- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

Aritzia (TSX:ATZ) Valuation in Focus Ahead of Q2 2026 Earnings Announcement

Reviewed by Kshitija Bhandaru

Aritzia (TSX:ATZ) has set October 9, 2025, as the date for its Q2 2026 earnings release and call, drawing investor attention as the market looks ahead to new insights on the retailer's financial momentum.

See our latest analysis for Aritzia.

Aritzia’s share price has climbed 52% year to date, capping off a strong year in which total shareholder return soared 64%. The latest earnings announcement has added fuel to the momentum and heightened anticipation about what’s next for the retailer.

If Aritzia’s rally has you rethinking your strategy, this is a perfect time to broaden your perspective by exploring fast growing stocks with high insider ownership.

The big question now, with shares surging and growth impressive, is whether Aritzia remains undervalued or if the market has already priced in the next phase of its expansion, leaving little room for upside.

Most Popular Narrative: 12.4% Undervalued

With Aritzia last closing at CA$81.81 and the narrative estimating fair value at CA$93.36, the market appears to trail analyst optimism, suggesting the story is not fully priced in yet.

Investments in digital marketing and successful marketing campaigns associated with flagship openings are anticipated to drive traffic and sales in both physical and online channels. This could potentially improve net margins through increased sales at reduced markdown rates. Strong product assortment and optimized inventory management have resulted in lower markdowns and gross margin improvement, a trend expected to continue, enhancing net margins and overall earnings.

Want to know what is fueling this high valuation? The narrative leans strongly on explosive earnings momentum and a bold margin outlook. The real twist is a future profit multiple that is more optimistic than most retailers ever see. Can Aritzia actually deliver? Dive in to see the financial ambitions that set this price target apart.

Result: Fair Value of $93.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. If US expansion slows or marketing spend fails to deliver growth, Aritzia's optimistic outlook could quickly come under pressure.

Find out about the key risks to this Aritzia narrative.

Another View: Are the Multiples Telling the Same Story?

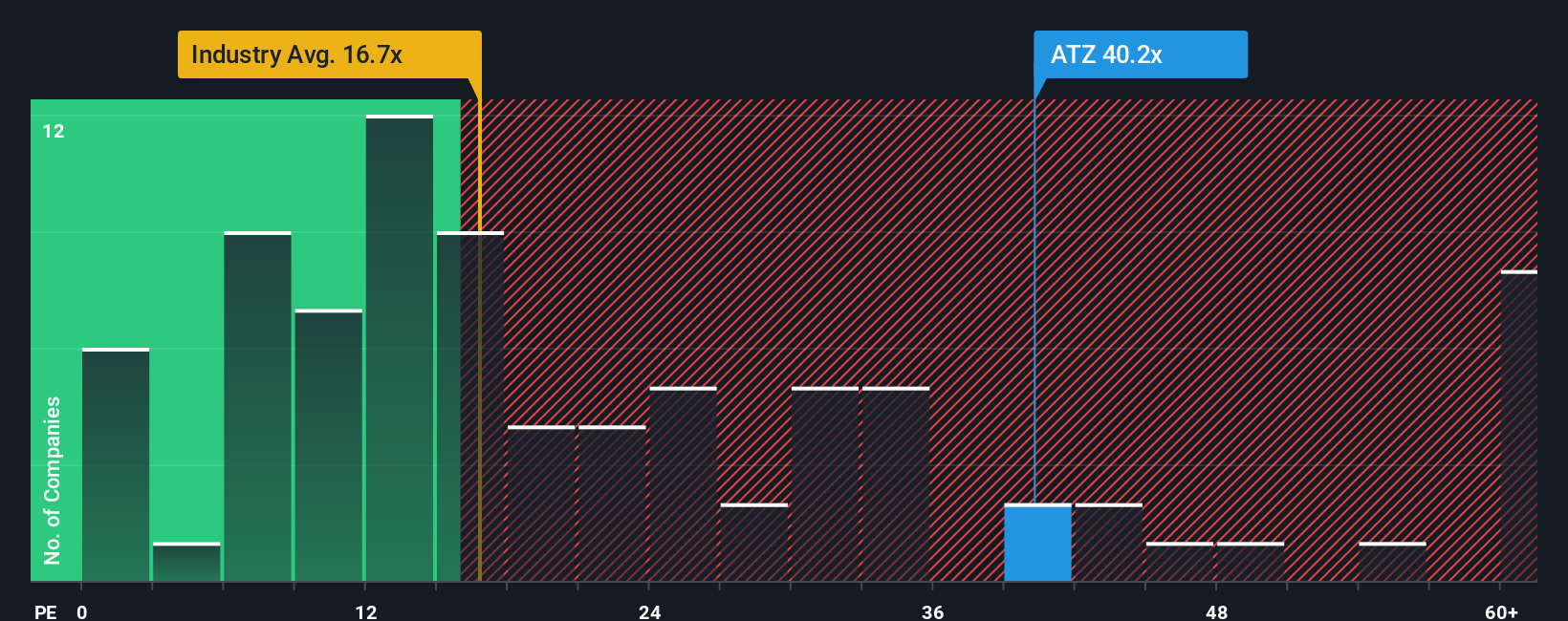

Looking at Aritzia through the lens of its price-to-earnings ratio, shares trade at 40.2 times earnings. That is much higher than both the North American Specialty Retail average of 16.8x and peers’ 22.9x. Even compared to its own fair ratio of 37.4x, Aritzia looks pricey. This suggests a premium is already baked in. Does this signal a valuation risk, or simply reflect confidence in the company's unique growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aritzia Narrative

If you are not convinced by the consensus or want to dig deeper on your own, you can piece together your own assessment in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aritzia.

Looking for More Investment Ideas?

Why settle for just one opportunity? Supercharge your portfolio by uncovering strategies and stocks that are already shaping tomorrow’s biggest investing stories.

- Accelerate your search for emerging technology leaders by tapping into these 25 AI penny stocks, which have the potential to disrupt entire industries.

- Target stable cash flows and attractive entry points through these 887 undervalued stocks based on cash flows, companies poised for long-term growth backed by strong fundamentals.

- Capture high yields and reliable performance from these 19 dividend stocks with yields > 3%, investments that regularly reward shareholders with substantial payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with high growth potential.

Market Insights

Community Narratives