- Canada

- /

- Retail REITs

- /

- TSX:PMZ.UN

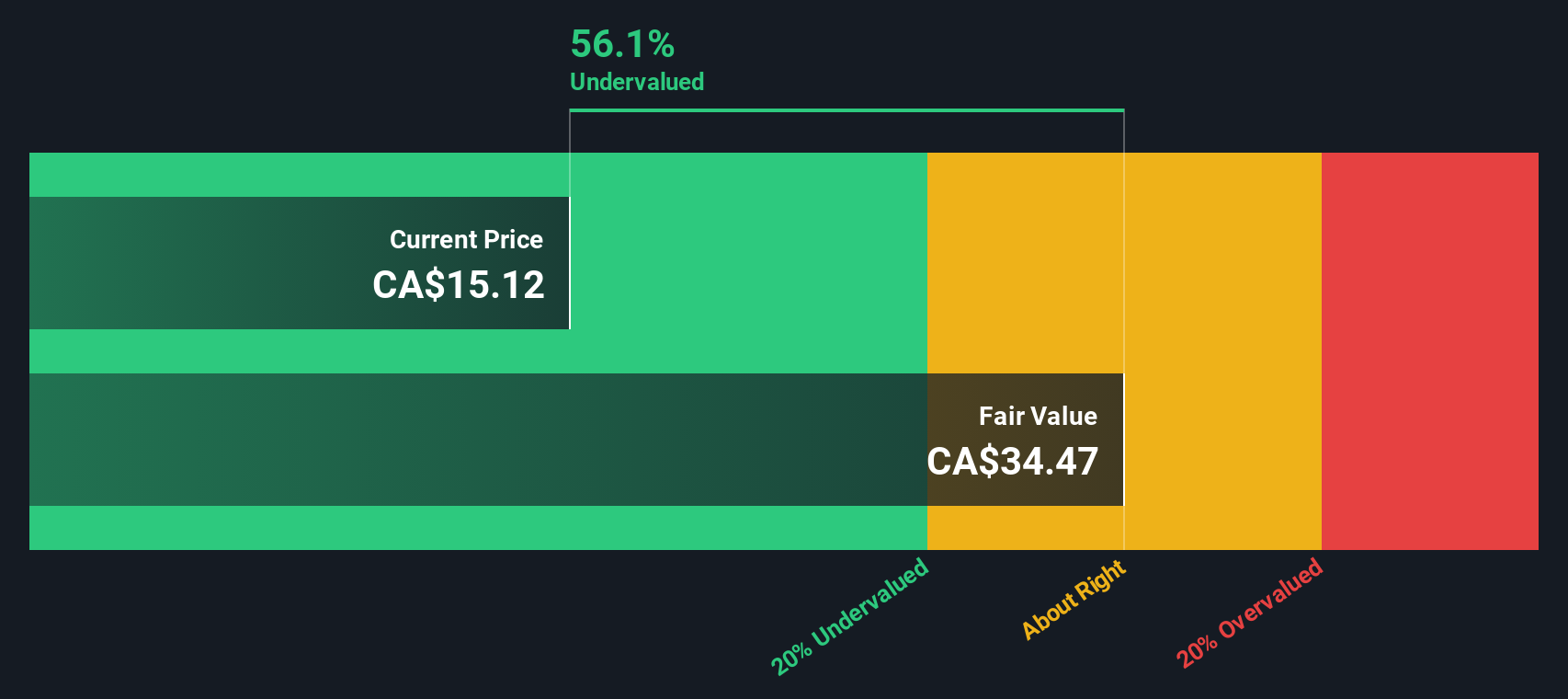

Is Primaris REIT (TSX:PMZ.UN) Undervalued? A Fresh Look at Its Current Valuation

Reviewed by Kshitija Bhandaru

Primaris Real Estate Investment Trust (TSX:PMZ.UN) has delivered annual growth in both revenue and net income, attracting investors who seek stability in Canada’s real estate sector. Shares have recently traded near CA$14.76, prompting valuation discussions.

See our latest analysis for Primaris Real Estate Investment Trust.

Momentum has cooled off lately for Primaris, with the share price down 4.8% year-to-date and a 1-year total shareholder return of just -0.5%. However, its standout 36% total return over three years suggests there may be enduring growth potential, as recently rising rates and shifting real estate sentiment influence the market.

If you’re interested in discovering what else is capturing investors’ attention outside of real estate, now is a great time to check out fast growing stocks with high insider ownership

But with the stock trading below analyst price targets and strong fundamental growth, the key question is whether Primaris is undervalued right now or if the market has already factored in its future potential.

Price-to-Earnings of 21.7x: Is it justified?

Primaris Real Estate Investment Trust is currently trading at a price-to-earnings (P/E) ratio of 21.7x, which stands out compared to both its peers and the broader Retail REITs sector. With its last close at CA$14.76, this multiple provides a window into how the market is valuing the company’s current and future earnings.

The price-to-earnings ratio indicates how much investors are willing to pay for each dollar of Primaris’s earnings. For REITs, the P/E multiple is a key measure of relative valuation, often reflecting sector growth expectations, stability of income, and the quality of earnings reported. An elevated P/E could signal either confidence in ongoing earnings growth or a premium placed on stability.

Primaris’s P/E ratio of 21.7x is lower than the North American Retail REITs industry average of 23.5x. This suggests some relative value. However, it remains above the peer group average of 17x, implying the market may be pricing in a more robust outlook or lower perceived risk than most direct peers. Compared to its fair P/E ratio estimate of 22.5x, the current multiple looks largely appropriate and aligns closely with model-based expectations that consider fundamentals and sector dynamics.

Explore the SWS fair ratio for Primaris Real Estate Investment Trust

Result: Price-to-Earnings of 21.7x (UNDERVALUED)

However, potential shifts in consumer behavior and unexpected changes in interest rates could quickly challenge Primaris's current outlook and affect its future performance.

Find out about the key risks to this Primaris Real Estate Investment Trust narrative.

Another View: Is the Discounted Cash Flow Telling a Different Story?

While the price-to-earnings ratio presents a view of relative value, our DCF model provides a broader perspective by projecting future cash flows. According to this method, Primaris's shares are trading at a significant 53.6% discount to estimated fair value. Could the market be underestimating the company's long-term potential, or is there hidden risk keeping the price lower?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Primaris Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Primaris Real Estate Investment Trust Narrative

If you want to dig into the numbers and develop your own perspective, you can create a custom narrative in just a few minutes. Do it your way

A great starting point for your Primaris Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself the edge by taking action now. Don’t let great opportunities pass you by when the next standout portfolio pick could be only a click away.

- Boost your income potential and take a closer look at reliable companies by tapping into these 19 dividend stocks with yields > 3% with yields over 3%.

- Step ahead of market trends and ride the momentum of innovation by checking out these 26 AI penny stocks shaping the AI landscape.

- Unlock hidden value and position yourself before the crowd moves by targeting these 889 undervalued stocks based on cash flows based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMZ.UN

Primaris Real Estate Investment Trust

Primaris is Canada’s only enclosed shopping centre focused REIT, with ownership interests in leading enclosed shopping centres located in growing Canadian markets.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives