How Investors Are Reacting To Canadian Tire Corporation (TSX:CTC.A) Joining the FTSE All-World Index

Reviewed by Sasha Jovanovic

- Canadian Tire Corporation, Limited (TSX:CTC.A) was recently added to the FTSE All-World Index (USD), marking its inclusion in a major global benchmark for investors.

- This addition has the potential to boost Canadian Tire's profile among international investors and increase participation from funds that track global indices.

- We’ll examine how this global index inclusion could influence Canadian Tire’s future investor base and overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Canadian Tire Corporation Investment Narrative Recap

To be a Canadian Tire shareholder today, you typically need to believe that its investments in digital infrastructure, loyalty programs, and private label brands can offset both demographic headwinds and growing e-commerce competition. The FTSE All-World Index inclusion may bring greater international attention in the short term, but it does not materially change the immediate importance of e-commerce execution, nor does it reduce the risk of margin pressure from ongoing catch-up spending in this area.

The recent partnership with WestJet is one of Canadian Tire’s more interesting announcements and aligns closely with its push to expand the Triangle Rewards ecosystem, an important driver of customer stickiness and repeat purchases. While international index inclusion may influence capital flows, the real catalyst for earnings growth remains tied to enhancements in loyalty and customer engagement, as seen in the boost from the WestJet collaboration.

But for cautious investors, there’s a critical detail about margin pressure lurking in the quarterly results that you should understand...

Read the full narrative on Canadian Tire Corporation (it's free!)

Canadian Tire Corporation's outlook forecasts CA$16.9 billion in revenue and CA$732.2 million in earnings by 2028. This reflects an annual revenue decline of 0.4% and a decrease of CA$83.4 million in earnings from the current CA$815.6 million.

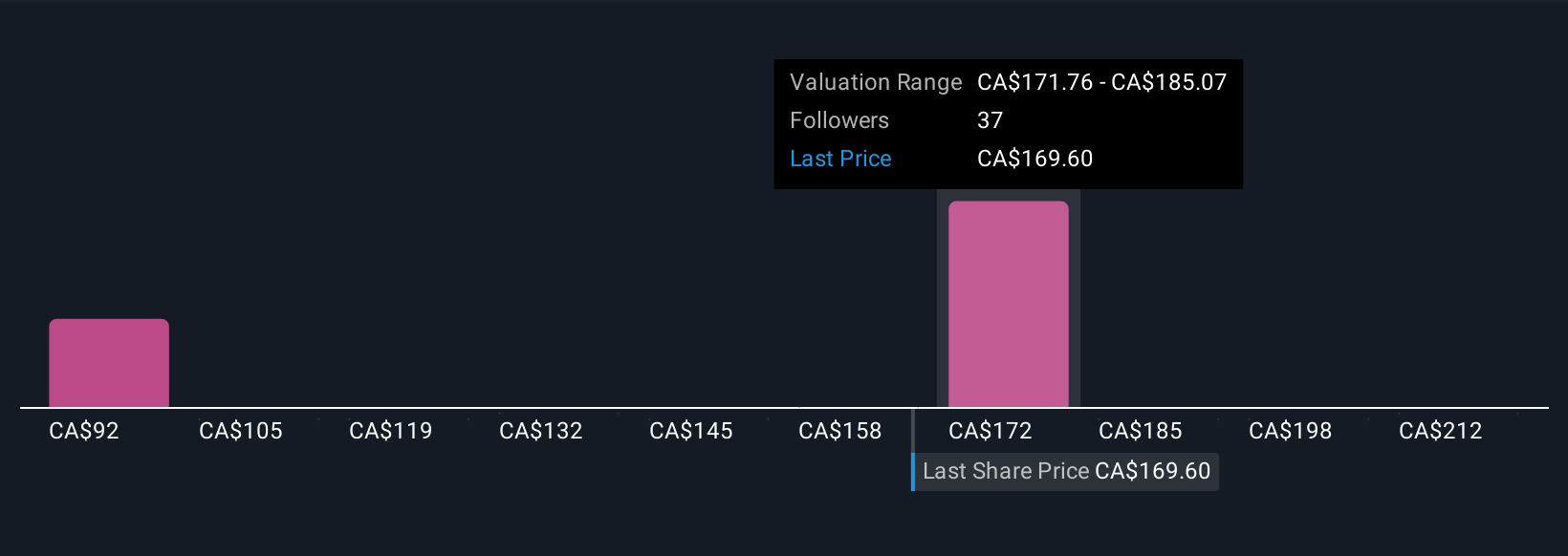

Uncover how Canadian Tire Corporation's forecasts yield a CA$175.64 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community for Canadian Tire range from CA$91.81 to CA$225 per share. Some investors focus on the company’s intense investments in digital and omnichannel upgrades, which could either drive future returns or threaten near-term profitability, see how their expectations diverge.

Explore 8 other fair value estimates on Canadian Tire Corporation - why the stock might be worth 46% less than the current price!

Build Your Own Canadian Tire Corporation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Tire Corporation research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian Tire Corporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Tire Corporation's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CTC.A

Canadian Tire Corporation

Provides a range of retail goods and services in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives