- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

NorthWest Healthcare Properties REIT (TSX:NWH.UN): Reassessing Valuation After Q3 2025 Return to Profitability

Reviewed by Simply Wall St

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN) is back in the spotlight after returning to profitability in Q3 2025, helped by a 4% same property NOI lift and tighter cost control.

See our latest analysis for NorthWest Healthcare Properties Real Estate Investment Trust.

The latest turnaround has not sparked fireworks in the share price yet, with a roughly 17% year to date share price return and a still deeply negative three year total shareholder return. This suggests momentum is only cautiously rebuilding as investors reassess risk.

If this recovery story has you rethinking healthcare real estate, it could be worth scanning other opportunities across healthcare stocks to see which names the market is rewarding right now.

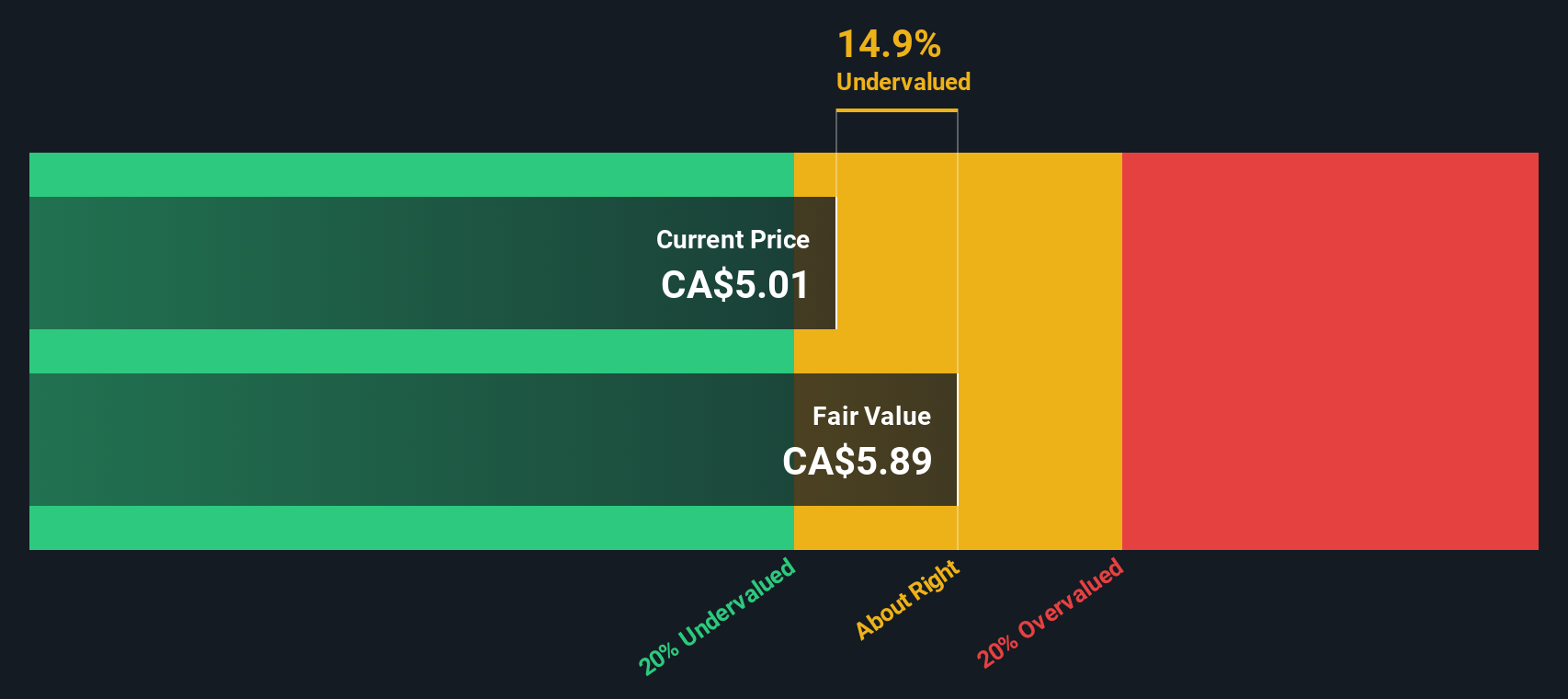

With units still trading at a double digit discount to analyst targets and a sizeable gap to some intrinsic value estimates, the key question becomes whether NorthWest is quietly undervalued or if the market is already pricing in its recovery and future growth.

Price-to-Earnings of 26.4x: Is it justified?

NorthWest Healthcare Properties REIT last closed at CA$5.24, which equates to a price to earnings multiple of 26.4 times. This places it at a premium to both peers and its own fair ratio.

The price to earnings ratio compares today’s unit price to the REIT’s per unit earnings. It is a convenient shorthand for how much investors are willing to pay for each dollar of current profit. For a healthcare REIT that has only recently returned to profitability, this multiple effectively embeds expectations that earnings will continue to improve from a low base.

In NorthWest’s case, the market is assigning a higher price to earnings than the Canadian Health Care REIT peer average of 6.5 times and the broader Global Health Care REITs industry average of 25.9 times, despite earnings having declined sharply over the last five years. It also sits notably above the estimated fair price to earnings ratio of 18.8 times. The multiple could gravitate toward that level if sentiment normalises or if forecast profit growth does not materialise as strongly as expected.

Explore the SWS fair ratio for NorthWest Healthcare Properties Real Estate Investment Trust

Result: Price-to-Earnings of 26.4x (OVERVALUED)

However, risks remain, including weak revenue growth and a history of value destruction, which could see the market continue to discount NorthWest’s turnaround.

Another View on Value

While the price to earnings ratio flags NorthWest as expensive, our DCF model points the other way, suggesting units trade about 31.8% below an estimated fair value of CA$7.69. If cash flows really recover as forecast, is the current discount a mispricing or a value trap in disguise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NorthWest Healthcare Properties Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NorthWest Healthcare Properties Real Estate Investment Trust Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A great starting point for your NorthWest Healthcare Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about upgrading your watchlist, do not stop at one REIT, use the Simply Wall Street Screener to uncover fresh, data driven opportunities.

- Capitalize on mispriced potential by targeting companies trading below their estimated cash flow value with these 906 undervalued stocks based on cash flows that the market may be overlooking today.

- Explore the next wave of digital innovation by focusing on blockchain leaders and payment disruptors through these 80 cryptocurrency and blockchain stocks before they become mainstream headlines.

- Strengthen your income engine by pinpointing reliable payers using these 15 dividend stocks with yields > 3% that could support your portfolio’s yield without stretching your risk limits.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest Healthcare Properties Real Estate Investment Trust ("Northwest", or the "REIT"), is a Canadian open-end trust established on January 1, 2010 and governed pursuant to a third amended and restated Declaration of Trust dated September 15, 2020, as amended by amendments dated as of March 30, 2023, September 21, 2023, June 18, 2024 and May 14, 2025, under the laws of the Province of Ontario ("Declaration of Trust").

Average dividend payer with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026