- Canada

- /

- Office REITs

- /

- TSX:TNT.UN

37% earnings growth over 1 year has not materialized into gains for True North Commercial Real Estate Investment Trust (TSE:TNT.UN) shareholders over that period

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the True North Commercial Real Estate Investment Trust (TSE:TNT.UN) share price is down 51% in the last year. That contrasts poorly with the market decline of 8.9%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 20% in three years. More recently, the share price has dropped a further 43% in a month. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

After losing 40% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for True North Commercial Real Estate Investment Trust

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the True North Commercial Real Estate Investment Trust share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

We don't see any weakness in the True North Commercial Real Estate Investment Trust's dividend so the steady payout can't really explain the share price drop. The revenue trend doesn't seem to explain why the share price is down. Unless, of course, the market was expecting a revenue uptick.

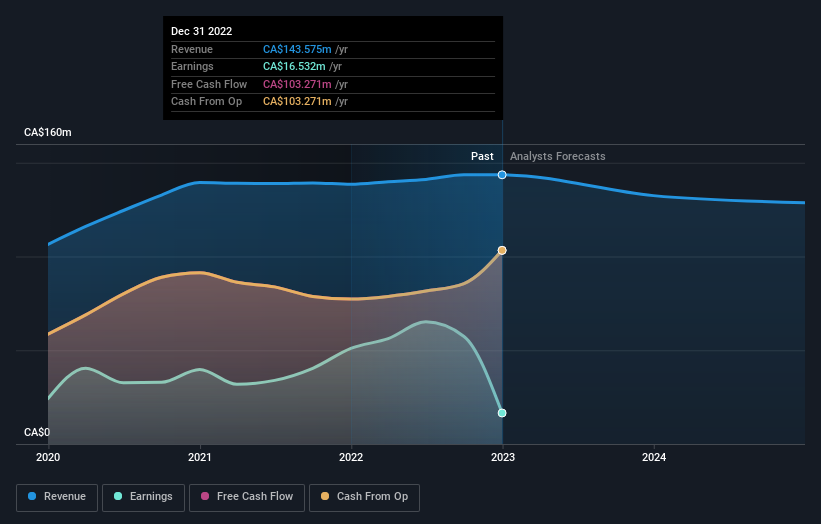

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on True North Commercial Real Estate Investment Trust

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for True North Commercial Real Estate Investment Trust the TSR over the last 1 year was -46%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that True North Commercial Real Estate Investment Trust shareholders are down 46% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 8.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - True North Commercial Real Estate Investment Trust has 4 warning signs (and 1 which is potentially serious) we think you should know about.

True North Commercial Real Estate Investment Trust is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if True North Commercial Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TNT.UN

True North Commercial Real Estate Investment Trust

The REIT is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario.

Good value average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026