- Canada

- /

- Oil and Gas

- /

- TSX:PXT

Exploring 3 Undervalued Small Caps On TSX With Recent Insider Activity In Canada

Reviewed by Simply Wall St

The Canadian market is currently navigating a landscape shaped by shifts in bond yields and interest rate adjustments from the Bank of Canada, which have influenced investor sentiment towards cash and fixed-income investments. As the yield curve potentially steepens with further rate cuts, small-cap stocks on the TSX may present unique opportunities for investors seeking growth beyond traditional bonds and cash instruments. In this environment, identifying promising small-cap stocks involves assessing their potential to thrive amid changing economic conditions while considering recent insider activity as a possible indicator of confidence in their future performance.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 43.81% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund | 12.3x | 7.6x | 46.67% | ★★★★★☆ |

| Calfrac Well Services | 11.6x | 0.2x | 36.92% | ★★★★★☆ |

| Nexus Industrial REIT | 12.5x | 3.1x | 29.25% | ★★★★★☆ |

| First National Financial | 13.3x | 3.7x | 47.28% | ★★★★☆☆ |

| Parex Resources | 3.9x | 0.9x | 16.41% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -140.88% | ★★★★☆☆ |

| Savaria | 31.3x | 1.7x | 27.86% | ★★★☆☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -109.79% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.6x | 19.07% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Primaris Real Estate Investment Trust (TSX:PMZ.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Primaris Real Estate Investment Trust focuses on the ownership, management, and development of its investment properties with a market capitalization of approximately CA$1.52 billion.

Operations: The primary revenue stream is derived from the ownership, management, and development of investment properties. As of 2025-01-02, the company reported a gross profit margin of 56.92%. Operating expenses include general and administrative costs amounting to CA$31.63 million.

PE: 12.7x

Primaris Real Estate Investment Trust, a smaller player in the Canadian market, has shown potential despite some financial challenges. Insider confidence is evident with Patrick Sullivan purchasing 20,000 shares for C$271,600 in late 2024. The company recently increased its monthly dividend to C$0.0717 per unit for December 2024 and completed a significant share buyback of over 1 million shares. While debt coverage remains an issue due to reliance on external borrowing, earnings are projected to grow by 22% annually.

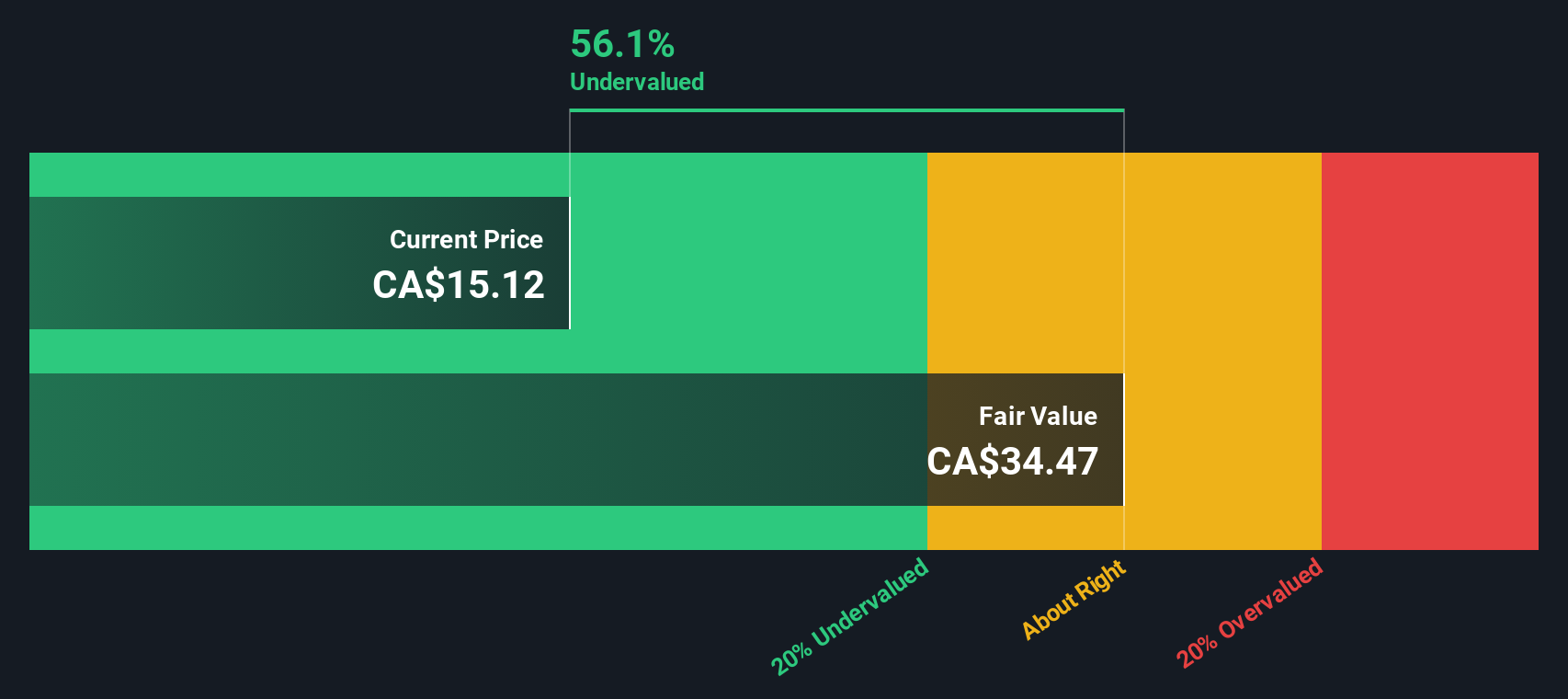

Parex Resources (TSX:PXT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Parex Resources is a company engaged in the exploration and production of oil and gas, with a market capitalization of approximately C$3.62 billion.

Operations: The company generates revenue primarily from its Oil & Gas - Exploration & Production segment, with recent quarterly revenues reaching $1.16 billion. Costs of goods sold (COGS) have been noted at $328.24 million, impacting the gross profit margin, which was 71.63% in the latest period. Operating expenses and non-operating expenses are significant components of the cost structure, with depreciation and amortization (D&A) also contributing to financial outcomes. The net income margin has shown variability over time, standing at 22.78% in the most recent quarter analyzed.

PE: 3.9x

Parex Resources, a Canadian energy player, has been navigating challenging waters with declining earnings and reduced profit margins. Despite these hurdles, insider confidence is evident as an executive acquired 23,915 shares worth approximately US$496,736 in the past year. The company has strategically partnered with Ecopetrol S.A., securing a 50% working interest in several Colombian blocks. While revenue dipped to US$257.8 million for Q3 2024 from US$314.78 million the previous year, Parex remains committed to shareholder returns through share repurchases totaling US$63.03 million and dividends of CAD 0.385 per share for Q4 2024.

- Click here to discover the nuances of Parex Resources with our detailed analytical valuation report.

Gain insights into Parex Resources' historical performance by reviewing our past performance report.

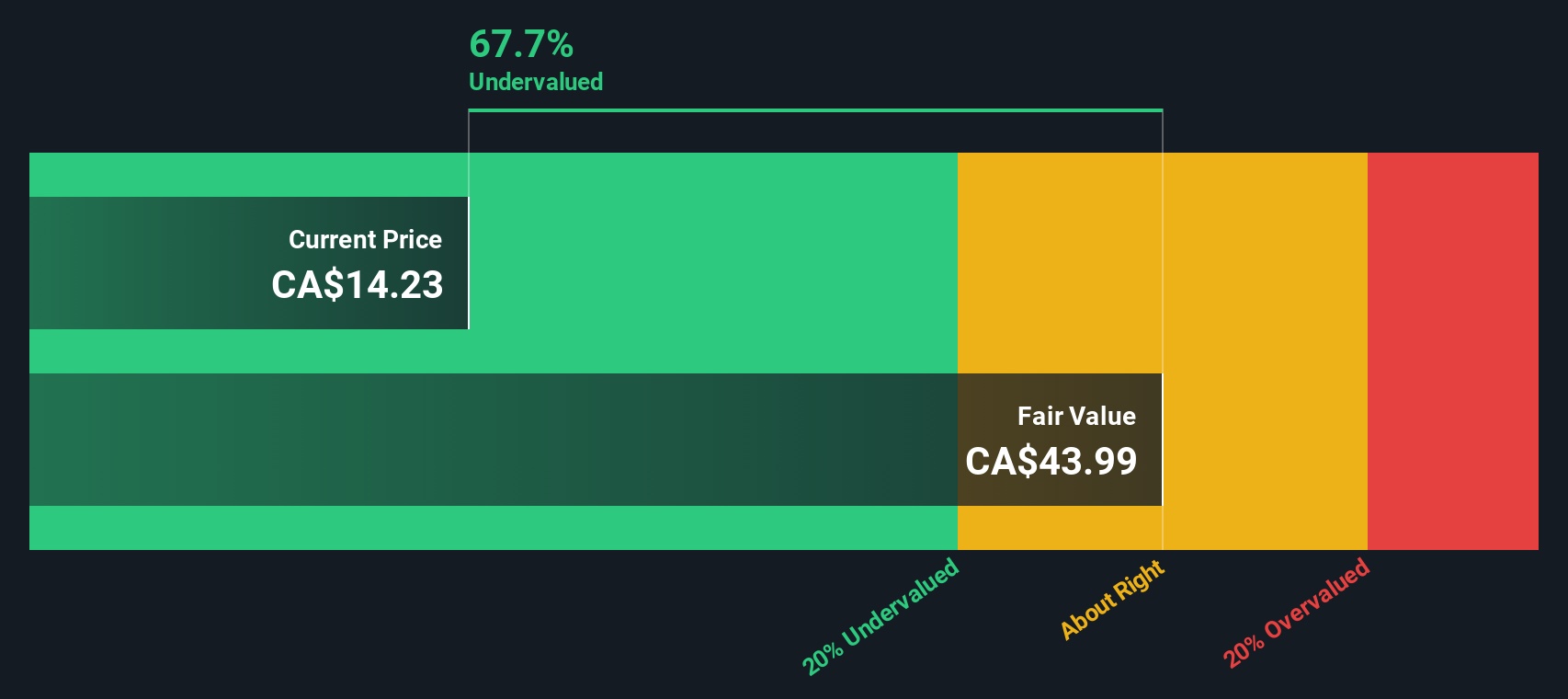

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vermilion Energy is a company engaged in the exploration and production of oil and gas, with operations contributing CA$1.82 billion to its revenue.

Operations: The company's revenue primarily stems from the oil and gas exploration and production segment, with recent figures showing CA$1.82 billion in revenue. The gross profit margin has shown fluctuations, reaching 64.63% in the latest period. Operating expenses have been a significant component of costs, impacting net income margins which have been negative recently at -45.77%.

PE: -2.6x

Vermilion Energy, a Canadian company, is exploring acquisitions to enhance its portfolio while planning non-core asset divestments for debt reduction. Insider confidence is evident with recent share repurchases totaling 3.2 million shares for C$46 million. Despite a challenging year with net losses of C$28.42 million over nine months, the company increased its quarterly dividend by 8% to C$0.13 per share starting Q1 2025, reflecting optimism in future cash flow and production guidance of 84,000-88,000 boe/d for 2025.

- Take a closer look at Vermilion Energy's potential here in our valuation report.

Understand Vermilion Energy's track record by examining our Past report.

Key Takeaways

- Navigate through the entire inventory of 25 Undervalued TSX Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PXT

Parex Resources

Engages in the exploration, development, production, and marketing of oil and natural gas in Colombia.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)