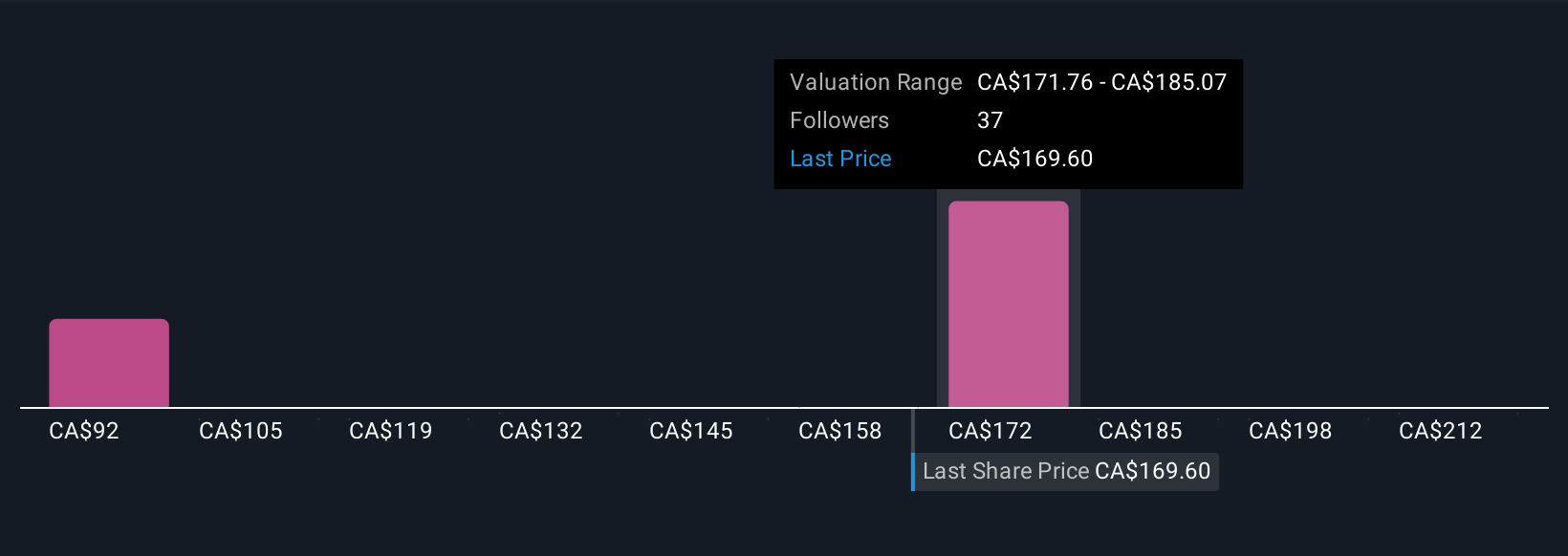

The Simply Wall St Community submitted 8 fair value estimates, which ranged from CA$92.63 to CA$225. As you compare these views, weigh them against the persistent risk that higher investments in omnichannel and automation could squeeze margins if digital sales do not accelerate as hoped. Several viewpoints are worth your attention.

Explore 8 other fair value estimates on Canadian Tire Corporation - why the stock might be worth as much as 30% more than the current price!

Build Your Own Canadian Tire Corporation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Canadian Tire Corporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Tire Corporation's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CTC.A

Canadian Tire Corporation

Provides a range of retail goods and services in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives