The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that StorageVault Canada Inc. (CVE:SVI) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for StorageVault Canada

How Much Debt Does StorageVault Canada Carry?

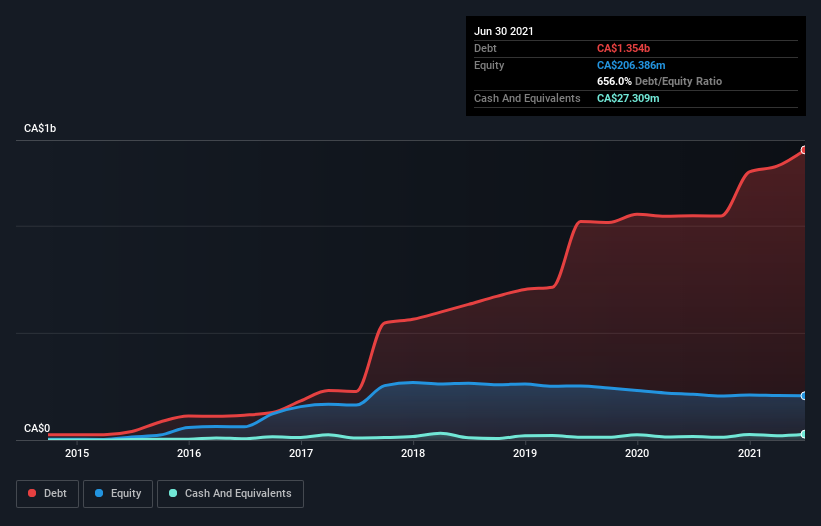

You can click the graphic below for the historical numbers, but it shows that as of June 2021 StorageVault Canada had CA$1.35b of debt, an increase on CA$1.05b, over one year. However, it does have CA$27.3m in cash offsetting this, leading to net debt of about CA$1.33b.

A Look At StorageVault Canada's Liabilities

The latest balance sheet data shows that StorageVault Canada had liabilities of CA$18.4m due within a year, and liabilities of CA$1.47b falling due after that. Offsetting this, it had CA$27.3m in cash and CA$4.30m in receivables that were due within 12 months. So its liabilities total CA$1.46b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of CA$2.16b, so it does suggest shareholders should keep an eye on StorageVault Canada's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.18 times and a disturbingly high net debt to EBITDA ratio of 14.4 hit our confidence in StorageVault Canada like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. The silver lining is that StorageVault Canada grew its EBIT by 1,096% last year, which nourishing like the idealism of youth. If it can keep walking that path it will be in a position to shed its debt with relative ease. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if StorageVault Canada can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, StorageVault Canada actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

StorageVault Canada's interest cover was a real negative on this analysis, as was its net debt to EBITDA. But its conversion of EBIT to free cash flow was significantly redeeming. When we consider all the factors mentioned above, we do feel a bit cautious about StorageVault Canada's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that StorageVault Canada is showing 2 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Mediocre balance sheet and overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026