Undervalued Small Caps With Insider Action In Global August 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by the Bank of England's rate cuts and the Nasdaq Composite reaching new highs, small-cap stocks remain in focus amid mixed economic signals. With the S&P MidCap 400 Index showing modest gains and interest rates potentially on a downward path, investors are keenly observing how these factors influence smaller companies that often thrive in dynamic environments. Identifying promising small-cap stocks involves looking for those with strong fundamentals and potential for growth, especially as insider actions can signal confidence in their future prospects amidst current market conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morguard North American Residential Real Estate Investment Trust | 6.6x | 1.7x | 22.25% | ★★★★★☆ |

| Hemisphere Energy | 5.3x | 2.2x | 10.39% | ★★★★☆☆ |

| Nexus Industrial REIT | 7.0x | 3.1x | 16.96% | ★★★★☆☆ |

| Sagicor Financial | 9.4x | 0.4x | -84.45% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.4x | 7.0x | 14.57% | ★★★★☆☆ |

| CVS Group | 46.1x | 1.3x | 36.75% | ★★★★☆☆ |

| A.G. BARR | 19.3x | 1.8x | 46.55% | ★★★☆☆☆ |

| Dicker Data | 20.4x | 0.7x | -20.97% | ★★★☆☆☆ |

| SmartCraft | 44.7x | 8.0x | 31.78% | ★★★☆☆☆ |

| Chinasoft International | 25.5x | 0.8x | 5.28% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

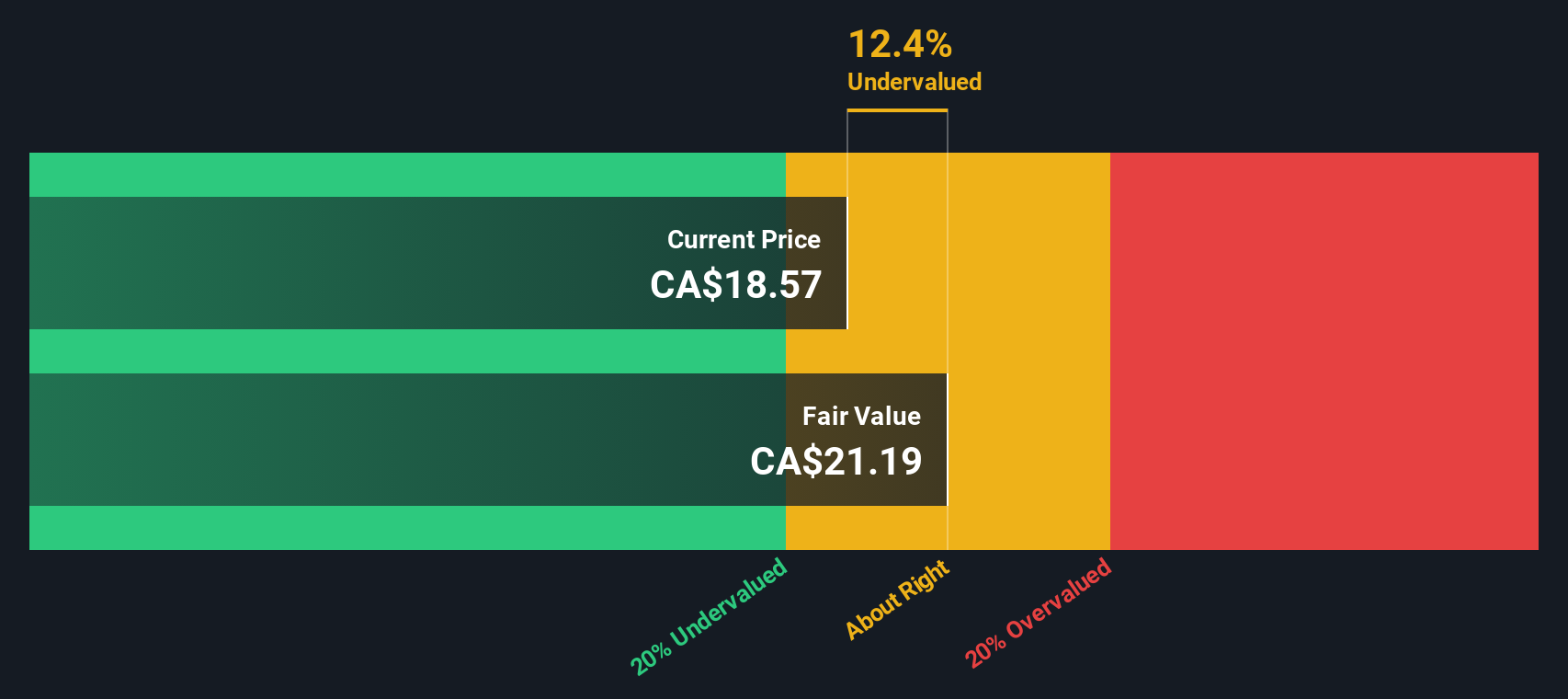

Morguard North American Residential Real Estate Investment Trust (TSX:MRG.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Morguard North American Residential Real Estate Investment Trust operates in the multi-suite residential real estate sector, focusing on acquiring and managing properties across North America, with a market capitalization of CA$1.14 billion.

Operations: The primary revenue stream is derived from its multi-suite residential real estate, generating CA$358.51 million. The gross profit margin has shown fluctuations, reaching 54.98% in the latest period. Operating expenses have gradually increased over time, with a recent figure of CA$22.88 million impacting net income margins, which have also varied significantly across periods.

PE: 6.6x

Morguard North American Residential REIT, a smaller player in the real estate sector, recently reported second-quarter sales of CAD 88.54 million, up from CAD 85.76 million last year, though net income decreased to CAD 29.17 million from CAD 48.32 million. Insider confidence is evident with recent purchases by executives during this period. The opening of Trader Joe's at The Square highlights their strategic expansion efforts in Rockville, Maryland, enhancing community engagement and potential revenue streams despite current financial challenges like lower profit margins and reliance on external borrowing for funding.

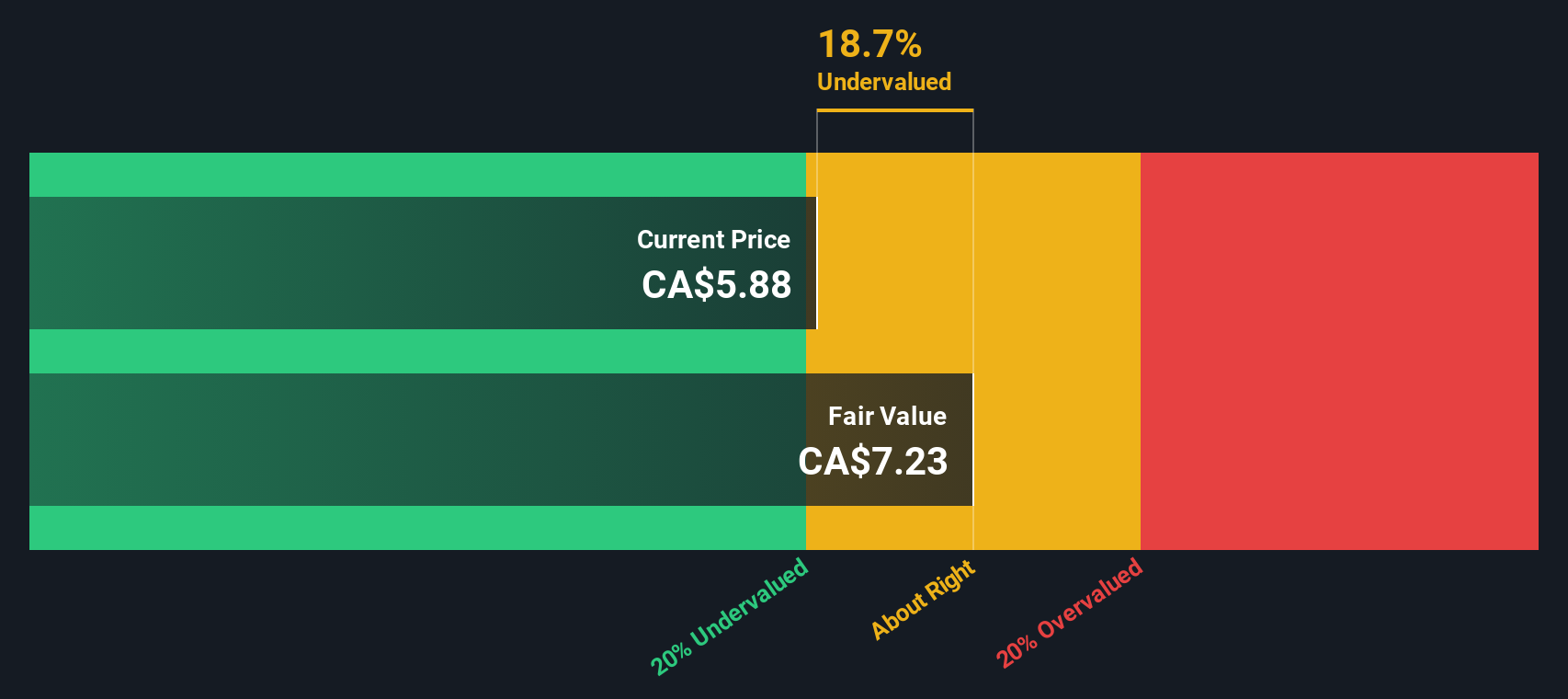

Pro Real Estate Investment Trust (TSX:PRV.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pro Real Estate Investment Trust is involved in the acquisition and management of a diversified portfolio of office, retail, and industrial properties with a market cap of CA$2.5 billion.

