- Canada

- /

- Residential REITs

- /

- TSX:KMP.UN

With EPS Growth And More, Killam Apartment Real Estate Investment Trust (TSE:KMP.UN) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Killam Apartment Real Estate Investment Trust (TSE:KMP.UN). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Killam Apartment Real Estate Investment Trust

Killam Apartment Real Estate Investment Trust's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, Killam Apartment Real Estate Investment Trust's EPS has grown 24% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

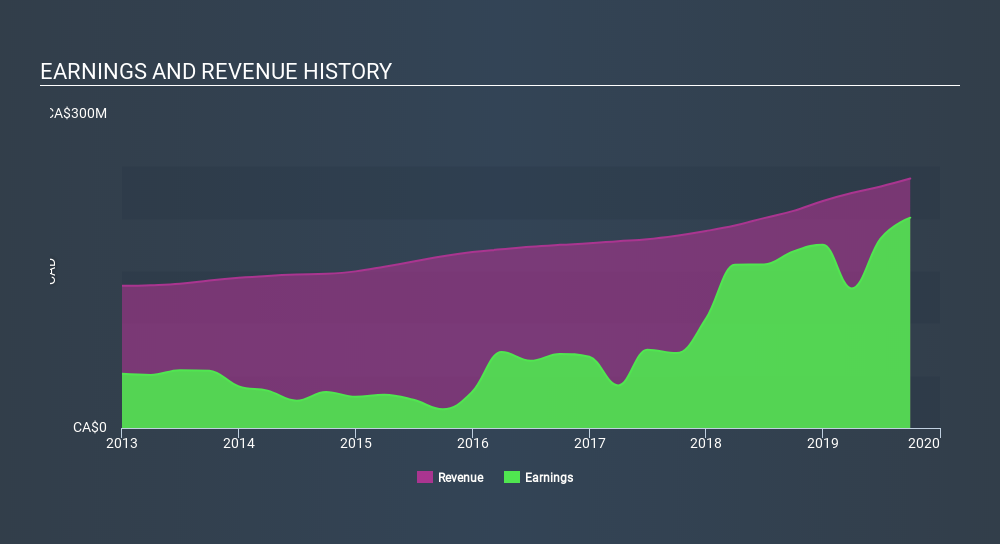

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Killam Apartment Real Estate Investment Trust maintained stable EBIT margins over the last year, all while growing revenue 15% to CA$238m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. You can view the exact numbers in our full report.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Killam Apartment Real Estate Investment Trust.

Are Killam Apartment Real Estate Investment Trust Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Killam Apartment Real Estate Investment Trust shares worth a considerable sum. To be specific, they have CA$34m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Killam Apartment Real Estate Investment Trust with market caps between CA$1.3b and CA$4.3b is about CA$2.9m.

Killam Apartment Real Estate Investment Trust offered total compensation worth CA$1.8m to its CEO in the year to December 2018. That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Killam Apartment Real Estate Investment Trust Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Killam Apartment Real Estate Investment Trust's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Each to their own, but I think all this makes Killam Apartment Real Estate Investment Trust look rather interesting indeed. If you think Killam Apartment Real Estate Investment Trust might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:KMP.UN

Killam Apartment REIT

Killam Apartment REIT, based in Halifax, Nova Scotia, is one of Canada's largest residential real estate investment trusts, owning, operating, managing and developing a $5.5 billion portfolio of apartments and manufactured home communities.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives