- Canada

- /

- Residential REITs

- /

- TSXV:FCA.UN

Do Firm Capital Apartment Real Estate Investment Trust's (CVE:FCA.U) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Firm Capital Apartment Real Estate Investment Trust (CVE:FCA.U). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Firm Capital Apartment Real Estate Investment Trust

How Fast Is Firm Capital Apartment Real Estate Investment Trust Growing Its Earnings Per Share?

Over the last three years, Firm Capital Apartment Real Estate Investment Trust has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Over twelve months, Firm Capital Apartment Real Estate Investment Trust increased its EPS from US$0.81 to US$0.87. That's a modest gain of 6.8%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Firm Capital Apartment Real Estate Investment Trust's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that Firm Capital Apartment Real Estate Investment Trust is growing revenues, and EBIT margins improved by 50.0 percentage points to 54%, over the last year. That's great to see, on both counts.

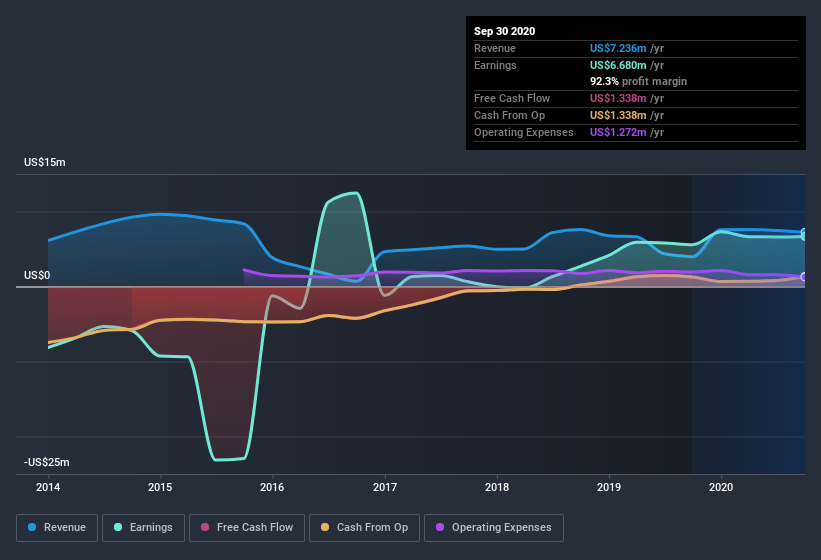

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Firm Capital Apartment Real Estate Investment Trust isn't a huge company, given its market capitalization of CA$46m. That makes it extra important to check on its balance sheet strength.

Are Firm Capital Apartment Real Estate Investment Trust Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Firm Capital Apartment Real Estate Investment Trust shares, in the last year. With that in mind, it's heartening that Sandy Poklar, the CFO & Director of the company, paid US$12k for shares at around US$6.78 each.

Should You Add Firm Capital Apartment Real Estate Investment Trust To Your Watchlist?

One important encouraging feature of Firm Capital Apartment Real Estate Investment Trust is that it is growing profits. Not every business can grow its EPS, but Firm Capital Apartment Real Estate Investment Trust certainly can. The icing on the cake is that an insider bought shares during the year, which inclines me to put this one on a watchlist. Before you take the next step you should know about the 5 warning signs for Firm Capital Apartment Real Estate Investment Trust that we have uncovered.

The good news is that Firm Capital Apartment Real Estate Investment Trust is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Firm Capital Apartment Real Estate Investment Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:FCA.UN

Firm Capital Apartment Real Estate Investment Trust

Firm Capital Apartment Real Estate Investment Trust (the “Trust”) is a U.S.

Adequate balance sheet low.

Market Insights

Community Narratives