Operations: The company's revenue is primarily derived from its Industrial Including Commercial Mixed Use segment, contributing significantly to its total income. Over recent periods, the gross profit margin has shown a trend of stability around 58.00% to 59.00%. Operating expenses and non-operating expenses play a notable role in affecting net income margins, which have experienced fluctuations over time.

PE: 13.6x

Pro Real Estate Investment Trust has been making strategic moves, including acquiring six industrial properties in Winnipeg for C$96.5 million, enhancing its market presence. This acquisition is financed partly by issuing units at a premium, reflecting confidence in the trust's value. Insider confidence is evident with Gordon Lawlor purchasing 20,000 shares worth over C$108K recently. Despite earnings declining by 8.8% annually over five years, revenue growth of 9.18% per year is forecasted, suggesting potential recovery and expansion opportunities ahead.

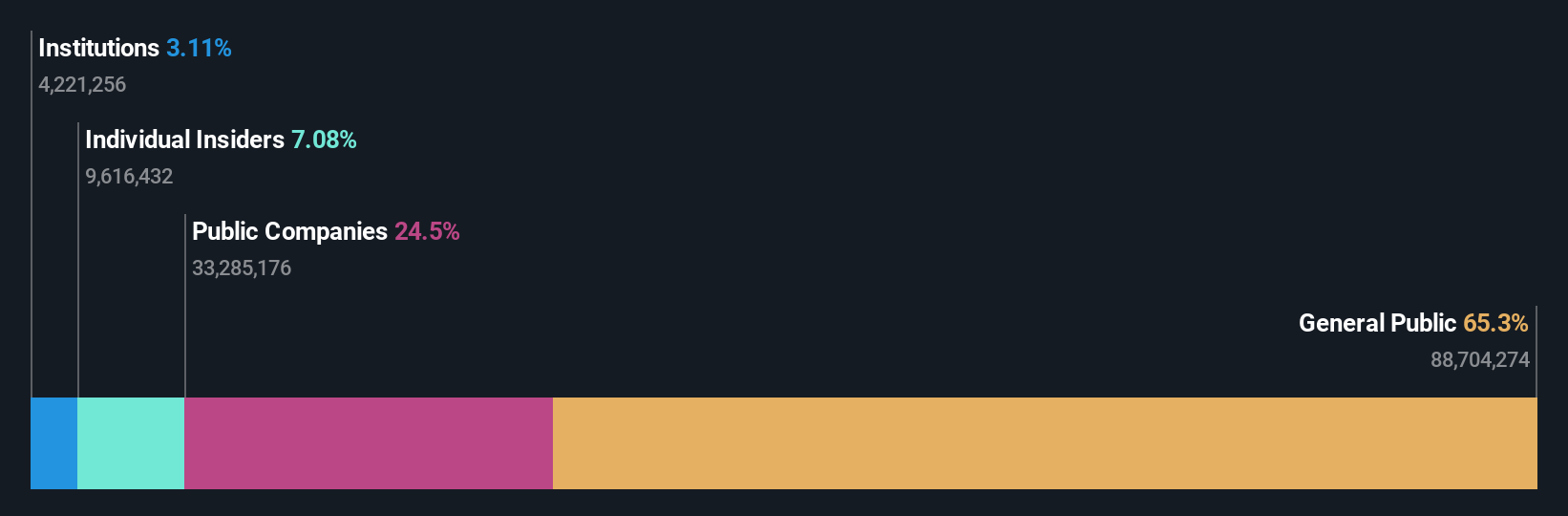

Sagicor Financial (TSX:SFC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sagicor Financial operates as a financial services provider with key segments including Sagicor Life, Sagicor Canada, and Sagicor Jamaica, and holds a market capitalization of approximately $1.13 billion.

Operations: Sagicor Financial's revenue streams are primarily derived from Sagicor Canada, Sagicor Jamaica, and Sagicor Life. The company has experienced fluctuations in its net income margin, which was -0.18% at the end of September 2022 and improved to 34.77% by December 2023. Operating expenses and non-operating expenses are significant cost components impacting overall profitability.

PE: 9.4x

Sagicor Financial, a stock with potential in the small-cap category, is navigating a challenging landscape. Recent insider confidence was evident as they initiated a share repurchase program on June 20, 2025, targeting up to 6.84% of its shares by June 2026. Despite profit margins declining from last year and net income dropping to US$6.7 million in Q1 2025 from US$26.25 million previously, earnings are projected to grow at an annual rate of over 18%.

- Navigate through the intricacies of Sagicor Financial with our comprehensive valuation report here.

Evaluate Sagicor Financial's historical performance by accessing our past performance report.

Where To Now?

- Investigate our full lineup of 104 Undervalued Global Small Caps With Insider Buying right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SFC

Sagicor Financial

Provides insurance products and related financial services in Jamaica, Barbados, Trinidad, Tobago, other Caribbean region, and the United States.

Good value second-rate dividend payer.

Market Insights

Community Narratives